FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

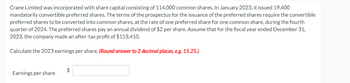

Transcribed Image Text:Crane Limited was incorporated with share capital consisting of 114,000 common shares. In January 2023, it issued 19,400

mandatorily convertible preferred shares. The terms of the prospectus for the issuance of the preferred shares require the convertible

preferred shares to be converted into common shares, at the rate of one preferred share for one common share, during the fourth

quarter of 2024. The preferred shares pay an annual dividend of $2 per share. Assume that for the fiscal year ended December 31,

2023, the company made an after-tax profit of $153,410.

Calculate the 2023 earnings per share. (Round answer to 2 decimal places, e.g. 15.25.)

Earnings per share

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lilac Company has 200,000 shares of ordinary shares outstanding on January 1, 2021. On March 31, 2021, 100,000 additional ordinary shares. On June 30, the company issued 10%, 100,000 convertible preference share par value of P20. The preference shares are convertible into 200,000 shares of ordinary shares. On December 31, 2021, Lilac Company reported a net income of P1,140,000 after tax and paid dividends of P300,000 to ordinary and P100,000 to preference shareholders. What is the diluted earnings per share? Group of answer choices 3.42 3.51 3.24 3.04arrow_forwardThe corporate charter of Alpaca Company authorized the issuance of 10 million, $1 par common shares. During 2024, its first year of operations, Alpaca had the following transactions: January 1 sold 8 million shares at $15 per share June 3 retired 2 million shares at $18 per share December 28 sold 2 million shares at $20 per share What amount should Alpaca report as additional paid-in capital—excess of par, in its December 31, 2024, balance sheetarrow_forwardDuring its first year of operations, Cupola Fan Corporation issued 36,000 of $1 par Class B shares for $415,000 on June 30, 2024. Share issue costs were $2,100. One year from the issue date (July 1, 2025), the corporation retired 10% of the shares for $42,500. Required: 1. to 4. Prepare the journal entries to record the issuance of the shares, the declaration of a $2.60 per share dividend on December 1, 2024, the payment of the dividend on December 31, 2024, and the retirement of the shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- In 2024, Blossom, Inc. issued 91000 shares of $100 par value convertible preferred stock for $102 per share. Each share of preferred stock can be converted into three shares of Blossom's $25 par value common stock at the option of the preferred stockholder. In August 2025, all of the preferred stock was converted into common stock. The market value of the common stock at the date of the conversion was $30 per share. What amount will be credited to additional paid-in capital from common stock as a result of the conversion? $2457000 O $2275000 O $1456000 O $1092000arrow_forwardOn January 1, 2024, when its $30 par value common stock was selling for $80 per share, Nash Corp. issued $10,200,000 of 8% convertible debentures due in 20 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into five shares of the corporation's common stock. The debentures were issued for $11,016,000. The present value of the bond payments at the time of issuance was $8,670,000, and the corporation believes the difference between the present value and the amount paid is attributable to the conversion feature. On January 1, 2025, the corporation's $30 par value common stock was split 2 for 1, and the conversion rate for the bonds was adjusted accordingly. On January 1, 2026, when the corporation's $15 par value common stock was selling for $135 per share, holders of 30% of the convertible debentures exercised their conversion options. The corporation uses the straight-line method for amortizing any bond discounts or premiums. (a) Prepare the journal…arrow_forwardBaez Corp. began operations on Jan. 1, 2023. Baez Corp. is authorized to issue 150,000 shares of it's 6%, $40 par value preferred stock. The company is authorized to issue 650,000 shares of the common stock with a par value of $2 per share. On January 5, 2023, the company issued 225,000 shares of common stock for cash at $13 per share. What is the journal entry to record the issuance of the common stock shares?arrow_forward

- Alpesharrow_forwardConcord Hills Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 5% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 3% when the bonds were issued at a price of 109. Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable accountarrow_forwardOn January 1, 2025, Swifty Company issued 10-year, $1,860,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 16 shares of Swifty common stock. Swifty's net income in 2025 was $412,800, and its tax rate was 20%. The company had 96,000 shares of common stock outstanding throughout 2025. None of the bonds were converted in 2025. a. Compute diluted earnings per share for 2025. (Round answer to 2 decimal places, e.g. 2.55.) Diluted earnings per share $ 3.99 b. Compute diluted earnings per share for 2025, assuming the same facts as above, except that $960,000 of 6% convertible preferred stock was issued instead of the bonds. Each $100 preferred share is convertible into 5 shares of Swifty common stock. (Round answer to 2 decimal places, e.g. 2.55.) Diluted earnings per sharearrow_forward

- On January 1, 2025, Nash Company issued 10-year, $1,810,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 15 shares of Nash common stock. Nash's net income in 2025 was $403,200, and its tax rate was 20%. The company had 96,000 shares of common stock outstanding throughout 2025. None of the bonds were converted in 2025. a. Compute diluted earnings per share for 2025. (Round answer to 2 decimal places, e.g. 2.55.) Diluted earnings per share $ b. Compute diluted earnings per share for 2025, assuming the same facts as above, except that $960,000 of 6% convertible preferred stock was issued instead of the bonds. Each $100 preferred share is convertible into 5 shares of Nash common stock. (Round answer to 2 decimal places, e.g. 2.55.) Diluted earnings per sharearrow_forwardDuring its first year of operations, Cupola Fan Corporation issued 30,000 of $1 par Class B shares for $385,000 on June 30, 2024. Share issue costs were $1,500. One year from the issue date (July 1, 2025), the corporation retired 10% of the shares for $39,500. Required: 1. to 4. Prepare the journal entries to record the issuance of the shares, the declaration of a $2 per share dividend on December 1, 2024, the payment of the dividend on December 31, 2024, and the retirement of the shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardOn January 5, 2020, Buffalo Corporation received a charter granting the right to issue 5,500 shares of $100 par value, 8% cumulative and nonparticipating preferred stock, and 46,300 shares of $10 par value common stock. It then completed these transactions. Dec. 31 Declared a $0.25 per share cash dividend on the common stock and declared the preferred dividend. Record the journal entry for the transaction listed above.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education