CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

am.1111.

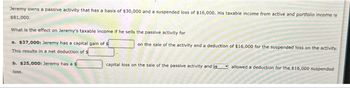

Transcribed Image Text:Jeremy owns a passive activity that has a basis of $30,000 and a suspended loss of $16,000. His taxable income from active and portfolio income is

$81,000.

What is the effect on Jeremy's taxable income if he sells the passive activity for

a. $37,000: Jeremy has a capital gain of $

This results in a net deduction of $

b. $25,000: Jeremy has a s

loss.

on the sale of the activity and a deduction of $16,000 for the suspended loss on the activity.

capital loss on the sale of the passive activity and is

allowed a deduction for the $16,000 suspended

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Michael owns a rental house that generated a 10,000 loss this year. Michael manages the rental property but does not meet the standards for material participation. Michael is a college professor and has wages of 60,000 and 5,000 in dividend income. How is the 10,000 rental real estate loss treated on Michaels tax return? a. 5,000 of the loss is deductible against the passive dividend income. b. The rental loss is not deductible because Michael does not have any passive income. c. 10,000 loss is not deductible because Michael does not materially participate in the rental activity. d. 10,000 loss is deductible under the rental real estate exception because Michael actively participates in the rental activity.arrow_forwardGrace acquired an activity four years ago. The loss from the activity is 50,000 in the current year (at-risk basis of 40,000 as of the beginning of the year). Without considering the loss from the activity, she has gross income of 140,000. If the activity is a convenience store and Grace is a material participant, what is the effect of the activity on her taxable income?arrow_forwardEd owns investment land with an adjusted basis of 35,000. Polly has offered to purchase the land from Ed for 175,000 for use in a real estate development. The amount offered by Polly is 10,000 in excess of what Ed perceives as the fair market value of the land. Ed would like to dispose of the land to Polly but does not want to incur the tax liability that would result. He identifies an office building with a fair market value of 175,000 that he would like to acquire. Polly purchases the office building and then exchanges the office building for Eds land. a. Calculate Eds realized and recognized gain on the exchange and his basis for the office building. b. Calculate Pollys realized and recognized gain on the exchange and her basis in the land.arrow_forward

- Evelyn has rental income of $44,500 and passive income of $15,250. She also has $133,500 of losses from a real estate rental activity in which she actively participates. Evelyn’s AGI is $88,000 before considering this activity. Required: How much rental loss can she deduct against other income sources without regard to the at-risk rules? Deductible rental loss $arrow_forwardJorge owns two passive investments, Activity A and Activity B. He plans to sell Activity A in the current year or next year. Juanita has offered to buy Activity A this year for an amount that would produce a taxable passive activity gain to Jorge of $115,000. However, if the sale, for whatever reason, is not made to Juanita, Jorge believes that he could find a buyer who would pay about $7,000 less than Juanita. Passive activity losses and gains generated (and expected to be generated) by Activity B follow: Two years ago ($35,000) Last year (35,000) This year (8,000) Next year (30,000) Future years Minimal profits All of Activity B's losses are suspended. Jorge is in the 32% tax bracket. If Activity A is sold next year for $7,000 less than Juanita's offer: How are the suspended losses for Activity B treated? What is the Federal income tax related to the sale of Activity A? $_______arrow_forwardPatrick owns a building used in his business with an adjusted basis of $300,000 and a $875,000 FMV. He exchanges the building for a building owned by Danny. Danny's building has a $1,000,000 FMV but is subject to a $125,000 liability. Patrick assumes Danny's liability and uses the building in his business. Read the requirements. Requirement a. What is Patrick's realized gain? The realized gain is Requirement b. What is Patrick's recognized gain? (If there is no recognized gain, make sure to enter "0" in the appropriate cell.) The recognized gain is Requirement c. What is Patrick's basis for the building received? Patrick's basis for the building received isarrow_forward

- 5arrow_forwardNoah Yobs, who has $97,000 of AGI (solely from wages) before considering rental activities, has $87,300 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $48,500 of income. He has other passive activity income of $31,040. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? b. Compute Noah’s AGI on Form 1040 [pages 1 and 2; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss. What amounts should go on lines 1, 6, & 7 on page 2 of FORM 1040? What amount s go on lines 17, & 22 on schedule one of FORM 1040?arrow_forwardaRhonda owns an office building that has an adjusted basis of $45,000. The building is subject to a mortgage of $20,000. She transfers the building to Miguel in exchange for $15,000 cash and a warehouse with an FMV of $50,000. Miguel assumes the mortgage on the building. Required: What are LaRhonda’s realized and recognized gain or loss? What is her basis in the newly acquired warehouse?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT