Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

can you explain what is the slide are saying

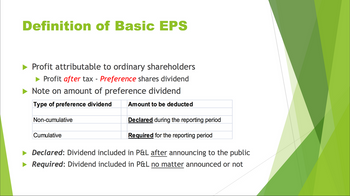

Transcribed Image Text:Definition of Basic EPS

Profit attributable to ordinary shareholders

► Profit after tax - Preference shares dividend

Note on amount of preference dividend

Type of preference dividend

Non-cumulative

Amount to be deducted

Declared during the reporting period

Cumulative

Required for the reporting period

Declared: Dividend included in P&L after announcing to the public

Required: Dividend included in P&L no matter announced or not

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Dividends in arrears on preference shares are reported in the financial statements as a (an) a. liabilityb. reduction from Retained Earningsc. reduction from Retained Earningsd. expensearrow_forwardcalculate the dividend payout?arrow_forwardDividends declared on redeemable preference shares are recognized O By a debit to retained earnings O By a credit to retained earnings O In a profit or loss In other comprehensive incomearrow_forward

- Calculate the total payout?arrow_forwardCumulative preferred dividends in arrears should be shown in a corporation's balance sheet as: O A footnote O An increase in current liabilities O An increase in current liabilities for the current portion and long-term liabilities for the long-term portion O An increase in stockholders' equityarrow_forwardStockholder Payout Ratios The following information pertains to Milo Mindbender Corporation: Required: Calculate the dividend yield, dividend payout, and total payout. (Note: Round answers to two decimal places.)arrow_forward

- What terminology best describes the EPS (earnings per share) formula below? Net income available to common stockholders/ (number of shares outstanding+ potential shares from employee options and convertible debt) A-diluted EPS B-Basic EPS C- operating EPS D- adjusted EPSarrow_forwardWhat is prefences share captial? What is the journal entries mean?arrow_forward1. Which of the following would appear first in a statement of retained earnings? Choices; Cash dividend Prior period error Net income Share dividend 2. Which of the following does not appear in a statement of retained earnings? Choices; Net loss Preference share dividend Other comprehensive income Prior period errorarrow_forward

- Indicate the effects of each of the following transactions on Assets, Liabilities, Share Capital and Retained Earnings. Use + for increase, - for decrease, and 0 for no effect. Share Retained Assets Liabilities Capital Earnings 1. Declaration of cash dividends 2. Payment of cash dividends 3. Declaration of share dividends 4. Issuance of share dividends 5. A share split 6. Cash purchase of treasury stock 7. Sale of treasury stock below costarrow_forward1. It represents the cumulative balance of periodic earnings, dividend distributions, prior period adjustments and other capital adjustments. a. Income summaryb. net incomec.dividends d. accumulated profits 2. The date on which liability for dividends must be recorded a. Date of recordb.Date of issuance c.Date of payment d. Declaration date 3. The amount attributable to every share of ordinary share capital outstanding during the period. a. Par value b. Stated value c. Carrying value d. Bookvalue 4. The date which determines who gets the dividend a. Date of payment b. Date of declaration c. Date of record d. Date of issuance 5. How is the treasury share account presented in the Statement of Financial Position? a. deducted from accumulated profitsb. deducted from shareholders’ equityc. part of reservesd. current assetarrow_forwardThe conversion of preference shares into ordinary shares requires that any excess of the par value of the ordinary shares issued over the carrying amount of the preference shares being converted should be Select one: O a. reflected currently in other comprehensive income. O b. reflected currently in income. treated as a direct reduction of retained earnings. O c. O d. treated as a prior period adjustment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning