SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

expert please answer this general account question

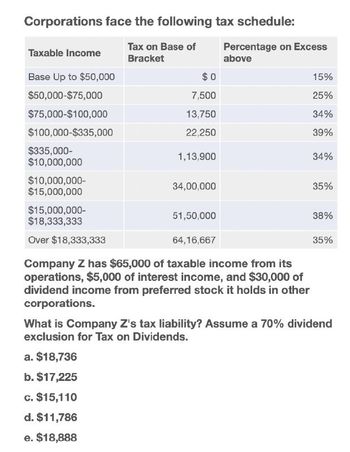

Transcribed Image Text:Corporations face the following tax schedule:

Taxable Income

Base Up to $50,000

Tax on Base of

Bracket

Percentage on Excess

above

$0

15%

$50,000-$75,000

7,500

25%

$75,000-$100,000

13,750

34%

$100,000-$335,000

22,250

39%

$335,000-

1,13,900

34%

$10,000,000

$10,000,000-

34,00,000

35%

$15,000,000

$15,000,000-

$18,333,333

Over $18,333,333

51,50,000

64,16,667

38%

35%

Company Z has $65,000 of taxable income from its

operations, $5,000 of interest income, and $30,000 of

dividend income from preferred stock it holds in other

corporations.

What is Company Z's tax liability? Assume a 70% dividend

exclusion for Tax on Dividends.

a. $18,736

b. $17,225

c. $15,110

d. $11,786

e. $18,888

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that a corporation has $100,000 of taxable income from operations plus $5,000 of interest income and $10,000 of dividend income. What is the company’s federal tax liability?arrow_forwardBarth James Inc. has the following deferred tax assets and liabilities: 12,000 noncurrent deferred tax asset, and 10,500 noncurrent deferred tax liability. Show how Barth James would report these deferred tax assets and liabilities on its balance sheet.arrow_forwardQuince Corporation has taxable income of $485,000 for its calendar tax year. Calculate the corporation's income tax liability for 2019 before tax credits. $________________arrow_forward

- Caloundra Corporation has book income of $ 40,000. Included in the book income is $3,000 of tax-exempt interest, $7,000 of book income tax expense, and a $2,000 nondeductible fine. Also included in book income are $10,000 of dividends. Caloundra received from a 30 percent owned corporation. Using this information and Form 1120 provide the amounts that go on each line on the form. Form 1120, Schedule M-1 Line 1 $__________________ Form 1120, Schedule M-1, Line 10 $__________________ Form 1120, Page 1, Line 28 $__________________ Form 1120, Schedule C, Line 2(a) $ and 2(c) $__________________ Form 1120, Schedule C, Line 24 $__________________ Form 1120, Page 1, Line 29b $__________________ Form 1120, Page 1 , Line 30 $__________________arrow_forwardposted in general accountarrow_forwardAns thisarrow_forward

- An entity provided the following net of tax figures for the current year: Net income 7,700,000 Net remeasurement loss on defined benefit plan 300,000 Unrealized gain on FA@FVOCI 1,500,000 Reclassification adjustment for gain on sale of 250,000 FA@FVOCI included in the net income Share warrants outstanding 400,000 Cumulative effect of change in accounting 500,000 policy - credit Interest revenue 100,000 Equity in associate's earnings 300,000 Prior period error - underdepreciation 200,000 What is the comprehensive income for the current year? A. 8,650,000 B. 8,900,000 C. 8,950,000 D. 9,050,000arrow_forwardCompany K operates in a jurisdiction that levies an income tax with the following rate structure: Percentage Rate Bracket 7% Income from −0− to $75,000 10 Income from $75,001 to $150,000 15 Income in excess of $150,000 Company K incurs a $23,600 deductible expense. Required: Compute the current year tax savings from the deduction assuming that Company K’s taxable income before considering the additional deduction is $69,200. Compute the current year tax savings from the deduction assuming that Company K’s taxable income before considering the additional deduction is $170,800. Compute the current year tax savings from the deduction assuming that Company K has a $5,100 loss before considering the additional deduction.arrow_forwardTaxable Income and Total Tax Liability are in thousands. Item Number of returns Taxable income Under $15,000 30,715,203 Total tax liability Average tax rate* $ 5,400,125 $ 529,117 9.80% Ranges of Adjusted Gross Income $15,000 to under $30,000 27,411,021 $ 189,357,926 $ 15,530,244 $30,000 to under $50,000 28,926,896 $ 639,301,718 $ 55,477,985 8.20% 8.68% *The average tax rate is total tax liability divided by taxable income. Required: $50,000 to under $100,000 37,548,054 $ 1,912,937,663 $ 214,989,667 11.24% $100,000 to under $200,000 24,180,826 $ 2,687,830,279 $ 385,058,662 14.33 % $200,000 or more 11,616,732 $ 6,249,277,422 $ 1,591,015,179 25.46% a. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17.10%, calculate the amount of tax liability for 2021 for all taxpayers. b. What is the amount and nature of difference from actual tax liability specified in the above table? Required A Required B If the federal tax system was changed to a…arrow_forward

- Using the following information to respond to the questions below. The corporation tax rate is 21%. Book income M&E disallowance Excess tax depreciation over book depreciation 1. What is taxable income? 2. What is the total tax expense on the financial statement? 3. What is the current tax expense 4. What is the deferred tax expense $100,000 $2,500 $ 4,000arrow_forwardvv. Subject:- Accountingarrow_forwardCompany K operates in a jurisdiction that levies an income tax with the following rate structure: Percentage Rate 7% 10 15 Company K incurs a $29,000 deductible expense. Required: a. Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the additional deduction is $70,600. Bracket Income from -0- to $75,000 Income from $75,001 to $150,000 Income in excess of $150,000 b. Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the additional deduction is $174,000. c. Compute the current year tax savings from the deduction assuming that Company K has a $5,250 loss before considering the additional deduction. Required A Complete this question by entering your answers in the tabs below. Tax savings Required B Required C Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the additional deduction is $174,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning