FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

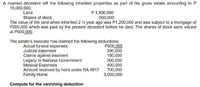

Transcribed Image Text:A married decedent left the following inherited properties as part of his gross estate amounting to P

15,000,000.

P 1,500,000

500,000

The value of the land when inherited 2 % year ago was P1,200,000 and was subject to a mortgage of

P200,000 which was paid by the present decedent before he died. The shares of stock were valued

Land

Shares of stock

at P600,000.

The estate's executor has claimed the following deductions;

P600,000

350,000

150,000

300,000

400,000

700,000

5,000,000

Actual funeral expenses

Judicial expenses

Claims against insolvent

Legacy to National Government

Medical Expenses

Amount received by heirs under RA 4917

Family Home

Compute for the vanishing deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As to Principal I charge myself with: Assets subsequently discovered: Total charges I redit myself with: Estate principal Estate principal: Estate principal As to Income I charge myself with: I credit myself with: Balance as to income Balance as to income:arrow_forward59. Upon death of Nicanor and after payment of the estate tax, it was determined that the net distributable estate amounted to Php 3,000,000.00 while the conjugal share of Inday as surviving spouse amounted to Php 5,000,000.00. Under the Rules of Succession, the following are the sharing in net distributive estate: Inday - ⅓ Jose - ⅓ Boni - ⅓ Assuming Inday waived her conjugal share in favor of his two children, the donor’s tax is? Answer:_______________arrow_forwardIn the settlement of the estate of Mr. Emman who died intestate, his wife renounced her inheritance worth P2 million and her share of the conjugal property worth P1 million in favor of her children. How much is subject to estate tax? * P3 million P2 million P1 million P0arrow_forward

- At the time of her death on September 4, Alicia held the following assets: Bonds of Emerald Tool Corporation Stock in Drab Corporation Insurance policy (face amount of $1,456,000) on the life of her brother, Mitch Traditional IRAs Cash surrender value. Fair Market Value The amount included in Alicia's gross estate for these items is $ $3,640,000 4,368,000 * 291,200 1,092,000 Alicia also held a lifetime income interest in a trust (fair market value of trust assets $5,500,000) created by her late spouse Bert. (The executor of Bert's estate had made a QTIP election.) In October, Alicia's estate received an interest payment of $15,000 ($7,500 accrued before September 4) paid by Emerald and a cash dividend of $10,550 from Drab. The Drab dividend was declared on August 19 and was payable to date of record shareholders on September 3. Although Mitch survives Alicia, she is the designated beneficiary of the insurance policy. The IRAs are distributed to Alicia's children.arrow_forwardMy A married decedent left the following inherited properties as part of his gross estate amounting to P 15,000,000. Land P 1,500,000 500,000 The value of the land when inherited 2 ½ year ago was P1,200,000 and was subject to a mortgage of P200,000 which was paid by the present decedent before he died. The shares of stock were valued Shares of stock CF An= at P600,000. Skip The estate's executor has claimed the following deductions; P600,000 350,000 150,000 300,000 400,000 700,000 5,000,000 Actual funeral expenses Judicial expenses Claims against insolvent Legacy to National Government Medical Expenses Amount received by heirs under RA 4917 Family Home Compute for the vanishing deductionarrow_forward17. TP had an adjusted basis in her LLC interest of $50,000 immediately before she received a current proportionate distribution of $20,000 cash, unrealized accounts receivable with a basis of 0 and a FMV of $10,000, and real property with a basis of $40,000 and a FMV of $50,000. Her basis in the distributed real property is: a. 0 b. $30,000 c. $20,000 d. $40,000 e. None of the abovearrow_forward

- When Jen dies this year her gross estate included the following: • Cash $249,295 held in Jen's name • Investments $2,461,396 title Tenants in Common with her husband Jake a U.S. Citizen • Life Insurance $1,982,343 son is beneficiary • House $1,520,148 owned solely by Jen Jen's will leaves $20,000 to her son and the remainder of her probate assets to Jake. Estate Administrative expenses are $25,000 for administrative expenses, $50,000 for funeral expenses and $200,000 for a mortgage. What is the amount of the marital deduction on Jen's estate tax return?arrow_forwardThe estate of Nancy Hanks reports the following information: What is the taxable estate value? $7,070,000. $7,100,000. $7,180,000. $7,420,000.arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education