FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

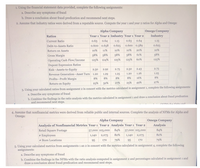

Transcribed Image Text:1. Using the financial statement data provided, complete the following assignments:

a. Deseribe any symptoms of fraud

b. Draw a conclusion about frand predication and recommend next steps.

2. Assume that industry ratios were derived from a reputable source. Compute the year 1 and year a ratios for Alpha and Omega:

Alpha Company

Отеgа Companу

Industry

Ratios

Year i Year a Industry Year i Year a

Current Ratio

0.64

L15

0.63 0.64

LIS

Debt-to-Assets Ratio

0.600 o.658

0.6a5

Return on Assets

10%

10%

20%

s0%

61%

Gross Margin

SRN

Operating Cash Flow/Income

1as

125N

Dupont Expression Ratios

Risk-Aasets-to-Equity

2.50

2.92

2.75

2.50

243

2.75

Revenue Generation-Asset Turn 1.20

1.29

125

L20

Profits-Profit Margin

8%

Return on Equity

as

3. Using your caleulated ratios from asignment a in concert with the metries caleulated in assignment , complete the following aignments

a. Describe any symptoms of fraud

b. Combine the findings in the ratio analysis with the metries caleulated in assignment i and draw a concluion about fraud predication

and recommend next steps.

4. Assume that nonfinancial metrics were derived from reliable public and internal sources. Complete the analysis of NFMS for Alpha and

Omega:

Alpha Company

Отера Company

Analysis of Nonfinancial Metries Year1 Year a Analysis Year i Year a

Analysis

Retal Square Footage

57.000 105.000

84%

57,000 105,000

84%

Employees

1140 2,075

L140 2,075

Store Locations

95

170

79%

95

170

79N

5. Using your caleulated metrics from assignments 1 an 2 in concert with the metrics caleulated in assignment 4, complete the following

assignments:

a Describe any symptoms of fraad

b. Combine the findings in the NFMS with the ratio analysis computed in assignment a and percentages calculated in assignment i and

draw a conclusion about fraad predication and recommend next steps.

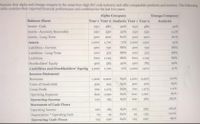

Transcribed Image Text:Assume that Alpha and Omega compete in the same four-digit SIC code industry and offer comparable products and services. The following

table contains their reported financial performance and condition for the last two years:

Alpha Company

Omega Company

Balance Sheet

Year 1 Year 2 Analysis Year 1 Year 2

Analysis

Assets-Cash

250

480

92%

250

480

92%

Assets-Accounts Receivable

250

330

32%

250

530

112%

Assets-Long-Term

500

900

80%

500

900

80%

Assets

1,000

1,710

71% 1,000

1,910

91%

Liabilities-Current

400

750

88%

400

750

88%

Liabilities-Long-Term

200

375

88%

88%

200

375

Liabilities

600

1,125

88%

600

1,125

88%

Stockholders' Equity

400

585

46%

400

785

96%

Liabilities and Stockholders' Equity 1,000

1,710

71% 1,000

1,910

91%

Income Statement

Revenues

1,200 2,20o

83% 1,200 2,400

100%

Costs of Goods Sold

500

925

85%

500

925

85%

Gross Profit

700

1,275

82%

700

1,475

111%

600

82%

600

1,090

82%

Operating Expenses

Operating Income

1,090

185

85%

385

285%

100

100

Statement of Cash Flows

85%

385

285%

Operating Income

Depreciation Operating Cash

Operating Cash Flows

100

185

100

25

45

80%

25

-155

-720%

125

230

84%

125

230

84%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 8 (Ratio Calculations) Assume the following relationships for Woody Corp: Sales/Total assets is 1.5x, Return on assets (ROA) is 3.0%, and Return on equity (ROE) is 5.0%. Calculate Woody Corp. profit margin and debt-to-assets ratio assuming the firm uses only debt and common equity.arrow_forwardconsider the following data RF= 4.15% RPM = 5.35% and B= .85 based on the CAPM approach what is the cost of equity from retained earnings?arrow_forwardplease help me thankuarrow_forward

- Qb 08.arrow_forwardTotal debt to total assets% ratio: ?? Round your answer to the nearest hundredth percent Return on equity% ratio: ?? Round your answer to the nearest hundredth percent Asset turnover ratio: ?? Round your answer to the nearest centarrow_forwardWhich company stock is better to invest and whyarrow_forward

- Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.7 Return on assets (ROA) 4% Return on equity (ROE) 6% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardKINDLY ANSWER PARTS IV & V FOLLOWED BY PART B.i,ii,iiiarrow_forwardHow to solve questionarrow_forward

- provide reasons for the attached calculated ratios using GSK 2023 annual report and provide non-financail performance analysis examples for GSK 2023.arrow_forwardUsing the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018: Current Ratio Quick Ratio Total Asset Turnover Average Collection Total Debt to Total Assets Times Interest Earned Net Profit Margin Return on Assets Return on Equity Modified Du Point Equation for FY 2018 PE Ratio Market to Book Ratioarrow_forwardRatios Calculated Year 1 Year 2 3.64 +Q+ Price-to-cash-flow 5.20 Inventory turnover 10.40 Debt-to-equity 0.70 8.32 0.56 Year 3 2.91 6.66 0.45 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. Cold Goose Metal Works Inc.'s ability to meet its debt obligations has improved since its debt-to-equity ratio decreased from 0.70 to 0.45. A decline in the inventory turnover ratio can be explained by the new Inventory management system that the company recently adopted, which led to more efficient inventory management. A decline in the debt-to-equity ratio implies a decline in the creditworthiness of the firm. A plausible reason why Cold Goose Metal Works Inc.'s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education