FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

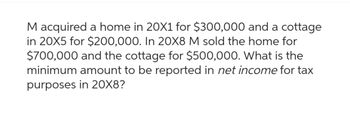

Transcribed Image Text:M acquired a home in 20X1 for $300,000 and a cottage

in 20X5 for $200,000. In 20X8 M sold the home for

$700,000 and the cottage for $500,000. What is the

minimum amount to be reported in net income for tax

purposes in 20X8?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ossie owns some property which has an assessed value of $174,800. Find the tax due if the tax rate is $8.88 per $100 of the assessed value. (Round your answer to the nearest cent.) A. $1,552.22 B. $13,809.20 C. $15,382.40 D. $15,522.24arrow_forwardRobert acquired his rental property 10 years ago for $110,000 and sold it in the current year for $230,000. The accumulated straight-line depreciation on the property at the time of the sale was $35,000. Robert is in the 32 percent tax bracket for ordinary income. What is Robert’s gain on the sale of his rental property? How is the gain taxed? (i.e., what tax bracket is the gain subject to)?arrow_forwardUnder Emma's will, Addison inherits property that generates an estate tax of $1,886,600. Addison dies 4 years later and the property triggers an estate tax of $1,603,610. Click to access Exhibit 18.2, Credit for Tax on Prior Transfers . What is the credit for estate tax on prior transfers claimed by Addison's estate? Addison's estate is entitled to a credit of $fill in the blank 1.arrow_forward

- Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of § 1237 and during the tax year sells the first eight lots to eight different buyers for $159,400 each. Dexter's basis in each lot sold is $111,580, and he incurs total selling expenses of $6,376 on each sale. What is the amount of Dexter's capital gain and ordinary income? If required, round your answers to the nearest dollar. Dexter has a realized and recognized gain of $ as a capital gain. of which $ is classified as ordinary income andarrow_forwardVikrambhaiarrow_forwardMarc, a single taxpayer, earns $60,000 in taxable income and $5,000 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for year 2023, what is his effective tax rate? ( Use tax rate schedule.) Note: Round your final answer to two decimal places. Multiple Choice 22 percent 13.09 percent 14.98 percent 10.62 percent None of the choices are correct. Don't use any AI. It's strictly prohibited.arrow_forward

- n each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the income effect. a. Mr. Edwards earns $32,000 a year as an employee, and Mrs. Edwards doesn’t work.b. Mr. Frank earns $22,000 a year as an employee, and Mrs. Frank earns $10,000 a year as a self-employed worker.c. Mr. George earns $22,000 a year as an employee, and Mrs. George earns $10,000 a year as an employee.arrow_forwardAram's taxable income before considering capital gains and losses is $82,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer) Required: a. Aram sold a capital asset that he owned for more than one year for a $5,440 gain, a capital asset that he owned for more than one year for a $720 loss, a capital asset that he owned for six months for a $1,640 gain, and a capital asset he owned for two months for a $1,120 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.220 gain, a capital asset that he owned for more than one year for a $2,940 loss, a capital asset that he owned for six months for a $420 gain, and a capital asset he owned for two months for a $2.340 loss c. Aram sold a capital asset that he owned for more than one year for a $2.720 loss, a capital asset that he owned for six months for a $4,640 gain, and a capital asset…arrow_forwardHow much is the estate tax due on the estate of Nicanor?arrow_forward

- Alicia sold her personal residence to Rick for $300,000. Before the sale, Alicia paid the real estate tax of $4,380 for the calendar year. For income tax purposes, the deduction is apportioned as follows; $2,160 for Alicia and $2,220 for Rick. What is Ricks basis in the residence?arrow_forwardGinger agreed to pay the full deed transfer tax on the $600,000 sale of her property in Miami-Dade County. Ho much will Ginger owe for the deed transfer tax? $2.500 $3,600 $4.200 $4.000arrow_forwardAram's taxable income before considering capital gains and losses is $71,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Required: Aram sold a capital asset that he owned for more than one year for a $5,220 gain, a capital asset that he owned for more than one year for a $610 loss, a capital asset that he owned for six months for a $1,420 gain, and a capital asset he owned for two months for a $1,010 loss. Aram sold a capital asset that he owned for more than one year for a $2,110 gain, a capital asset that he owned for more than one year for a $2,720 loss, a capital asset that he owned for six months for a $310 gain, and a capital asset he owned for two months for a $2,120 loss. Aram sold a capital asset that he owned for more than one year for a $2,610 loss, a capital asset that he owned for six months for a $4,420 gain, and a capital asset he…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education