Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give true answer the accounting question

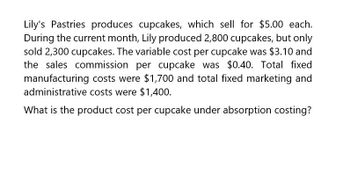

Transcribed Image Text:Lily's Pastries produces cupcakes, which sell for $5.00 each.

During the current month, Lily produced 2,800 cupcakes, but only

sold 2,300 cupcakes. The variable cost per cupcake was $3.10 and

the sales commission per cupcake was $0.40. Total fixed

manufacturing costs were $1,700 and total fixed marketing and

administrative costs were $1,400.

What is the product cost per cupcake under absorption costing?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ABD's Breads produces loaves of bread, which sell for $6.00 each. During the current month, ABD produced 3,500 loaves of bread, but only sold 3,200 loaves. The variable cost per loaf was $2.50. Total fixed manufacturing costs were $2,100 and total fixed marketing and administrative costs were $1,500. What is the product cost per loaf under absorption costing?arrow_forwardBonita Industries produces tinted SPF 100 moisturizer that it sells for $120 each. Each bottle costs $6 of variable costs to make. During the most recent quarter, 1100 bottles of moisturizer were manufactured and sold. Fixed costs for the quarter were $20 per unit for a total of $22000. What is the company's contribution margin ratio?arrow_forwardJackie's Creamery sells fudge, cookies, and popcorn to patrons in the local community. The manager at the creamery sold 6000 total boxes of merchandise last year. The popcorn outsold fudge by a margin of 2 to 1. The sales of caramels equaled the sales of popcorn. Total fixed costs for Jackie's Creamery total $10,000. The managerial accountant at Jackie's Creamery reported the following information: Product Unit Sales Prices Unit Variable Cost Fudge $8.00 $5.00 Caramels $4.00 $3.00 Popcorn $5.00 $2.00 Which formula should the managerial accountant use to determine the number of boxes of each different snack sold? Question 1 options: 3x + 2x + x = 6000 x + y + z = 6000 x + 2x + 2x = 6000 None of thesearrow_forward

- Legrand Company produces hand cream. In 2018, their financial information is as follows:Each jar sells for: $3.40Total variable cost (materials, labor, and overhead) per jar: $2.55Total fixed cost: $58,140Total jars sold in 2018: 81,6001. Calculate the break-even sales dollar?arrow_forwardGood Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose is more popular. Data concerning the two products follow: Expected sales (in cases) Selling price per case Direct labor hours Machine hours Receiving orders Packing orders Material cost per case Direct labor cost per case The company uses a conventional Direct labor benefits Machine costs Receiving department Packing department Total costs All depreciation Fixed $ Rose Violet Break-even cases of Rose Break-even cases of Violet 47,000 9,400 $103 $80 35,800 5,550 10,250 2,700 $53 $12 costing system and assigns overhead costs to products using direct labor hours. Annual overhead costs follow. They are classified as fixed or variable with respect to direct labor hours. Variable $210,885 186,500 243,965 233,000 142,500 $562,000 $454,850 Break-even cases of Rose Break-even cases of Violet 51 104 24 55 Required: 1. Using the conventional approach, compute the number of cases of Rose and the number of cases of Violet…arrow_forwardYarn Basket, Ltd., sells handminus−knit scarves. Each scarf sells for $35. The company pays $350 to rent a vending space for one day. The variable costs are $10 per scarf. What total revenue amount does the company need to earn to break even?arrow_forward

- Native Wood Products Ltd sells hand-made coffee tables. The shop owner has divided sales into two categories according to the type of wood used in the tables, as follows: Product type Kahikatea Rimu Sales price $2,000 $1,200 Costs $1,200 $520 Sales commission $100 $60 Seventy percent (70%) of the shop's sales are rimu tables. The shop's annual fixed costs are $161,000. Calculate the weighted average contribution margin, assuming the sales mix stays the same.arrow_forwardWildhorse Company produces desk lamps. The information for June indicated that the selling price was $25 per unit, variable costs were $15 per unit, and fixed costs totaled $7320. Wildhorse currently sells 1342 lamps and earns $6100 of profit. How much is Wildhorse’s margin of safety in dollars?arrow_forwardSEved Spring Corp. has two divisions, Daffodil and Tulip. Daffodil produces a gadget that Tulip could use in its production. Tulip currently purchases 170,000 gadgets for $13.90 on the open market. Daffodil's variable costs are $7 per widget while the full cost is $11.45. Daffodil sells gadgets for $14.40 each. If Daffodil is operating at capacity, what would be the minimum transfer price Daffodil would accept for an internal transfer? Multinic Choice $7.40 $1.45 $13.90 $14.40arrow_forward

- Garcia Company sells snowboards. Each snowboard requires direct materials of $111, direct labor of $41, variable overhead of $56, and variable selling, general, and administrative costs of $14. The company has fixed overhead costs of $657,000 and fixed selling, general, and administrative costs of $120,000. It expects to produce and sell 11,100 snowboards. What is the selling price per unit if Garcia uses a markup of 10% of total cost? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar amounts.) Selling price per undarrow_forwardBeantown Baseball Company makes baseballs that sell for $13 per two-pack. Current annual production and sales are 576,000 baseballs. Costs for each baseball are as follows: Direct material $2.00 Direct labor $1.25 Variable overhead $0.50 Variable selling expenses $0.25 Total variable cost $4.00 Total fixed overhead $750,000 d. Determine the company’s margin of safety in number of baseballs, in sales dollars, and as a percentage. Margin of safety in baseballs: 276,000 Margin of safety in dollars: $______ Margin of safety percentage: ______%arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball Is manufactured In a small plant that relles heavly on direct labor workers. Thus, varlable expenses are high, totallng $15.00 per ball, of which 60% Is direct labor cost. Last year, the company sold 58,000 of these balls, with the following results: $ 1,450,000 Sales (58,800 balls) variable expenses Contribution margin Fixed expenses 870,000 580,000 374,000 Net operating income 206,000 Required: 1. Compute (a) last year's CM ratio and the break-even polnt in balls, and (b) the degree of operating leverage at last year's sales level. 2. Due to an Increase in labor rates, the company estimates that next year's varlable expenses will Increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt in balls? 3. Refer to the data in (2) above. If the expected change in varlable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning