Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

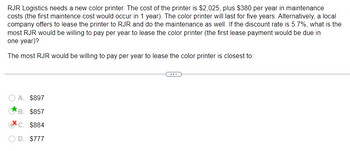

Transcribed Image Text:RJR Logistics needs a new color printer. The cost of the printer is $2,025, plus $380 per year in maintenance

costs (the first maintence cost would occur in 1 year). The color printer will last for five years. Alternatively, a local

company offers to lease the printer to RJR and do the maintenance as well. If the discount rate is 5.7%, what is the

most RJR would be willing to pay per year to lease the color printer (the first lease payment would be due in

one year)?

The most RJR would be willing to pay per year to lease the color printer is closest to:

O A. $897

B. $857

C. $884

D. $777

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You have to buy a new copier. The cost of the copier is $2,075, plus $410 per year in maintenance costs. The copier will last for five years. Alternatively, a local company offers to lease the copier to you and do the maintenance as well. If your discount rate is 6.4 % what is the most you would be willing to pay per year to lease the copier (your first lease payment is due in one year)?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.05 million per year. Your upfront setup costs to be ready to produce the part would be $8.22 million. Your discount rate for this contract is 8.3%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.) firm?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be$5.01milion per year. Your upfront selup costs to be ready to produce the part would be$7.97million. Your discount rate for this contract is8.1%. a. What is the IRR? b. The NPV is$4.92million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forward

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.85 million per year. Your upfront setup costs to be ready to produce the part would be $7.94 million. Your discount rate for this contract is 8.3%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.99 million per year. Your upfront setup costs to be ready to produce the part would be $8.06 million. Your discount rate for this contract is 8.1%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? *round to two decimal places*arrow_forwardSauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $430,000. The company can borrow $430,000 for three years at 13 percent annual interest or for one year at 11 percent annual interest. Assume interest is paid in full at the end of each year. a. How much would Sauer Food Company save in interest over the three-year life of the computer system if the one-year loan is utilized and the loan is rolled over (reborrowed) each year at the same 11 percent rate? Compare this to the 13 percent three- year loan. 11 percent loan 13 percent loan Interest savings Interest b. What if interest rates on the 11 percent loan go up to 16 percent in year 2 and 19 percent in year 3? What would be the total interest cost compared to the 13 percent, three-year loan? Fixed-rate 13% loan Variable-rate loan Additional interest cost Interestarrow_forward

- MAG Industrial needs 1000 square meters of storage space. Purchasing land for $80,000 and then erecting a temporary metal building at $70 persquare meter is one option. The president hopes to sell the land for $100,000 and the building for $20,000 after 3 years. Another option is to lease space for $30 per square meter per year payable at the beginning of each year. The MARR is 20%. Perform a present worth analysis of the building and leasing alternatives to determine the sensitivity of the decision if the construction cost decreases by 10% to $63 per square meter and the lease cost remainsat $30 per square meter per year.arrow_forwardThe ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. Suppose that ABC would like to realize a monthly profit of $50,000. How many units must they sell each month to realize this profit?arrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $970,000, and it would cost another $18,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $495,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $14,000. The sprayer would not change revenues, but it is expected to save the firm $366,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar.1) What is the Year-0 net cash flow? A) What are the net operating cash flows in Years 1, 2, and 3? B) What is the additional Year-3 cash flow (i.e, the after-tax…arrow_forward

- The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,030,000, and it would cost another $25,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $473,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $18,500. The sprayer would not change revenues, but it is expected to save the firm $396,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is the additional…arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.17 million per year. Your upfront setup costs to be ready to produce the part would be $7.81 million. Your discount rate for this contract is 8.4%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.05 million per year. Your upfront setup costs to be ready to produce the part would be $7.98 million. Your discount rate for this contract is 7.8%. a. What is the IRR? b. The NPV is $5.08 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education