SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Kindly help me with this question answer general accounting

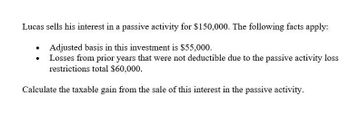

Transcribed Image Text:Lucas sells his interest in a passive activity for $150,000. The following facts apply:

•

Adjusted basis in this investment is $55,000.

Losses from prior years that were not deductible due to the passive activity loss

restrictions total $60,000.

Calculate the taxable gain from the sale of this interest in the passive activity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pat sells land for $25,000 cash and a $75,000 5-year note. If her basis in the property is $30,000 and she receives only the $25,000 down payment in the year of sale, how much is Pat's taxable gain in the year of sale using the installment sales method? $0 $5,000 $17,500 $25,000 $75,000arrow_forwardJasmine owned rental real estate that she sold to her tenant in an instalment sale. Jasmine acquired the property in 2007 for 400,000; took 178,000 of depreciation on it; and sold it for 210,000, receiving 25,000 immediately and the balance (plus interest at a market rate) in equal payments of 18,500 for 10 years. a. What is the nature of the recognized gain or loss from this transaction? b. Assuming that the interest rate on the installment contract is 5%, what is the present value of the installment payments? See Appendix H for present value factors.arrow_forwardLeon sells his interest in a passive activity for $165,500. Determine the tax effect of the sale based on each of the following independent facts: If an amount is zero, enter "0". a. Adjusted basis in this investment is $57,925. Losses from prior years that were not deductible due to the passive activity loss restrictions total $63,718. The The suspended losses at the end of the year are IS b. Assume the same sales price but the adjusted basis in this investment is $124,125. Losses from prior years that were not deductible due to the passive activity loss restrictions total $63,718. The IS The suspended losses at the end of the year are $ The c. Assume the same sales price but the adjusted basis in this investment is $124,125. Losses from prior years that were not deductible due to the passive activity loss restrictions total $63,718. In addition, suspended credits total $16,550. is The suspended losses at the end of the year are $ The suspended credits at the end of the year arearrow_forward

- Alfonso sells a passive activity in the current year for $800,000. His adjusted basis in the activity is $200,000, and he uses the installment method of reporting the gain. The activity has suspended losses of $44,000. Alfonso receives $400,000 in the year of sale. a. What is his gross profit ratio on the sale? Enter as a percentage. For example, .35 would be entered as "35".% b. His recognized gain for the current year is $. c. Alfonso can currently deduct $of suspended losses.arrow_forwardVerlin sells a commercial building and receives $50,000 in cash and a note for $60,000 at 10 percent interest. Verlin's adjusted basis in the building on the date of sale is $45,000 and he collects only the $50,000 down payment in the year of the sale. a. If Verlin elects to recognize the total gain on the property in the year of sale, calculate the taxable gain. b. Assuming Verlin uses the installment sale method, calculate the taxable gain he must report for the year of the sale. c. Assuming Verlin collects $10,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized under the installment sale method.arrow_forwardBetty sells an interest in a passive activity for $100,000. Her adjusted basis is $70,000 and losses from prior years that were not deductible due to the passive activity loss restrictions total $40,000. The tax effects of the sale are: Gain $30,000 O Gain $60,000 O Loss $10,000 O No gain, No loss.arrow_forward

- During the current year, TLI Corporation sells a tract of land for $90,000. The sale is made to Sophie, TLI Corporation's sole shareholder. TLI Corporation originally purchased the land five years earlier for $121,000. Read the requirements. Requirement a. What is the amount of gain or loss that TLI Corporation will recognize on the sale during the current year? First, calculate the gain or loss realized and then calculate the gain or loss recognized in the current year. (For a gain or loss with a zero value, enter $0 and select N/A.) Amount Gain or loss Gain or loss realized Gain or loss recognized Requirements a. What is the amount of gain or loss that TLI Corporation will recognize on the sale during the current year? b. Assume that in the following year, Sophie sells the land for $111,000. What is the amount of gain or loss Sophie will recognize? What are the tax consequences to TLI Corporation upon the subsequent sale by Sophie? c. Assume that in the following year, Sophie sells…arrow_forwardHurwitz, LLC sells a parcel of waterfront land and a residential condo building with an adjusted tax basis of $100,000 and 50,000, respectively for $500,000. The original purchase price Hurwitz, LLC allocated to the building was $600,000. Hurwitz LLC has deducted $550,000 in depreciation expense. Hurwitz, LLC's realized gain on this transaction is $350,000. If Hurwitz LLC takes back a note as part of the proceeds, what is Hurwitz LLC's gross profit percentage? A. 83.33% B. 71.43% C. 70% D. 50% E. 30%arrow_forwardKNB sold real property to Firm P for $15,000 cash and Firm P’s assumption of the$85,000 mortgage on the property.Required: What is KNB’s amount realized on the sale?b. Compute KNB’s after-tax cash flow from the sale if its adjusted basis in the realproperty is $40,000 and its marginal tax rate is 35 percent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you