FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

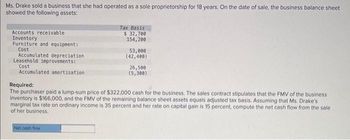

Transcribed Image Text:Ms. Drake sold a business that she had operated as a sole proprietorship for 18 years. On the date of sale, the business balance sheet

showed the following assets:

Accounts receivable

Inventory

Furniture and equipment:

Cost

Accumulated depreciation

Leasehold improvements:

Cost

Accumulated amortization

Tax Basis

$ 32,700

154,200

Net cash flow

53,000

(42,400)

26,500

(5,300)

Required:

The purchaser paid a lump-sum price of $322,000 cash for the business. The sales contract stipulates that the FMV of the business

Inventory is $166,000, and the FMV of the remaining balance sheet assets equals adjusted tax basis. Assuming that Ms. Drake's

marginal tax rate on ordinary income is 35 percent and her rate on capital gain is 15 percent, compute the net cash flow from the sale

of her business.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- is: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciation—equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,700 $194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Paid-in capital: Excess of issue price over par—common stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of goods sold 1,245,476 Gross profit $778,422 Operating…arrow_forwardSales Cost of goods sold Gross profit Operating expenses Salaries expense Depreciation expense Rent expense Amortization expenses-Patents Utilities expense Gain on sale of equipment Net income $ 2,134,000 1,045,660 1,088,340 $ 292,358 51,216 57,618 6,402 23,474 431,068 657,272 8,536 $ 665,808 Accounts receivable Inventory $ 47,650 increase Accounts payable 34,400 increase Salaries payable $ 8,025 decrease 2,550 decrease Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities es Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities + กarrow_forwardFocarrow_forward

- Accounts payable $281,700 Prepaid insurance $6,800 Property and equipment 672,500 Contributed capital 380,600 Cost of service expense 183,600 Other revenue 114,100 Supplies inventory 216,900 Deferred revenue 83,600 Service revenue 904,000 Depreciation expense 57,750 Bonds payable 229,600 Accounts receivable 607,550 Interest receivable 4,300 Rent expense 30,500 Retained earnings 187,400 Cash 351,340 Notes payable 356,040 Accrued liabilities 23,400 Investments 146,400 Prepaid rent 11,200 Accumulated depreciation 128,900 Administrative and general expense (includes interest, utilities, etc.) 64,300 Supplies expense 336,200 Income tax payable 0 Based on the following data for Checkmate Company, prepare a Statement of Retained Earnings and demonstrate that the accounting equation remains in balance after the retained earnings account has been updated. (Assume that the…arrow_forwardSelling & administrative expenses 20,200 Loss on sale of plant assets 11,700 Gross profit 90,500 Interest expense 8,000 Income tax 10,000 Rent revenue 10,200 If this information was used to prepare an income statement, Income from Operations should be: Select one: a. 68,800 b. 70,300 c. 78,800 d. 110,700 e. 58,600arrow_forwardSir please help me sir urgently pleasearrow_forward

- Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 You are required to:i) Calculate the operating cash flow ii) Calculate the cash flow to creditors iii) Calculate the cash flow to shareholdersarrow_forwardWalmart Stores, Inc. Property and Equipment ($ in millions) Land Buildings and improvements Fixtures and equipment Transportation equipment Property under capital lease Property and equipment Accumulated depreciation Property and equipment, net January 31, 2015 $ 26,261 97,496 January 31, 2014 $ 26,184 95,488 45,044 42,971 2,807 2,785 5,787 5,661 177,395 173,089 (63,115) (57,725) $114,280 $115,364arrow_forwardCalculate the assessed value of the piece of property: Assessment rate Market value Assessed value 80% $210,000arrow_forward

- Date Accounts Debit Credit Cash 145,000 a. Accounts Receivable 145,000 b. Selling and Administrative Expenses 32,000 Cash 32,000 Accounts Payable 39,000 C. Cash 39,000 d. Raw Materials Inventory 28,200 Accounts Payable 28,200 Work-in-Process Inventory Manufacturing Overhead 8,850 e. 1,200 Raw Materials Inventory 10,050 Work-in-Process Inventory Manufacturing Overhead f. 20,600 18,400 Wages Payable 39,000 Wages Payable 38,700 g. Cash 38,700 h. Manufacturing Overhead 2,500 Accumulated Depreciation 2,500 Work-in-Process Inventory 16,480 i. Manufacturing Overhead 16,480 j. Finished Goods Inventory 47,430 Work-in-Process Inventory 47,430 k. Accounts Receivable 104,000 Sales Revenue 104,000 k. Cost of Goods Sold 47,430 Finished Goods Inventory 47,430 L. Cost of Goods Sold 5,620 Manufacturing Overhead 5,620arrow_forwardAccounting Questionarrow_forwardAccount Title Balance ($) Accounts Payable 11,700Accounts Receivable 69,000Accumulated Depreciation - Building 44,200Building 439,500Cash 28,000Depreciation Expense - Building 8,750Insurance Expense 2,500Miscellaneous Expense 6,200Prepaid Insurance 2,500Repairs Expense 3,000Rent Expense 48,000Rent Revenue 12,000Salaries Expense 522,100Salaries…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education