Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

I want correct answer

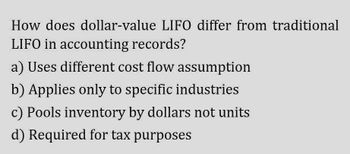

Transcribed Image Text:How does dollar-value LIFO differ from traditional

LIFO in accounting records?

a) Uses different cost flow assumption

b) Applies only to specific industries

c) Pools inventory by dollars not units

d) Required for tax purposes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Define extraordinary items. How are extraordinaryitems distinguished from items that are presented asseparate line items in an income statement, but are notextraordinary?arrow_forwardWhich is incorrect concerning the presentation of Income Statement? A. When items of income and expense are material, their nature and amount shall be disclosed separately. B. An entity shall present extraordinary items separately on the face of the income statement or in the notes to F/S. C. Natural presentation means that expenses are aggregated according to their nature like depreciation and employee benefits. D. Cost of sales method classifies expenses according to their function such as cost of sales, cost of distribution and cost of administrative activities. E. Both the natural presentation and functional presentation has their own merits for different types of entities, so the standard allows management to choose which they think is more relevant and reliable presentation.arrow_forwardUnder ASC Topic 606 for revenue recognition, which of the following factors is not an indicator of the principal/agent determination? A. Inventory risk. B. Credit risk. C. Shipping terms.arrow_forward

- Which is not generally accepted in presenting the income statement? A) the condensed income statement B) including income tax in determining income. including prior period error in determining income D) the consolidated income statement To Darrow_forwardAdvantages and Disadvantages of Reporting Items in Other comprehensive income instead of on the face of the income statementarrow_forwardcoparrow_forward

- Which of the following accounts is an example of a contra-asset?A) Cost of Goods Sold B)Sales Discounts C) Purchases D) Deferred Revenue E) LIFO Reservearrow_forward68. Which of the following is reported as other comprehensive income in accordance with PAS 1, Presentation of Financial Statement? Group of answer choices sale of inventory at more than cost changes in revaluation surplus impairment loss of depreciable asset loss on sale of machineryarrow_forwardHow should the following changes be treated, according to PAS 8? I. A change is to be made in the method of calculating the provision for uncollectible receivables.; II. Investment properties are now measured at fair value, having previously been measured at cost. Change (1) Change (2) * Change of accounting policy Change of accounting policy Change of accounting policy Change of accounting estimate Change of accounting estimate Change of accounting policy Change of -current cost accounting estimate Change of accounting estimatearrow_forward

- The following statements relate to analysis of expenses in the income statement based on either the nature ofexpenses or their function within the entity. Which statement is incorrect?I. An entity classifying expenses by function shall disclose additional information on the nature ifexpenses including depreciation, amortization expenses and employee benefit cost.II. PAS 1 requires the use of the cost of sales method because this presentation often provides morerelevant information to users than the nature of expense method. a. I onlyb. II onlyc. Both I and IId. Neither I nor IIarrow_forwardWhat items are not presented on the income statement?arrow_forwardWhich of the following accounts would not be involved in preparing the income statement? Group of answer choices Tax expense All the accounts would be involved in preparing the income statement. Interest income Accumulated depreciation Depreciation expensearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning