Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

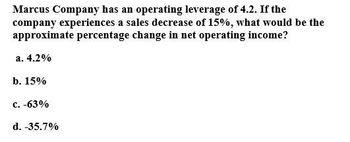

Transcribed Image Text:Marcus Company has an operating leverage of 4.2. If the

company experiences a sales decrease of 15%, what would be the

approximate percentage change in net operating income?

a. 4.2%

b. 15%

c. -63%

d. -35.7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please provide this question solution general accountingarrow_forwardBendel Incorporated has an operating leverage of 7.3. If the company's sales volume increases by 3%, its net operating income should increase by about: Multiple Choice O 7.3% 3.0% 21.9% 243.3%arrow_forwardPlease help me with accounting questionsarrow_forward

- I need answer of this question accountingarrow_forwardCleckley corporation operating leverage solve this accounting questionsarrow_forwardS Firm J has net income of $124,800, sales of $960,000, and average total assets of $640,000. Required: Calculate Firm J's margin, turnover, and return on investment (ROI). Choose Numerator: Choose Numerator: Choose Numerator: Margin /Choose Denominator: Turnover /Choose Denominator: 1 1 Return on Investment /Choose Denominator: 1 1 11 11 II 11 = = || = = II Margin Margin Turnover Turnover Return on Investment Return on Investmentarrow_forward

- Adams Inc. has the following data: rRF = 4.00%; RPM = 7.00%; and b = 1.20. What is the firm's cost of common from retained earnings based on the CAPM? Group of answer choices 11.53% 12.40% 12.03% 11.78% 12.65%arrow_forwardAdams Inc. has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.05. What is the firm's cost of common from reinvested earnings based on the CAPM? a. 12.72% O b. 11.99% c. 12.35% d. 11.64% e. 11.30%arrow_forwardSales for Green Inc. are expected to change by 16%. If Green's degree of operating leverage is 2.20, how much is Green's operating income expected to change? A В D E 1 2 3 Green's operating income is expected to change by: 4 6 7 8 9 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub