FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

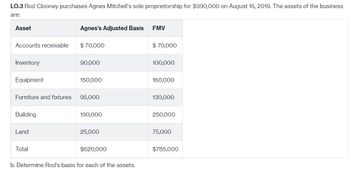

Transcribed Image Text:LO.3 Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2019. The assets of the business

are:

Asset

Agnes's Adjusted Basis

FMV

Accounts receivable

$ 70,000

$ 70,000

Inventory

90,000

100,000

Equipment

150,000

160,000

Furniture and fixtures

95,000

130,000

Building

190,000

250,000

Land

25,000

75,000

Total

$620,000

$785,000

b. Determine Rod's basis for each of the assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2 nts BHL owns only one asset-the warehouse building and related land that is rented by Quantro for $39,600 per year. The property was originally owned by Quantro but was sold to BHL several years ago as a means to reduce the risk exposure of this appreciating asset. On December 31, 2023 (the year-end of both companies), BHL sold the warehouse property to a third party for $407,000 (land $44,000, building $363,000). The property originally cost $352,000 (land $27.500, building $324,500). The undepreciated capital cost of the building at December 31, 2022, was $279,400. One month before selling the warehouse property, BHL purchased a newly constructed warehouse property for $528,000. (land $55,000, building $473,000.). Required: Determine BHL's net income for tax purposes for 2023, B Answer is not complete. Rent CCA on new warehouse Recapture of CCA Property Income Building Taxable capital gains Land: Taxable capital gains Taxable Capital Gains $ 0 S 0 Net Income for Tax purposes Prev 2…arrow_forwardam. 110.arrow_forwardOn January 1, 2022, Don Buchanan purchases a business that he will carry on as a sole proprietor. The purchase price includes $60,000 for goodwill. The business has a fiscal period that ends on December 31 and, for 2022, Don claims the maximum CCA. On January 1, 2023, the business is sold in an arm's length transaction with $82,000 paid for the goodwill. The affect of the sale of the goodwill is to increase net income for 2022 by: a. $14,000. b. $13,500. c. $15,500. d. $11,000.arrow_forward

- Harry owns 25% of David. On January 1, 2020 Harry’s investment account has a balance of $500,000. On that date, Harry sells 30% of its investment for $200,000. a. What is the balance in the investment account after sale b. What is the gain or loss on sale recorded by Harry.arrow_forwardPlease Solve In 20minsarrow_forwardMy A married decedent left the following inherited properties as part of his gross estate amounting to P 15,000,000. Land P 1,500,000 500,000 The value of the land when inherited 2 ½ year ago was P1,200,000 and was subject to a mortgage of P200,000 which was paid by the present decedent before he died. The shares of stock were valued Shares of stock CF An= at P600,000. Skip The estate's executor has claimed the following deductions; P600,000 350,000 150,000 300,000 400,000 700,000 5,000,000 Actual funeral expenses Judicial expenses Claims against insolvent Legacy to National Government Medical Expenses Amount received by heirs under RA 4917 Family Home Compute for the vanishing deductionarrow_forward

- 17. TP had an adjusted basis in her LLC interest of $50,000 immediately before she received a current proportionate distribution of $20,000 cash, unrealized accounts receivable with a basis of 0 and a FMV of $10,000, and real property with a basis of $40,000 and a FMV of $50,000. Her basis in the distributed real property is: a. 0 b. $30,000 c. $20,000 d. $40,000 e. None of the abovearrow_forwardRequired Information [The following information applies to the questions displayed below.] Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $12,000 from Falcons Corporation. Sales revenue Cost of goods sold Falcons Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Salary to owners Julio and Milania Employee wages Depreciation expense Section 179 expense Interest income (related to business income) Municipal bond income Government fines Overall net income Distributions Ordinary Income Amount Year 1 $ 335,000 (42,000) (40,000) (30,000) (20,000) (30,000) 12,000 1,808 Allocated to Julio 0 $ 186,800 $ 24,000 a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $240,000 of qualified property (unadjusted basis). Year 2 $ 465,000…arrow_forwardTonia acquires the following 5-year class property in 2019: Asset Date of Acquisition Cost X January 15 $ 70,000 Y May 28 45,000 Z November 23 90,000 Total $ 205,000 Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.arrow_forward

- Lizette inherited the following items from her grandmother: Unrealized Gain/(Loss) Painting $25,000 Stocks $20,000 Vehicle ($15,000) How much gain/(loss) is Lizette required to report in income? OA) $45,000 gain Adjusted Basis Fair Market Value $75,000 $50,000 $25,000 $50,000 $30,000 $40,000 B) $150,000 gain C) $0 gain D) $30,000 gainarrow_forwardN1.arrow_forwardDinesh Bhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education