FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Today's dollars, assuming of 3 percent?

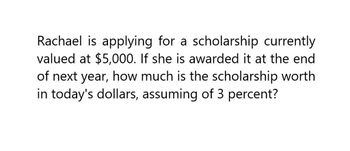

Transcribed Image Text:Rachael is applying for a scholarship currently

valued at $5,000. If she is awarded it at the end

of next year, how much is the scholarship worth

in today's dollars, assuming of 3 percent?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are applying for a scholarship currently valued at $6,500. If you are awarded it at the end of next year, how much will it be worth in today's dollars, assuming inflation of 2.5 percentarrow_forwardPlease help mearrow_forwardEmma wants to donate $1,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of j4=5% p.a. effective and the first scholarship will be first awarded 2.5 years after the date of the donation. (a) What is the amount of the annual scholarship (rounded to two decimal places)?arrow_forward

- Emma wants to donate $1,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of j4=4.12% p.a. effective and the first scholarship will be first awarded 2.5 years after the date of the donation. (a) What is the amount of the annual scholarship (rounded to two decimal places)? (b) Assume that the fund's earnings rate rate has changed from j4=4.12% to j4 = 3.87% one year before the first scholarship payment. How much does Emma need to add to the fund at that time (one year before the first scholarship payment) to ensure that scholarship amount will be unchanged (rounded to two decimal places)? (a) What is the amount of the annual scholarship (rounded to two decimal places)? a. 44494.20 b. 46355.87 C. 41840.92 d. 43772.21 (b) Assume that the fund's earnings rate rate has changed from 4-4.12% to 4-3.87% one year before the first scholarship payment. How much does Emma need to add to the fund at that time (one year before the first…arrow_forwardBrenda Young desires to have $16,500 eight years from now for her daughter’s college fund. If she will earn 12 percent (compounded annually) on her money, what amount should she deposit now?arrow_forwardMary Cooper, Sheldon's mother, who lives in east Texas, wants to help pay for her grandchild's education. How long will it take Mary to reach her goal of $295,000 if she invests $10,000 per year, earning 6 percent? Use Appendix A-3 or the Garman/Forgue companion website. Round your answer to the nearest half-year. yearsarrow_forward

- Annalise will deposit into her investment account $4,500, $1,000, and $5,500 at the end of Years 1, 2, and 3, respectively. What will her account be worth at the end of the Year 3 if she earns an annual rate of 6.15 percent? O $11,632.02 O $10,381.25 O $9,725.12 O $11,526.50 None of these answers are correctarrow_forwardDengerarrow_forward10. Tracy won a scholarship which pays $5,000 per year for the next three 3 years beginning a year from today. What is the present value of the scholarship using a discount rate of 7%? 11. Jason will receive $8,500 a year for the next 15 years. Assuming an interest rate of 7%, calculate the present value of the future payments if first receipt occurs today?arrow_forward

- Palma wants to establish a fund for her granddaughter's college education. What lump sum must she deposit in an account that pays an annual interest rate of 6%, compounded monthly, if she wants to have $10,000 in 10 years?arrow_forwardYou want to endow a scholarship that will pay $11,000 per year forever, starting one year from now. If the school’s endowment discount rate is 6%, what amount must you donate to endow the scholarship?arrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education