Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use ai given answer accounting questions

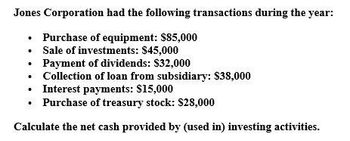

Transcribed Image Text:Jones Corporation had the following transactions during the year:

Purchase of equipment: $85,000

⚫ Sale of investments: $45,000

Payment of dividends: $32,000

⚫ Collection of loan from subsidiary: $38,000

⚫ Interest payments: $15,000

⚫ Purchase of treasury stock: $28,000

Calculate the net cash provided by (used in) investing activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardVaden Corp. reported long-term borrowings of $9,400,000, repayments of long-term borrowings of $3,500,000, interest payments of $230,000, repurchase of treasury shares of $150,000, sale of investment securities for $170,000 and cash dividends declared and paid of $95,000. Calculate Vaden’s net cash flow from financing activities.arrow_forwardThe following events occurred last year at Dorder Corporation: Purchase of plant and equipment Sale of long-term investment $ 45,000 Depreciation expense $ 24,000 Dividends received on long- $ 9,000 term investments Paid off bonds payable $ 12,000 $ 32,000 Based on the above information, the net cash provided by (used in) investing activities for the year on the statement of cash flows would be:arrow_forward

- Umberg Company started the year with $119,200 cash and reported net cash provided by operating activities of $240,000, cash paid for dividends of $49,600, cash received from stock issuance of $46,000, cash paid for equipment purchases of $158,000, cash paid for intangible assets of $124,000, and cash paid on bank loan of $43,000. Required: Calculate the following: Net cash provided by (used in) investing activities. Net cash provided by (used in) financing activities. Ending cash. Free cash flow.arrow_forwardKaze Corporation's cash and cash equivalents consist of cash and marketable securities. Last year the company's cash account increased by $25,000 and its marketable securities account decreased by $15,000. Net cash provided by (used in) operating activities was $38,000. Net cash provided by (used in) investing activities was $9,000. Based on this information, the net cash provided by (used in) financing activities on the statement of cash flows was $(47,000). O $47,000. $(37,000). $37,000.arrow_forwardPaper Co. had net income of $70,000 during the year. Dividend payment was $10,000. The following information is available:What amount should Paper report as net cash provided by operating activities in its statement of cash flows for the year? Mortgage repayment Available-for-sale securities purchased Bonds payable-issued Inventory Accounts payable O $0 O $10,000 O $30,000 O $20,000 $20,000 10,000 increase 50,000 increase 40,000 increase 30,000 decreasearrow_forward

- Quinze Seize Corp. reported the following amounts in its statement of financial position at each year-end:a. What is the net cash provided by operating activities?b. What is the net cash used in investing activities?c. What is the net cash provided by financing activities?arrow_forwardWhat is the accruals total reported for this period on these general accounting question?arrow_forwardFinancial Accountingarrow_forward

- Kela corporation reports net income of 570,000 that includes depreciation expense of 77,000 also cash of 47,000 it was borrowed on a three year note payable based on the data total cash inflows operating activities arearrow_forwardPlease Need Answer with calculationarrow_forwardKela Corporation reports net income of $550,000 that includes depreciation expense of $77,000. Also, cash of $52,000 was borrowed on a 3-year note payable. Based on this data, total cash inflows from operating activities are: $679,000. $473,000. $627,000. $602,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning