FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

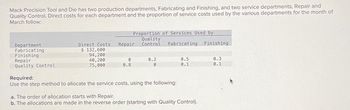

Transcribed Image Text:Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and

Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of

March follow:

Proportion of Services Used by

Department

Fabricating

Direct Costs Repair

$ 132,600

Quality

Control

Fabricating

Finishing

Finishing

94,200

Repair

40,200

0

0.2

0.5

0.3

Quality Control

75,000

0.8

0

0.1

0.1

Required:

Use the step method to allocate the service costs, using the following:

a. The order of allocation starts with Repair.

b. The allocations are made in the reverse order (starting with Quality Control).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following departmental information is for the four departments at Samoa Industries. Number of Total Cost Cost Driver Square Feet Employees Janitorial $150,000 Square footage serviced 200 40 Cafeteria 50,000 Number of employees 20,000 12 Cutting 1,125,000 Assembly 1,100,000 4,000 16,000 120 40 ? The Janitorial and Cafeteria departments are support departments. Samoa uses the sequential method to allocate support department costs, first allocating the costs from the Janitorial Department to the Cafeteria, Cutting, and Assembly departments. Determine the proportional (percentage) usage of the Janitorial Department by the (a) Cafeteria, (b) Cutting, and (c) Assembly departments. a. Cafeteria Department b. Cutting Department c. Assembly Department % % % +arrow_forwardSuarrow_forwardFounder Consulting Corporation has its headquarters in Memphis and operates from three branch offices in Nashville, Atlanta, and Louisville. Two of the company's activity cost pools are Administrative Service and Development Service. These costs are allocated to the three branch offices using an activity-based costing system. Information for next year follows: Activity Cost Pool Activity Measure Estimated Cost Administrative service % of time devoted to branch $ 1,680,000 Development service Computer time $ 630,000 Estimated branch data for next year is as follows: Time to branch Computer time Nashville 70 % 1,600,000 minutes Atlanta 20 % 1,200,000 minutes Louisville 10 % 400,000 minutes Total 100 % 3,200,000 minutes How much of the headquarters cost allocation should Nashville expect to receive next year?arrow_forward

- Hanshabenarrow_forwardanswer in text form please (without image)arrow_forwardDepartmental information for the four departments at Samoa Industries is provided below. Total Cost Cost Driver Square Feet Number of Employees Janitorial $150,000 Square footage serviced 200 40 Cafeteria 50,000 Number of employees 20,000 12 Cutting 1,125,000 4,000 120 Assembly 1,100,000 16,000 40 The Janitorial and Cafeteria departments are support departments. Determine the dollar amount of the Janitorial Department costs to be allocated to the (a) Cutting and (b) Assembly departments using the direct method. a. Cutting Department b. Assembly Departmentarrow_forward

- In July, one of the processing departments at Junkin Corporation had beginning work in process inventory of $30,000 and ending work in process inventory of $32,000. During the month, $206,000 of costs were added to production and the cost of units transferred out from the department was $204,000. Required: Construct a cost reconciliation report for the department for the month of July. Costs to be accounted for: Cost of beginning work in process inventory Costs added to production during the month Total cost to be accounted for Costs accounted for as follows: Cost of ending work in process inventory Cost of units transferred out Total cost accounted forarrow_forward7arrow_forwardDhapaarrow_forward

- Mervon Company has two operating departments: Mixing and Bottling. Mixing occupies 24,660 square feet. Bottling occupies 16,440 square feet. Indirect factory costs include maintenance costs of $234,000. If maintenance costs are allocated to operating departments based on square footage occupied, determine the amount of maintenance costs allocated to each operating department.arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Proportion of Services Used by Department Fabricating Direct Costs Repair $ 134,600 Quality Control Fabricating Finishing Finishing 98,200 Repair Quality Control 42,000 78,400 0 0.2 0.5 0.3 0.6 0 0.2 0.2 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). Complete this question by entering your answers in the tabs below. Required A Required B Use the step method to allocate the service costs, using the following: The allocations are made in the reverse order (starting with Quality Control). Note: Amounts to be deducted should be indicated by a minus sign. Do…arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Required A Required B Direct Costs Repair $ 136,600 102, 200 43,800 81,800 Required: Use the step method to allocate the service costs, using the following: From: a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). Service department costs Repair Quality control Total costs allocated Complete this question by entering your answers in the tabs below. $ $ Repair Proportion of Services Used by Quality Control 0 0.8 Use the step method to allocate the service costs, using the following: The order of allocation starts with Repair. Note: Amounts to be deducted should be indicated by a minus…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education