FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

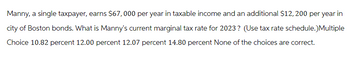

Transcribed Image Text:Manny, a single taxpayer, earns $67,000 per year in taxable income and an additional $12, 200 per year in

city of Boston bonds. What is Manny's current marginal tax rate for 2023? (Use tax rate schedule.)Multiple

Choice 10.82 percent 12.00 percent 12.07 percent 14.80 percent None of the choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2020. Please show all work and calculations where appropriate. Taxpayer(s) Filing Status Taxable Income Income Tax Macintosh Single $35,700 Hindmarsh MFS $62,000 Kinney MFJ $143,000 Rosenthal H of H $91,500 Wilk Single $21,400arrow_forwardManny, a single taxpayer, earns $65,600 per year in taxable income and an additional $12,060 per year in city of Boston bonds. What is Manny's current marginal tax rate for 2021? (Use tax rate schedule.) Multiple Choice 11.23 percent 12.00 percent 12.93 percent 15.34 percent None of the choices are correct.arrow_forwardProblem Renee and Sanjeev Patel, who are married, reported taxable income of $1,008,000 for 2022. They incurred positive AMT modifications of $142,500. Click here to access the exemption table. a. Compute the Patels' alternative minimum taxable income (AMTI) for 2022. 1,008,000 Taxable income Plus: Equals: AMTI AMTI b. Compute the Patel's tentative minimum tax. Computation of AMT Base and Tax 8) AMT modifications AMT exemption AMT base TMT $ 75,000 1,083,000 1,083,000arrow_forward

- A9arrow_forwardIn 2023, Jasmine and Thomas, a married couple, had taxable income of $162,000. If they were to file separate tax returns, Jasmine would have reported taxable income of $152,000 and Thomas would have reported taxable income of $10,000. Use Tax Rate Schedule for reference. What is the couple's marriage penalty or benefit? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. X Answer is complete but not entirely correct. Marriage benefit 23,615 Xarrow_forwardVishnuarrow_forward

- ! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forward10.arrow_forwardRequired information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $530,000. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. b. His $530,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $570,000. Answer is complete but not entirely correct. Income tax Net investment income tax Total tax liability Amount 159,251.75 x 2,000.00 x 161,251.75arrow_forward

- Clayton received a $140,000 distribution from his 401(k) account this year. Assuming Clayton's marginal tax rate is 25 percent, what is the total amount of tax and penalty Shauna will be required to pay if she receives the distribution on her 62nd birthday and she has not yet retired? Group of answer choices $0 $14,000 $35,000 $49,000 None of the choices is correct.arrow_forward2. Determine from the tax table or the tax rate schedule, whichever is appropriated, the amount of the income tax for each of the following taxpayers for 2022. Taxpayer(s) Filling Status Single MFS Elisha Leo Tommy Emilia H of H Single Taxable Income Income Tax 74,580 $86,200 $20,350 $49,650 $ $ $12312arrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education