FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

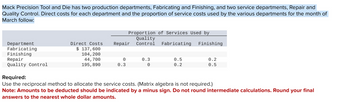

Transcribed Image Text:Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and

Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of

March follow:

Proportion of Services Used by

Department

Fabricating

Finishing

Repair

Quality Control

Required:

Direct Costs

Repair

Quality

Control

Fabricating Finishing

$ 137,600

104,200

44,700

195,890

0

0.3

0.3

0.5

0.2

0

0.2

0.5

Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.)

Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round your final

answers to the nearest whole dollar amounts.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Logan Products has two production departments—assembly and finishing. These are supported by two service departments—sourcing (purchasing and handling of materials and human resources) and operations (work scheduling, supervision, and inspection). Logan has the following labor hours devoted by each of the service departments to the other departments. Total Labor Hours Used by DepartmentsSourcing Operations Assembly FinishingSourcing - 20,000 40,000 60,000Operations 10,000 - 60,000 50,000The costs incurred in the plant are as follows: Departments Departmental CostsSourcing $ 177,000Operations 225,000Assembly 418,000Finishing 263,000Total $ 1,083,000 What are the total costs in the production departments after allocation?arrow_forwardHaresharrow_forwardRahularrow_forward

- answer in text form please (without image)arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control From: Direct Costs Repair $ 147,600 Service department costs Repair Quality control Total 112, 200 48,300 140, 210 $ Repair 8 0.3 0 $ Proportion of Services Used by Quality Control Fabricating Required: Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amounts. 0.3 Cost Allocation To: Quality Control 0.5 8.2 Fabricating $ Finishing 0.2 0.5 0 $ Finishingarrow_forwardHaresharrow_forward

- Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Required: Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amounts.arrow_forwardDhepaarrow_forwardSagararrow_forward

- sanjuarrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Proportion of Services Used by Department Direct Costs Repair Quality Control Fabricating Finishing Fabricating $ 136,600 Finishing 102,200 Repair 43,800 0 0.2 0.6 0.2 Quality Control 81,800 0.8 0 0.1 0.1 Required: Use the step method to allocate the service costs, using the following: The order of allocation starts with Repair. The allocations are made in the reverse order (starting with Quality Control). Complete this question by entering your answers in the tabs below. Required A Required B Use the step method to allocate the service costs, using the following:The order of allocation starts with Repair.Note: Amounts to be deducted should be indicated by a…arrow_forwardCordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows: Proportion of Services Used by: Department Direct costs S1 S2 P1 P2 S1 $ 72,000 0.70 0.10 0.20 S2 $ 157,000 0.20 0.30 0.50 P1 $ 214,000 P2 $ 179,000 Under the step method of allocation, the total amount of service costs allocated to producing departments would be: Multiple Choice $174,000. $178,600. $74,000. $229,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education