Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

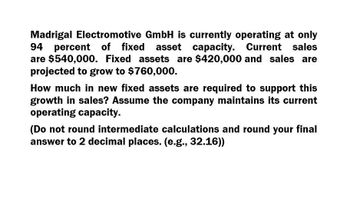

Transcribed Image Text:Madrigal Electromotive GmbH is currently operating at only

94 percent of fixed asset capacity. Current sales

are $540,000. Fixed assets are $420,000 and sales are

projected to grow to $760,000.

How much in new fixed assets are required to support this

growth in sales? Assume the company maintains its current

operating capacity.

(Do not round intermediate calculations and round your final

answer to 2 decimal places. (e.g., 32.16))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (please correct answer and don't use hand rating and don't use Ai solution) Quantitative Problem 2: Mitchell Manufacturing Company has $1,000,000,000 in sales and $260,000,000 in fixed assets. Currently, the company's fixed assets are operating at 75% of capacity. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % If Mitchell's sales increase 60%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardDatabase Systems is considering expansion into a new product line. Assets to support expansion will cost $ 500,000. It is estimated that Database can generate $ 1,200,000 in annual sales, with a 6 percent profit margin. What would net income and return on assets ( investment) be for the year? (Round your return on assets to 1 decimal place. Omit the "$" and "%" signs in your response.)arrow_forwardConsider equipment for the expansion of a production line that will cost $600,000 up front (i.e., today, t = 0). The production line will be depreciated using a 3-year straight-line schedule. At the end of Year 3, the used equipment will have no value. The new line will generate earnings according to the schedule below. What is the Average Accounting Return (AAR) of the new production facility? Answer with a number rounded to three decimal places, e.g., 4.0877% should be entered as 4.088. Year 01 Earnings = $24,500 Year 02 Earnings = $26,000 Year 03 Earnings = $27,250arrow_forward

- Howell Petroleum is considering a new project that complements its existing business. The machine required for the project costs GH¢3.8 million. The marketing department predicts that sales related to the project will be GH¢2.5 million per year for the next four years, after which the market will cease to exist. The machine will be depreciated down to zero over its four-year economic life using the straightline method. Cost of goods sold and operating expenses related to the project are predicted to be 25 percent of sales. Howell also needs to add net working capital of GH¢ 150,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The corporate tax rate is 35 percent. The required rate of return for Howell is 16 percent. Should Howell proceed with the project?arrow_forwardConsider a firm with a contract to sell an asset for $154,000 five years from now. The asset costs $90,000 to produce today. a. Given a relevant discount rate of 13 percent per year, calculate the profit the firm will make on this asset. (A loss should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At what rate does the firm just break even? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Firm's profit (loss) b. Break-even rate %arrow_forwardA firm is considering the installation of an automatic data processing unit to handlesome of its accounting operations. Machine for that purpose may be purchased for P2M or may be leased for P 800,000 for the first year and P 100,000 less every year until the end of the 4th year. If money is worth 15%, which alternative is better and by how much?arrow_forward

- Ian Goods, Inc. has a total assets turnover of 0.30 and a profit margin of 10%. The president is unhappy with the current return on assets, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 15% and (2) by increasing total assets turnover. What new asset turnover ratio, along with the 15% profit margin, is required to double the return on total assets? (SHOW SOLUTION) a. 35% b. 45% c. 40% d. 50%arrow_forwardCello Corporation is considering an investment in new equipment. An analysis by management indicates that the required initial investment is $235,000 and the project has a profitability index of 1.46. What is the net present value of this project? Round to the nearest whole dollar amount and do not enter a dollar sign or a decimal point (e.g., enter 89, not $89.00).arrow_forwardAt an output level of 17,500 units, you have calculated that the degree of operating leverage is 3.40. The operating cash flow is $59,000 in this case. Ignore the effect of taxes. What will be the new degree of operating leverage for output levels of 18,500 units and 16,500 units? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. DOL at 18,500 units 3.40x DOL at 16,500 units 3.40Xarrow_forward

- he. Subject :- Accountingarrow_forwardCan you please answer the accounting question?arrow_forwardA proposed project has fixed costs of $108,000 per year. The operating cash flow at 6,800 units is $96,600. Ignore the effect of taxes. a. What is the degree of operating leverage? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) b. If units sold rise from 6,800 to 7,300, what will be the new operating cash flow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If units sold rise from 6,800 to 7,300, what is the new degree of operating leverage? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning