Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

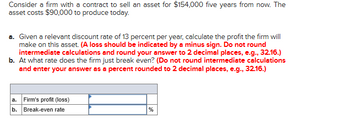

Transcribed Image Text:Consider a firm with a contract to sell an asset for $154,000 five years from now. The

asset costs $90,000 to produce today.

a. Given a relevant discount rate of 13 percent per year, calculate the profit the firm will

make on this asset. (A loss should be indicated by a minus sign. Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. At what rate does the firm just break even? (Do not round intermediate calculations

and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Firm's profit (loss)

b. Break-even rate

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $79,000 immediately. If your cost of capital is 7.2%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $ (Round to the nearest dollar) COOarrow_forwardOriole Company is considering an investment that will return a lump sum of $820,000, 6 years from now. Click here to view the factor table 1. Table 2 Table 3 Table 4 What amount should Oriole Company pay for this investment to earn an 7% return? (For calculation purposes, use 5 decim displayed in the factor table provided, e.g. 5.24571. Round answer to 2 decimal places, e.g. 25.25.) Oriole Company should pay 4 $arrow_forwardpls answer the following questionarrow_forward

- Your company has an opportunity to invest in four companies. You are trying todetermine which of these investments make sense. Your company has a 9% cost ofcapital. It will invest in these companies and receive an annual cash dividend eachyear starting one year after the investment. At the end of the term of investment, theinvestment will be scrapped with no salvage value. (a) Determine the internal rate ofreturn for each investment. Round off to the nearest integer discount rate, withdetailed calculation process. (b)Which investments would you recommend yourcompany make?arrow_forwardA firm, whose cost of capital is 8 percent, may acquire equipment for $146,825 and rent it to someone for a period of five years. Note: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or when using present value factors. If the firm charges $38,730 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % Should the firm acquire the equipment? The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of capital. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to earn the required 8…arrow_forwardModern Artifacts can produce keepsakes that will be sold for $280 each. Nondepreciation fixed costs are $5, 000 per year, and variable costs are $260 per unit. The initial investment of $13,000 will be depreciated straight-line over its useful life of five years to a final value of zero, and the discount rate is 10%. What is the accounting break-even level of sales if the firm pays no taxes? What is the NPV break-even level of sales if the firm pays no taxes? Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. What is the accounting break-even level of sales if the firm's tax rate is 20%? What is the NPV break-even level of sales if the firm's tax rate is 20%? Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. What is the degree of operating leverage for the firm for the NPV break-even points when the tax rate is 0% and when the tax rate is 20%? Note: Round intermediate calculation to the…arrow_forward

- A new computer system will require an initial outlay of $19,000, but it will increase the firm’s cash flows by $3,800 a year for each of the next 8 years. How high can the discount rate be before you would reject the project? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal placesarrow_forwardSuppose you sell a fixed asset for $115,000 when it's book value is $135,000. If your company's marginal tax rate is 21%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardYour storage firm has been offered $100,000 in one year to store some goods for one year. Assume your costs are $95.700, payable immediately, and the cost of capital is 8.5%. Should you take the contract? The NPV will be $ (Round to the nearest cent.)arrow_forward

- Suppose you sell a fixed asset for $125,000 when its book value is $139,000. If your company's marginal tax rate is 30%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? Group of answer choices a. $120,080 b. $129,200 c. $9,800 d. $14,000arrow_forwardA firm is considering renting a trailer at $300/mo. The unit is needed for 5 yr. The leasing company offers a lump sum payment of $24,000 at the end of 5 yr as an alternative payment plan, but is willing to discount this figure. The firm places a value of 10% (effective annual rate) on invested capital. How large should the discount be in order to be acceptable as an equivalent?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education