Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give me true answer this general accounting question

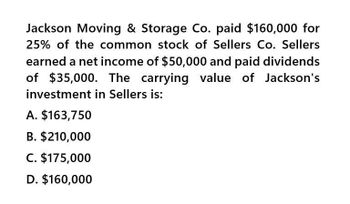

Transcribed Image Text:Jackson Moving & Storage Co. paid $160,000 for

25% of the common stock of Sellers Co. Sellers

earned a net income of $50,000 and paid dividends

of $35,000. The carrying value of Jackson's

investment in Sellers is:

A. $163,750

B. $210,000

C. $175,000

D. $160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- m. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (g). Description Debit Credit n. Received interest of $6,000 from the Solstice Corp. investment in (f). Description Debit Credit o. Sold Solstice Corp. bonds with a face value of $40,020 for $45,000, realizing a gain of $4,980. Description Debit Credit p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for 6 months. The amortization is determined using the straight-line method. Description Debit Credit q. Accrued interest for 3 months on the Dream Inc. bonds purchased in (1). Description Debit Creditarrow_forwardDuring 20X2, Evans Company had the following transactions: a. Cash dividends of 6,000 were paid. b. Equipment was sold for 2,880. It had an original cost of 10,800 and a book value of 5,400. The loss is included in operating expenses. c. Land with a fair market value of 15,000 was acquired by issuing common stock with a par value of 3,600. d. One thousand shares of preferred stock (no par) were sold for 4.20 per share. Evans provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Evans Company.arrow_forwardDuring 20X2, Norton Company had the following transactions: a. Cash dividends of 20,000 were paid. b. Equipment was sold for 9,600. It had an original cost of 36,000 and a book value of 18,000. The loss is included in operating expenses. c. Land with a fair market value of 50,000 was acquired by issuing common stock with a par value of 12,000. d. One thousand shares of preferred stock (no par) were sold for 14 per share. Norton provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Norton Company.arrow_forward

- Josie Corporation reported the following information for 2022. Sales revenue $1000,000 Cost of goods sold 700,000 Operating expenses 110,000 Unrealized holding gain on available-for-sale securities 40,000 Cash dividends received on the securities 4,000 For 2022, Josie would report comprehensive income of O $194,000. O $230,000. O $234,000. O $40,000.arrow_forwardFairbanks Corporation purchased 400 ordinary shares of Sherman Inc. as a trading investment for E13,200. During the year, Sherman paid a cash dividend of £3.25 per share. At year-end, Sherman shares were selling for £34.50 per share. How much total revenues (all revenues) should be recognized from this investment during the year? Select one: Oa. $1900 Ob. $700 OC $1300 Od. $600arrow_forwardDuring 20X5, X co. had the following income and expenses: Gross income from operations $3,000,000 Business expenses <1,400,000> Dividends received from Y co. (32% owned by X co.) 400,000 Capital gains 150,000 Capital loss carry forward <183,000> Net operating loss carry forward <25,000> a. Determine X co.’s dividends received deduction in 20X5? b. Determine X co.’s dividends received deduction in 20X5 assuming that there was no NOL carry forward and X co.’s business expenses were: (i) $3,050,000 or (ii) $3,200,000arrow_forward

- Answerarrow_forwardQuestion: Parent Co. invested $1,070,000 in Sub Co. for 25% of its outstanding stock. Sub Co. pays out 40% of net income in dividends each year. Use the information in the following T- account for the investment in Sub to answer the following questions. Investment in Sub Co. 1,070,000 130,000 52,000 (a) How much was Parent Co.'s share of Sub Co.'s net income for the year? (b) How much was Parent Co.'s share of Sub Co.'s dividends for the year? (c) What was Sub Co.'s total net income for the year? (d) What was Sub Co.'s total dividends for the year?arrow_forward3.During 20X6, X co. had the following income and expenses: Gross income from operations $1,000,000 Business expenses <400,000> Dividends received from Y co. (32% owned by X co.) 200,000 Capital gains 50,000 Capital loss carry forward <65,000> Net operating loss carry forward 100,000 a. Determine X co.’s dividends received deduction in 20X6? b. Determine X co.’s dividends received deduction in 20X6 assuming that there was no NOL carry forward and X co.’s business expenses were:(i) $1,030,000 or (ii) $1,100,000.arrow_forward

- 3arrow_forwardne profit. A&B Co. started operations on April 1, 20x1. Mr. A, a partner in A&B Co., is entitled to 6% interest on the weighted average balance of his capital account. Mr. A's ledger shows the following: A, Capital Ref. Date Debit Credit Balance 100,000.00 79,000.00 87,000.00 001 100,000.00 April 1, 20x1 June 30, 20x1 September 30, 20x1 December 1, 20x1 (98 21,000.00 146 8,000.00 211 4,000.00 83,000.00 Requirement: Compute for the interest on Mr. A's weighted average capital balance.arrow_forward6. Assad Corporation repurchases 10,000 of its shares for $12 per share. The shares were originally issued at an average price of $10 per share. How much gain or loss should Assad report on its statement of comprehensive income as a result of this transaction? a.$0 b.$20,000 loss c.$100,000 gain d.$20,000 loss and $100,000 gainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning