EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please help me Accounting question

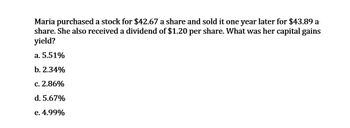

Transcribed Image Text:Maria purchased a stock for $42.67 a share and sold it one year later for $43.89 a

share. She also received a dividend of $1.20 per share. What was her capital gains

yield?

a. 5.51%

b. 2.34%

c. 2.86%

d. 5.67%

e. 4.99%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Investment - Total Rate of Return. Isabela purchased 100 shares of Gorman Inc. at $3.15 and sold them a year later at $4.00. With 1% commission rate on each transaction and a dividend of $0.35 per share throughout this year, what was the return on her investment? O a. 11.00% O b. 28.50% O c. 24.47% d. 35.47%arrow_forwardBob sold 100 shares of ABC stock for $2,100 and 300 shares of XYZ stock for $8,900. He purchased the ABC stock four years ago for $1,200 and the XYZ stock two years ago for $9,100. What is the net effect of these sales on Bob’s income? a. $200 net gain b. $700 net gain c. $900 net gain d. $1,100 net gainarrow_forward1. Andrew owns shares in Telstra. Last financial year, Andrew received a $140 dividend from Telstra with $60 of franking credits attached. What amount must Andrew include in his assessable income for the year in relation to the dividend?a. $200b. None of the above.c. $140d. $60arrow_forward

- On 3/30/22 you purchased 1 share of Ford Motor company for $9. On 7/1/22 you received a dividend of $1.15. On 12/10/22 you sold your share to but holiday gifts for $10.30. What was your total return on your investment? 16% O 23% O 27.2% O 37%arrow_forwardCorrect answerarrow_forwardInvestment - Total Rate of Return. Marvin purchased 7,000 shares of Strawn Corp. at $85.72 and sold them a year later at $102.66. With 5% commission rate on each transaction and a dividend of $6.91 per share throughout this year, what was the return on his investment? O a. 7.68% O b. 8.36% O c. 16.03% O d. 14.80%arrow_forward

- jacques purchased x shares of a corporation that pays a y dollar annual dividend. what is his annual dividend income, expressed algebraically?arrow_forwardLeonardo paid a total of $12,500 for stock that was $4 per share. If he sold all his shares for $20,312.50, how much profit on each share did he make? a. S2.5 b.8.5 C. $2.000 d. $6000arrow_forwardrrarrow_forward

- Bart Simpson bought 200 shares of TCB at $20. One year later, he still held the shares, and the value of TCB had risen to $30. This $10 per share difference is considered what kid of profit? Capital gain Paper gain Income gain Taxable capital gainarrow_forward1. Ian holds 100 shares in Big Bank Pty Ltd. The company paid a dividend of $4 per share (franked to 30%) on 1 June. Assume a corporate tax rate of 30%. What amount must Ian include in his assessable income for the year?a. $571b. $451c. $400d. $51arrow_forwardAisha Knox paid a total of $1,500 for 75 shares of stock. He sold the stock for $22.50 a share and paid a sales commission of $49.00. What is the profit or loss from the sale?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT