College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Q1:

Wyatt Company had three intangible assets at the end of 2024 (end of the fiscal year):

Computer software and Web development technology purchased on January 1, 2024, for $70,000. The technology is expected to have a useful life of four years.

A patent purchased from R. Jay on January 1, 2024 for a cash cost of $6,000. Jay had registered the patent with the Canadian Intellectual Property Office seven years earlier on January 1, 2017. The cost of the patent is amortized over its legal life.

A trademark that was internally developed and registered with the Canadian government for $13,000 on November 1, 2023. Management decided that the trademark has an indefinite life.

Required:

1. What is the acquisition cost of each intangible asset?

tech 70k

patent 6k

trademark 13k

2. Compute the amortization of each intangible asset at December 31, 2024. The company does not use contra accounts. (Round the final answers to the nearest whole dollar.)

tech 17.5k

patent: ????

3-a. Compute the amount of amortization on the statement of earnings for 2024. (Round the intermediate calculations to nearest dollar amount.)

amount of amortization: ????

3-b. Show how these assets and any related expenses should be reported on the statement of financial position at December 31, 2024. (Round the intermediate calculations to nearest dollar amount.)

technology net: 52.5k

patent, net: ????

trademark: 13k

Q2:

During the current year, Fortini Company disposed of three different assets. The company’s accounts reflected the following on January 1 of the current years, prior to the disposal of the assets:

| Asset | Original Cost | Residual Value | Estimated Life | |||||||||

| Machine A | $21k | 3k | 8 yr | $15750 | (7 years) | |||||||

| Machine B | 50k | 4k | 10 yr | 36.8k | (8 years) | |||||||

| Machine C | 75k | 3k | 12 yr | 60k | (10 years) | |||||||

The machines were disposed of in the following ways:

- Machine A: Sold on January 1 of the current year for $5,000 cash.

- Machine B: Sold on April 1 for $10,500; received cash, $2,500, and a note receivable for $8,000, due on March 31 of the following year, plus 6 percent interest.

- Machine C: Suffered irreparable damage from an accident on July 2. On July 10, a salvage company removed the machine at no cost. The machine was insured, and $18,000 cash was collected from the insurance company.

Required:

1. Prepare all journal entries related to the disposal of each machine in the current year. (If no entry is required for a transaction/event, select "No

Apr 1:

Dr cash 2.5k

Dr note recivable 8k

Dr accumulated depreciation, machine B: ???

Dr loss on disposal of machine: ????

Cr equipment, machine b: 50k

Jul 2:

Dr cash 18k

Dr accumulated depreciation, machine C: ???

Dr equipment, machine C: ???

Cr Gain on disposal of machine: ????

Please help me correct the wrong answers. Please answer the "???". Photos will be Q3 and Q4.

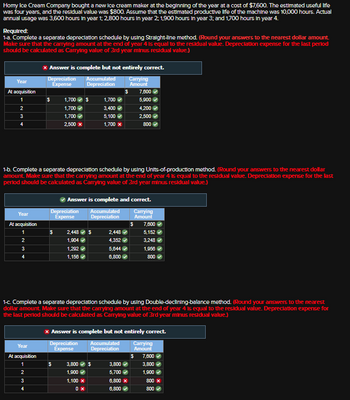

Transcribed Image Text:Homy Ice Cream Company bought a new ice cream maker at the beginning of the year at a cost of $7,600. The estimated useful life

was four years, and the residual value was $800. Assume that the estimated productive life of the machine was 10,000 hours. Actual

annual usage was 3,600 hours in year 1; 2,800 hours in year 2; 1,900 hours in year 3; and 1,700 hours in year 4.

Required:

1-a. Complete a separate depreciation schedule by using Straight-line method. (Round your answers to the nearest dollar amount.

Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last period

should be calculated as Carrying value of 3rd year minus residual value.)

× Answer is complete but not entirely correct.

Year

Depreciation

Expense

Accumulated

Depreciation

Carrying

Amount

At acquisition

7,600

1

$

1,700 $

1,700

5,900

2

1,700 →

3,400

4,200

3

1,700

5,100 ✔

2,500

4

2,500 x

1,700 x

800

1-b. Complete a separate depreciation schedule by using Units-of-production method. (Round your answers to the nearest dollar

amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last

period should be calculated as Carrying value of 3rd year minus residual value.)

Answer is complete and correct.

Year

Depreciation

Expense

Accumulated

Depreciation

Carrying

Amount

At acquisition

$

7,600

1

S

2,448 $

2,448

5,152

2

1,904 ✔

4,352

3,248

3

4

1,292

1,158

5,844

1,956

6,800 →

800

1-c. Complete a separate depreciation schedule by using Double-declining-balance method. (Round your answers to the nearest

dollar amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for

the last period should be calculated as Carrying value of 3rd year minus residual value.)

× Answer is complete but not entirely correct.

Accumulated

Depreciation

Year

Depreciation

Expense

Carrying

Amount

At acquisition

$

7,600

1

$

234

3,800

1,900

$

3,800

5,700

3,800

1,900

1,100 x

6,800 x

800 x

4

0 x

6,800

800

Transcribed Image Text:Rungano Corporation is a global publisher of magazines, books, and music, as well as video collections, and it is one of the world's

leading direct-mail marketers. Many direct-mail marketers use high-speed Didde press equipment to print their advertisements. These

presses can cost more than $1 million. Assume that Rungano owns a Didde press acquired at an original cost of $400,000. It is being

depreciated on a straight-line basis over a 20-year estimated useful life and has a $50,000 estimated residual value. At the end of

2024, the press had been depreciated for eight years. On April 1, 2025, a decision was made, on the basis of improved maintenance

procedures, that a total estimated useful life of 25 years and a residual value of $73,000 would be more realistic. The fiscal year ends

December 31.

Required:

1-a. Compute the amount of depreciation expense recorded in 2024.

Answer is complete and correct.

Depreciation expense

$17,500

1-b. Compute the carrying amount of the printing press at the end of 2024.

Answer is complete and correct.

Carrying amount

260,000

2. Compute the amount of depreciation that should be recorded in 2025.

× Answer is complete but not entirely correct.

Depreciation expense

11,000

3. Prepare the adjusting entry to record depreciation expense at December 31, 2025. (If no entry is required for a transaction/event,

select "No journal entry required" In the first account field.)

× Answer is complete but not entirely correct.

No

date

General Journal

1

December 31, 20 Depreciation expense

Accumulated depreciation

Debit

Credit

11,000 x

11,000 x

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Video Concepts, Inc. (VCI) markets video equipment and film through a vari- ety of retail outlets. Presently, VCI is faced with a decision as to whether it should obtain the distribution rights to an unrelcased film titled Touch of Orange. If this film is distributed by VCI directly to large retailers, VCI's invest- ment in the project would be $150,000. VCI estimates the total market for the film to be 100,000 units. Other data available are as follows: Cost of distribution rights for film $125,000 Label design 5,000 Package design 10,000 Advertising 35,000 Reproduction of copies (per 1,000) 4,000 Manufacture of labels and packaging (per 1,000) 500 Royalties (per 1,000) VC's suggested retail price for the film is $20 per unit. The retailer's margin is 40 percent. 500 a. What is VCI's unit contribution and contribution margin? b. What is the break-even point in units? In dollars? c. What share of the market would the film have to achieve to earn a 20 percent return on VCI's investment…arrow_forwardAmazon.com, Inc. is the world's leading Internet retailer of merchandise and media. Amazon also designs and sells electronic products, such as e-readers. Netflix, Inc. is the world's leading Internet television network. Both companies compete in the digital media and streaming space. However, Netflix is more narrowly focused in the digital streaming business than is Amazon. Sales and average book value of fixed assets information (in millions) are provided for Amazon and Netflix for a recent year as follows: Netflix Amazon Sales $107,006 $6,780 Average book value of fixed assets 19,403 162 a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company is more efficient in generating sales from fixed assets? Interpret your results. C.arrow_forwardElise Carpets Inc. has just acquired a new backing division that produces a rubber backing, which it sells for $3.30 per square yard. Sales are about 1,200,000 square yards per year. Since the Backing Division has a capacity of 2,000,000 square yards per year, top management is thinking that it might be wise for the company's Tufting Division to start purchasing from the newly acquired Backing Divi- sion. The Tufting Division now purchases 600,000 square yards per year from an outside supplier at a price of $3.00 per square yard. The current price is lower than the competitive $3.30 price as a result of the large quantity discounts. The Backing Division's cost per square yard follows. Direct materials.. Direct labor.... Variable overhead.. Fixed overhead (1,200,000 level) Total cost.... $1.80 0.45 0.37 0.15 $2.77 Required a. If both divisions are to be treated as investment centers and their performance evaluated by the ROI formula, what transfer price would you recommend? Why? b. If…arrow_forward

- NE-YO Corporation is currently manufacturing laptops using traditional technology. Only one machine is used for assembling the product. With the improving economic decisions and increasing demands of the market, a more sophisticated machine costing P250,000 may be bought and used for assembling purposes. The terms of acquisition is 5/10, n/30. Additional cost such as freight and installation amounted to P10,000. If the new machine will be purchased, the old machine with book value of P5,000 may be sold for its fair value of P8,000. Other supplies used for the old machine is not necessary for the new machine and can be sold for P9,000, resulting to a loss of P2,500. Additional net working capital of P50,000 is needed for the new machine. Major repairs amounting P4,500 on the old machine will be avoided once the new machine is purchased. Major repairs are not deductible for tax purposes. Assume a tax rate of 40%. Compute the net investmentarrow_forwardSandhill Company manufactures equipment. Sandhill's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $225,000 to $1,500,000, and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment to perform to specifications. Sandhill has the following arrangement with Tamarisk Inc. Tamarisk purchases equipment from Sandhill on May 2, 2023, for a price of $1,034,000 and contracts with Sandhill to install the equipment. Sandhill charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Sandhill determines that the installation service is estimated to have a fair value of $66,000. The cost of the equipment is $700,000. (a) Tamarisk is obligated to pay Sandhill the $968,000 on delivery of the equipment and the balance on the completion of the installation. Sandhill delivers the equipment on June 1,…arrow_forwardWISsub annually resells to industrial manufacturing companies approximately 30,000 industrial ovens purchased from FORCo, its foreign parent, that are neither branded nor warranted. FORCo also sells 5,000 industrial ovens to an independent third party in Canada for $100,000 each. Unlike the industrial ovens sold to WISsub, the industrial ovens sold in Canada are warranted and bear the valuable FORCo label. Suppose that the comparable profits methodology is the best method. Further assume that your search for comparable companies preliminarily includes those on the list below with all return on sales figures being a proper average of the last three taxable years. Which of the companies are functionally comparable to WISsub? (a)arrow_forward

- William Burris invested $100,000 in an Australian-based franchise, Rent Your Boxes, purchasing three territories in the Washington area. After finding out the company had gone bankrupt, he rallied 10 other franchisees to join him and created a new company, Rent Our Boxes. Assume Rent Our Boxes had net income of $38,302 with net sales of $280,585. What was its profit margin on net sales? (Round your answer to the nearest hundredth percent.) Profit margin Prev 14 of 16 Next > ..... rer 90arrow_forwardTruGreen is the worlds largest lawn and landscape company, employing over 10,000 employees and serving more than 1.7 million customers. The Pawtucket Red Sox is a minor league baseball affiliate of the Boston Red Sox. The teams current roster consists of 25 active players, along with the teams manager, coaches, and mascots. Hock It To Me is a privately owned pawn shop. The company has annual revenue of less than 500,000 and employs a staff of one to four people. Even though each of these businesses has a unique payroll due to different amounts of salaries or wages, benefits, and withholdings, explain why each business needs to (a) accurately calculate the amount of payroll for each employee, (b) determine the amount of payroll taxes for which the employer is liable, (c) make the payroll tax deposits as required, and (d) file the appropriate payroll tax returns on a timely basis.arrow_forwardJetTaxi is a passenger airplane line that contracts with larger, well-known lines to provide transportation across the United States. JetTaxi owns 30 aircraft, and currently has contracts for 20 of those aircraft. JetTaxi normally charges $2,700,000 each year per jet to provide the carrier services. Each JetTaxi plane incurs yearly costs of $600,000 for labor, $200,000 for fuel, $400,000 in fixed overhead, and $800,000 in variable overhead. JetTaxi is considering a new contract where they would provide 5 airplanes to a new company for $2,000,000 each year per jet. Should JetTaxi accept the contract? Why? Group of answer choices No, because the differential net income would be zero. Yes, because the differential net income would be $1.6M. No, because the differential net income would be - $2M. Yes, because the differential net income would be $2M.arrow_forward

- Crane Company manufactures equipment. Crane's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $255,000 to $1,550,000, and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment to perform to specifications. Crane has the following arrangement with Shamrock Inc. Shamrock purchases equipment from Crane on May 2, 2023, for a price of $1,065,000 and contracts with Crane to install the equipment. Crane charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $700,000. (a) Shamrock is obligated to pay Crane the $1,009,000 on delivery of the equipment and the balance on the completion of the installation Crane delivers the equipment on June 1, 2023, and completes the installation of the equipment on September 30, 2023. Assume that the equipment and the installation are two…arrow_forwardWilliam Burris invested $100,000 in an Australian-based franchise, Rent Your Boxes, purchasing three territories in the Washington area. After finding out the company had gone bankrupt, he rallied 10 other franchisees to join him and created a new company, Rent Our Boxes. Assume Rent Our Boxes had net income of $39, 902 with net sales of $296,585. What was its profit margin on net sales? (Round your answer to the nearest hundredth percent.)arrow_forwardRiverbed Corporation builds in-home theater systems. Riverbed’s business is growing quickly. Therefore, the CEO, Paul Riverbed, decides to purchase three new trucks on September 20, 2017. The terms of acquisition for each truck are described below. 1. The first truck’s list price is $21,420. Riverbed exchanges home theater equipment from its inventory for the truck. The home theater equipment cost Molitor $13,260. Riverbed normally sells the equipment for $20,145. Riverbed uses a perpetual inventory system. 2. The second truck has a list price of $22,440. Riverbed makes a down payment of $5,100 cash on this truck and signs a zero-interest-bearing note with a face amount of $17,340. Payment of the note is due September 20, 2018. Riverbed would normally have to pay interest at a rate of 8% for such a borrowing. 3. The list price of the third truck is $19,584. This truck is acquired in exchange for 1,224 shares of common stock in Riverbed Corporation. The stock has a par…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning