Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

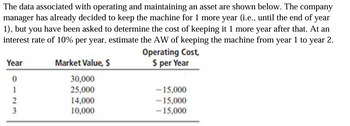

Transcribed Image Text:The data associated with operating and maintaining an asset are shown below. The company

manager has already decided to keep the machine for 1 more year (i.e., until the end of year

1), but you have been asked to determine the cost of keeping it 1 more year after that. At an

interest rate of 10% per year, estimate the AW of keeping the machine from year 1 to year 2.

Operating Cost,

$ per Year

Market Value, $

30,000

25,000

14,000

10,000

Year

0

1

2

3

-15,000

-15,000

-15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Nonearrow_forward. Using the table in Exercise 10, calculate the net present value for each project shown below at the end of six years and determine which would be the better decision for Mike’s Camping Supply. Assume that Project 1 can be sold for $15,000 at the end of the sixth year. Project 1 Project Cost $160,000 Cost $150,000 Minimum desired rate of return 12% Minimum desired rate of return 12% Expected useful life 7 years Expected useful life 6 years Yearly cash flows to be received: Yearly cash flows to be received: Year 1…arrow_forwardThe management of Arnold Corporation is considering the purchase of a new machine costing $430,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for one through five years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to this information, use the following data in determining the acceptability in this situation: Year Income from Operations Net Cash Flow 1 $100,000 $180,000 2 40,000 120,000 3 20,000 100,000 4 10,000 90,000 5 10,000 90,000 The net present value for this investment is a.negative $25,200. b.positive $25,200. c.negative $124,800. d.positive $152,000.arrow_forward

- Payback, Accounting Rate of Return, Net Present valde, Internal Rate of Retum Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year 1 2 3 4 5 Required: Cash Revenues $612,000 612,000 612,000 612,000 612,000 Cash Expenses $432,000 432,000 432,000 432,000 432,000 1. Compute the payback period for the NC equipment. Round your answer to two decimal places. 2.56 ✓ years Check My Work 2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation. 19.1 ✓ % 3. Compute the investment's NPV, assuming required rate of return of 10%. Round present value calculations and your final answer…arrow_forwardDetermine the FW of the following engineering project when the MARR is 16% per year. Is the project acceptable? Proposal A Investment cost $9,500 5 years -$1.200 Expected life Market (salvage) value Annual receipts Annual expenses $8,000 $4.500 A negative market value means that there is a net cost to dispose of an asset A Click the icon to view the interest and annuity table for discrete compounding when the MARR is 16% per year The FW of the following engineering project is S (Round to the nearest dollar) According to the FW Decision Rule the project Vaccentablearrow_forwardPayback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below. Blaylock Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $384,000. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses 1 $510,000 $360,000 2 510,000 360,000 3 510,000 360,000 4 510,000 360,000 5 510,000 360,000 Required: 1. Compute the payback period for the NC equipment. Round your answer to two decimal places.fill in the blank 1 years 2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation.fill in the blank 2 % 3. Compute the investment's NPV, assuming a required rate of return of…arrow_forward

- With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine X that will render its AW equal to that of machine Y at an interest rate of 10% per year. Determine the replacement value. Machine X Machine Y Market Volue, S 87,000 -40.000 for year 1,increasing by 2000 per year thereafter, Annual Cost, $ per Year -63,000 Salvage Value 17,500 17,000 Life, Years 3. 5. The replacement value is $arrow_forwardSuppose that annual income from a rental property is expected to start at $1,250 per year and decrease at a uniform amount of $40 each year after the first year for the 13-year expected life of the property. The investment cost is $7,000, and i is 7% per year. Is this a good investment? Assume that the investment occurs at time zero (now) and that the annual income is first received at EOY one. Click the icon to view the interest and annuity table for discrete compounding when i= 7% per year. The present equivalent of the rental income equals S (Round to the nearest dollar.)arrow_forwardYou are equipping an office. The total office equipment will have a first cost of2.0Mand a sal-vage value of$200,000. You expect the equipment will last 10 years. Use a spreadsheet to compute the40%bonus depreciation with MACRS depreciation schedule.arrow_forward

- A company must purchase a new machine to increase production. The machine will cost $50,000 to purchase. The following are the remaining cash flows of the machine and its probabilities. The machine is supposed to be used for 6 years and the MARR is 10%. Annual Cost Annual Revenue Calculate the Present Worth. Probability .2 .6 .2 .6 .4 Outcome $3,000 $4,500 $5,500 $35,000 $40,000arrow_forwardWith the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine X that will render its AW equal to that of machine Y at an interest rate of 8% per year. Determine the replacement value. Machine X Machine Y 90,000 Market Value, S -40,000 for year 1,increasing by 2000 per year thereafter. 24,000 Annual Cost, $ per Year -59,500 Salvage Value Life, Years 19,500 The replacement value is $arrow_forwardMjarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education