Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

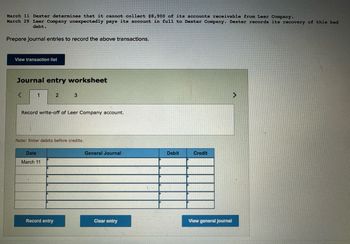

Transcribed Image Text:March 11 Dexter determines that it cannot collect $8,900 of its accounts receivable from Leer Company.

March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad

debt.

Prepare journal entries to record the above transactions.

View transaction list

Journal entry worksheet

<

1

2

3

Record write-off of Leer Company account.

Note: Enter debits before credits.

Date

March 11

General Journal

Debit

Credit

Record entry

Clear entry

View general Journal

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 30, Oscar Inc.s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $2,820.76, but the accounts receivable subsidiary ledger shows total account balances of $2,220.76. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake?arrow_forwardNillsons Nursery uses the direct write-off method for recording bad debts. Required Journalize the following selected entries: 2012 Apr. 10Write off the account of P. A. Seldon as uncollectible, 458. July 27Write off the account of J. M. Weller as uncollectible, 268. Check Figure Total amount debited to Bad Debts Expense 726arrow_forwardDexter Company applies the direct write-off method in accounting for uncollectible accounts. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from its customer Leer Company 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad d Prepare journal entries to record the above selected transactions of Dexter. View transaction list Journal entry worksheet 1 2 Record write off of Leer Company account Note: Enter debits before credits. Date General Journal Debit Credit March 11 Record entry Clear entry View general journal 2arrow_forward

- I need help with the attached imagearrow_forwardSolstice Company determines on October 1 that it cannot collect $61,000 of its accounts receivable from its customer, P. Moore. Apply the direct write-off method to record this loss as of October 1. View transaction list Journal entry worksheet 1 Record the write-off an account. Note: Enter debits before credits. Date October 01 General Journal Debit Creditarrow_forwardes Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $9,800 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Record write-off of Leer Company account. Note: Enter debits before credits. Date March 11 General Journal Debit Credit Record entry Clear entry View general journal >arrow_forward

- Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $9,900 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list 49 6 Journal entry worksheet + prt sc } ] delete backspace k home num end 7arrow_forwardDexter Company uses the direct write-off method March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Co 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt Prepare journal entries to record the above transactions View transaction list Journal entry worksheet 1 2 Record the cash received on account. Note: Enter debits before credits Debit Date General Journal Credit March 29arrow_forwardDexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions View transaction list Journal entry worksheet < 1 Record write off of Leer Co. account Note: Enter debits before credits. Date General Journal Debit Credit March 11 Cash 45,000 45,000 Narrow_forward

- Also answer the Analysis pleasearrow_forwardDexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $10,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Record write-off of Leer Company account. Note: Enter debits before credits. Date March 11 General Journal Debit Credit Record entry Clear entry View general journal >arrow_forwardDexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $9,100 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. Record write off of Leer Co. account. Record the reinstatement of an account previously written off. Record the cash received on account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage