Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

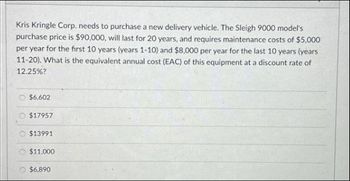

Transcribed Image Text:Kris Kringle Corp. needs to purchase a new delivery vehicle. The Sleigh 9000 model's

purchase price is $90,000, will last for 20 years, and requires maintenance costs of $5,000

per year for the first 10 years (years 1-10) and $8,000 per year for the last 10 years (years

11-20). What is the equivalent annual cost (EAC) of this equipment at a discount rate of

12.25%?

$6.602

$17957

$13991

$11,000

$6,890

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- A new electronic process monitor costs $990,000. This cost could be depreciated at 30 percent per year (Class 10). The monitor would actually be worthless in five years. The new monitor would save $460,000 per year before taxes and operating costs. If we require a 15 percent return, what is the NPV of the purchase? Assume a tax rate of 40 percent. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) NPVarrow_forwardA construction company can purchase a used backhoe for $90,000 and spend $450 per day in operating costs. The equipment will have a 5 -year life then sell it at salvage for $3,000. Alternatively, the company can lease the equipment for $800 per day. How many days per year must the company use the equipment in order to justify its purchase at an interest rate of 6% per year.arrow_forward) Hendrix Company needs a new warehouse. Below are three potential options for purchasing a new warehouse. Which would you recommend? Hendrix's borrowing rate is 8%. Building 1: $1,500,000 cash purchase Building 2: Take out a 25 year loan - annual payments ($125,000) due at the beginning of each year Building 3: $1,750,000 cash purchase. There is extra space in this building that can be rented out over the 25 years. The rental agreement would state that annual payments ($21,000) are due at the end of each year. SU 000 of Insist Worth rataillon 022) CC-001 vnsqmio Telln 2012arrow_forward

- Elijah Enterprises will need to upgrade the computer system in 4 years. They anticipate the upgrade to cost $105,300. If the discount rate is 13%, what will be the required yearly investment needed to obtain the money for the upgrade?Round your (1+R)^n value to 2 decimal places and use that number for your final amount required rounded to the nearest dollar. Future Value / (1+R)^n = Amount Required / = What would be required if the discount rate was 8%? Future Value / (1+R)^n = Amount Required / =arrow_forwardDeutsche Transport can lease a truck for four years at a cost of €38,000 annually. It can instead buy a truck at a cost of €88,000, with annual maintenance expenses of €18,000. The truck will be sold at the end of four years for €24,500. Ignore taxes. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Enter your answer in euros. Round your answer to the nearest whole number. b. Which is the better option: leasing or buying? a. Equivalent annual cost b. Better optionarrow_forwardElijah Enterprises will need to upgrade the computer system in 5 years. They anticipate the upgrade to cost $98,900. If the discount rate is 15%, what will be the required yearly investment needed to obtain the money for the upgrade?Round your (1+R)^n value to 2 decimal places and use that number for your final amount required rounded to the nearest dollar.arrow_forward

- Kamil Koç Transportation is considering two models of buses for newly opened routes. Bus Model 1 will have a first cost of $160912, an operating cost of $21338 per year, and a resale value of $86231 after 6 years. Bus Model 2 will have a first cost of $108347, an operating cost of $15486 per year, and also have a $75850 resale value, but after 4 years. At an interest rate of 7% per year, which model should the Kamil Koç buy based on an annual worth analysis? What is the annual worth and the present worth of the selected alternative? Select one: a. Bus Model 1 is selected, AW is $-25017 and PW is $-102936 b. Bus Model 2 is selected, AW is $-30390 and PW is $– 30390 c. Bus Model 1 is selected, AW is $-25017 and PW is $-205161 d. Bus Model 2 is selected, AW is $-33123 and PW is $ – 102936 e. Bus Model 2 is selected, AW is $-33123 and PW is $-205161 f. Bus Model 1 is selected, AW is $-30390 and PW is $-102936arrow_forwardSauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $290,000. The company can borrow $290,000 for three years at 11 percent annual interest or for one year at 9 percent annual interest. Assume interest is paid in full at the end of each year. a. How much would Sauer Food Company save in interest over the three-year life of the computer system if the one-year loan is utilized and the loan is rolled over (reborrowed) each year at the same 9 percent rate? Compare this to the 11 percent three-year loan. 9 percent loan 11 percent loan Interest savings Interest b. What if interest rates on the 9 percent loan go up to 14 percent in year 2 and 17 percent in year 3? What would be the total interest cost compared to the 11 percent, three-year loan? Fixed-rate 11% loan Variable-rate loan Additional interest cost Interestarrow_forwardA firm can lease a truck for 4 years at a cost of $35,000 annually. It can instead buy a truck at a cost of $85,000, with annual maintenance expenses of $15,000. The truck will be sold at the end of 4 years for $25,000. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Equivalent annual cost b. Which is the better option? Lease O Buyarrow_forward

- Green Power Company is considering acquiring a new machine that will last 14 years and it can be purchased right now for 116,319 dollars; maintenance will cost 23,444 dollars the first year, increasing by 6,434 dollars per year thereafter (e.g. maintenance at the end of year two is equal to 23,444 plus 6,434 dollars). If the interest rate is 7% per year, compounded annually, how much money should the company set aside now to purchase and provide for the future maintenance of this machine (NPV)? (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)arrow_forwardFabco, Inc., is considering purchasing flow valves that will reduce annual operating costs by $10,000 per year for the next 12 years. Fabco’s MARR is 7%/year. Using an internal rate of return approach, determine the maximum amount Fabco should be willing to pay for the valves. $arrow_forwardDengerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education