FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

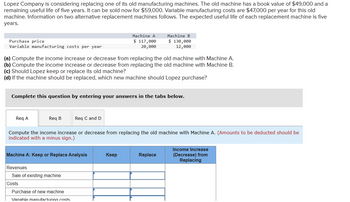

Transcribed Image Text:Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $49,000 and a

remaining useful life of five years. It can be sold now for $59,000. Variable manufacturing costs are $47,000 per year for this old

machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five

years.

Purchase price

Variable manufacturing costs per year

Machine A

$ 117,000

20,000

Machine B

$ 130,000

12,000

(a) Compute the income increase or decrease from replacing the old machine with Machine A.

(b) Compute the income increase or decrease from replacing the old machine with Machine B.

(c) Should Lopez keep or replace its old machine?

(d) If the machine should be replaced, which new machine should Lopez purchase?

Complete this question by entering your answers in the tabs below.

Req A

Req B

Req C and D

Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted should be

indicated with a minus sign.)

Machine A: Keep or Replace Analysis

Keep

Replace

Income Increase

(Decrease) from

Replacing

Revenues

Sale of existing machine

Costs

Purchase of new machine

Variable manufacturing costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $360,500 and will generate $100,000 per year for 5 years. Calculate the IRR for this piece of equipment. (Click here to see present value and future value tables) fill in the blank 1%arrow_forwardPT Tamaro has a plastic manufacturing machine. To increase its production capacity, PT Tamaro plans to buy a new machine at a price of 2,400 dollars and an installation of 100 dollars. This machine has an economic life of 5 years with no residual value. projected with this new machine can increase the level of sales to 2000 dollars per year. operational costs that must be borne by the company are the HPP of 40% of sales and $600 in overhead costs including $300 in depreciation costs. The current tax rate is 20% and the desired rate of return is 20%. Make an analysis whether PT Tamaro's plan to purchase this machine is feasible to implement. Use Discounted Payback Period and Net Present Value?arrow_forwardProblem 1: You are considering the purchase of one of two machines used in your manufacturing plant. Machine A has a life of two years, costs $80 initially, and then $125 per year in maintenance costs. Machine B costs $150 initially, has a life of three years, and requires $100 in annual maintenance costs. Either machine must be replaced at the end of its life with an equivalent machine. Which is the better machine for the firm? The discount rate is 12 percent, and the tax rate is zero.arrow_forward

- Xinhong Company is considering replacing one of its manufacturing machines. The machine has a book value of $41,000 and a remaining useful life of five years, at which time its salvage value will be zero. It has a current market value of $51,000. Variable manufacturing costs are $33,300 per year for this machine. Information on two alternative replacement machines follows. Alternative A Alternative B Cost $ 118,000 $ 118,000 Variable manufacturing costs per year 22,200 10,700 Calculate the total change in net income if Alternative A, B is adopted. Should Xinhong keep or replace its manufacturing machine? If the machine should be replaced, which alternative new machine should Xinhong purchase?arrow_forwardA 3 year-old a computer-controlled fabric cutting machine, which had a $20,000 purchasing price, has a current market (trade- in) value of $12,000 and expected O&M costs of $8,000, increasing by $1,000 per year. The machine is required to have an immediate repair that costs $2,000. The estimated market values are expected to decline by 20% annually (going forward). The machine can be used for another 7 years at most. The new machine has a $40,000 purchasing price. The new machine's O&M cost is estimated to be $4,000 for the first year, decreasing at an annual rate of $100 thereafter. The firm's MARR is 20%. Assume a unique minimum AEC(20%) for both machines (both the current and replacement machine). Using the information above, determine the economic service life along with the optimum annual equivalent cost of the defender (This is an infinite Horizon decision problem).arrow_forwardHelp mearrow_forward

- Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $45,000 and a remaining useful life of five years. It can be sold now for $52,000. Variable manufacturing costs are $36,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Machine A Machine B Purchase price $ 115,000 $ 125,000 Variable manufacturing costs per year 19,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A.(b) Compute the income increase or decrease from replacing the old machine with Machine B.(c) Should Lopez keep or replace its old machine?(d) If the machine should be replaced, which new machine should Lopez purchase?arrow_forwardA "standard" model of a dozer costs $20,000 and has an annual operating expense of $450. The dozer will be replaced in 6 years when the salvage value is expected to be $2,000. A "super" model can be purchased for $25,000, but will have a salvage value of $7,000 when retired in 6 years. Its operating expenses are also $450 a year. The purchaser's other investment opportunities are 5%. Compare these alternatives by using the annual equivalent method.arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $55,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $160,000. This machine will require $23,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $250,000. This machine will require $15,000 per year in ongoing maintenance expenses and will lower bottling costs by $12,000 per year. Also, $39,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a ten-year life with a negligible salvage value. The corporate tax rate is 20%. Should Beryl's Iced Tea continue…arrow_forward

- Vijay shiyalarrow_forwardA three-year-old small crane is being considered for early replacement. Its current market value is $17,500. Estimated future market values and annual operating costs for the next five years are given in the table below. What is the economic life for this crane if the interest rate is 5.1% per year? Year 0 Market Value Annual Operating Cost $17,500 1 $15,110 $4,700 2 $12,930 $4,809 3 $10,110 $4,883 4 $7,400 $4,997 5 $- $5,095arrow_forwardJax Inc is considering the purchase of a new machine for the production of computers. Machine A costs $7,000,000 and will last for six years. Variable costs are 25% of sales, and fixed costs are $500,000 annually. Machine B costs $10,000,000 and will last for ten years. Variable costs for the machine are 15% of sales, and fixed costs are $750,000 annually. The sales for each machine will be $4,000,000 per year. The required rate of return is 9%, the tax rate is 21%, and both machines will be depreciated using straight-line depreciation with no salvage value. Calculate the equivalent annual annuity for Machine B. (Round to 2 decimals) What is the Net Present Value for Machine B? (round to 2 decimals)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education