FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

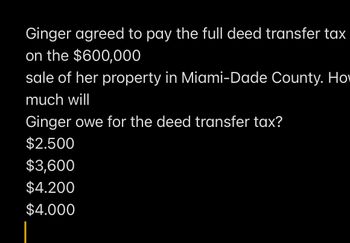

Transcribed Image Text:Ginger agreed to pay the full deed transfer tax

on the $600,000

sale of her property in Miami-Dade County. Ho

much will

Ginger owe for the deed transfer tax?

$2.500

$3,600

$4.200

$4.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joe Taxpayer had state withholding of $30,000, dmv of $1000, property taxes of $6,000. What is the net state and local deduction? Part II: Joe calls and wants to know how much paying his second installment of property taxes of $5,000 will save him. Assume he is in the 30% marginal bracket.arrow_forwardSuppose Ms. Heiter's property has an assessed value of $230,000. She originally paid $60.000 to purchase the land and paid $120,000 to build the structure on it. The property tax rate in Ms. Heiter's municipality is 4 percent. What does Ms. Heiter owe in property taxes annually? NOTE Please enter your numeric answer below, rounded to the nearest dollar. Do not enter the dollar sign or any commas.arrow_forwardV5Dennis buys land by paying $50,000 in cash and assuming a loan for $45,000. He incurs legal fees and commissions of $5,000. He pays a special $3,000 street improvement assessment. Dennis receives $6,000 from the county for a portion of his property that was needed to widen the street. His property tax liability for this year is $750 and his interest on the loan is $1,850. What is the adjusted basis of Dennis’s land? Show your work.arrow_forward

- In the current tax year, a taxpayer sells a painting for $12,000. She purchased the painting two years ago for $8,000. The short-term capital gains rate is 25%. The long-term capital gains rate is 15%. What is the taxpayer's gain for the current tax year? O $600 short-term capital gain. O $600 long-term capital gain. O $1,000 long-term capital gain. O$1,000 short-term capital gain An individual with a taxable income of $50,000 sells 300 shares of stock at a market price of $100 per share. At the individual's present level of income, there is a marginal ordinary income tax rate of 25% and a long-term capital gains rate of 15%. 200 shares of the stock were acquired 13 months earlier at a price of $80 per share, and 100 shares were acquired two years earlier at a price of $60 per share. What is this individual's tax liability after this transaction? O $2,000 O $1,800 O $8,000 O $1,200arrow_forwardGeorge and Almaida sold their property. The deposit was $40,000 and was paid to the real estate broker. The total commission was $34,400. Will George and Almaida get the difference back, and if yes, how?arrow_forwardOn March 18, 2021, Nicanor consulted you on the sale of his principal residence located in Recto, Manila last March 15, 2021. The following are the information he provided to you: Selling price P 4,000,000 Cost of the principal residence (property was acquired in 2000) 2,000,000 Fair market value of land as per tax declaration (based on the latest tax declaration) 3,000,000 Fair market value of house as per tax declaration (based on the latest tax declaration) 2,000,000 Zonal value of the land as determined by the CIR 4,000,000 Additional information: He acquired a new principal residence amounting to P 3,000,000 located in Sampaloc, Manila last March 17, 2021. His TIN is registered in Makati where he works as an employee of ABC Corp while the TIN of the buyer of his principal residence is registered in Caloocan. In what RDO will Nicanor file the capital gains tax return? Group of answer choices a. RDO in Makati b. RDO in Manila c. RDO in…arrow_forward

- 2. How much is the donor's tax In January 2018, Don Nor donated commercial land to his second cousin. The value in the tax declaration is P2million pesos while the zonal value is P1.7million pesos. 102,000 O 120,000 87,000 O 105,000arrow_forwardGive correct answerarrow_forwardConner and Matsuko paid $1,000 and $2,000, in qualifying expenses for their two sons, Jason and Justin, respectively, to attend Idaho State University. Jason is a sophomore and Justin is a freshman. Conner and Matsuko's AGI is $195,000. What is their allowable American opportunity tax credit? Multiple Choice $0. $3,000. $2,000. $3,700.arrow_forward

- How much and where on the tax return would Jessica James, a cash-basis farmer, deduct $8,544 mortgage interest expense; 20% allocable to her home and 80% allocable to the farm land? (a) $1,709 on Schedule A, and $6,835 increases the basis of the farm land. (b) $1,709 on Schedule A, and $6,835 on Schedule F. (c) $6,835 on Schedule A. (d) $6,835 on Schedule F.arrow_forwardSalvador and Jenna Porter purchased a home in Kenosha, Wisconsin, for $400,000. They moved into the home on February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the home for $500,000. The Porters' marginal ordinary tax rate is 35 percent. Note: Leave no answer blank. Enter zero if applicable. Required: a-1. Assume that the Porters sold their home and moved because they didn't like their neighbors. How much gain will the Porters recognize on their home sale? a-2. At what rate, if any, will the gain be taxed? b. Assume the Porters sell the home because Jenna's employer transfers her to an office in Texas. How much gain will the Porters recognize on their home sale? c. Assume the same facts as in part (b), except that the Porters sell their home for $700,000. How much gain will the Porters recognize on the home sale? Note: Do not round intermediate calculations. d. Assume the same facts as part (b), except that on December 1 of…arrow_forwardAn investor has a taxable income of $125997. He has an investment property which earns $21780 in rental income and incurs $35782 in expenses, including maintenance, local council rates, land tax and interest on a mortgage loan. What is his total income tax payable (excluding the 2% Medicare surcharge)? a. $23865 b. $26865 c. $24865 d. $27865arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education