FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

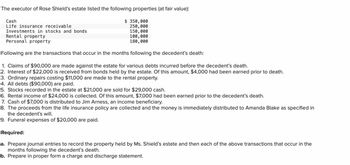

Transcribed Image Text:The executor of Rose Shield's estate listed the following properties (at fair value):

$ 350,000

250,000

150,000

Cash

Life insurance receivable

Investments in stocks and bonds

Rental property

100,000

180,000

Personal property

Following are the transactions that occur in the months following the decedent's death:

1. Claims of $90,000 are made against the estate for various debts incurred before the decedent's death.

2. Interest of $22,000 is received from bonds held by the estate. Of this amount, $4,000 had been earned prior to death.

3. Ordinary repairs costing $11,000 are made to the rental property.

4. All debts ($90,000) are paid.

5. Stocks recorded in the estate at $21,000 are sold for $29,000 cash.

6. Rental income of $24,000 is collected. Of this amount, $7,000 had been earned prior to the decedent's death.

7. Cash of $7,000 is distributed to Jim Arness, an income beneficiary.

8. The proceeds from the life insurance policy are collected and the money is immediately distributed to Amanda Blake as specified in

the decedent's will.

9. Funeral expenses of $20,000 are paid.

Required:

a. Prepare journal entries to record the property held by Ms. Shield's estate and then each of the above transactions that occur in the

months following the decedent's death.

b. Prepare in proper form a charge and discharge statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Individual taxpayer entered into the following transactions in 20X1 with long-term owned property: Taxable Year: 20X1 Property Bonds Shares sale price $100,000 $75,000 Adjusted Basis $150,000 $60,000 During taxable year 20X2 the taxpayer did not carry out any property transactions and did not follow capital gains or losses. Your net income subject to tax for taxable years 20X1 and 20X2 is $20,000 and $600, respectively. How much can the taxpayer claim as a capital loss deduction in 20X2?arrow_forwardIn the current year, Erin had the following capital gains (losses) from the sale of her investments: $2,900 LTCG, $24,100 STCG, ($9,900) LTCL, and ($15,900) STCL. What is the amount and nature of Erin's capital gains and losses? Multiple Choice $1,200 net short-term capital gain. $1,200 net long-term capital loss. $3,100 net short-term capital gain. $3,100 net long-term capital loss. None of the choices are correct.arrow_forwardThe widow of an individual received a death benefit from his employer of $25,000. She must include the $25,000 in income in the year of receipt. True or Falsearrow_forward

- The estate of Nancy Hanks reports the following information: What is the taxable estate value? $7,070,000. $7,100,000. $7,180,000. $7,420,000.arrow_forwardMargaret Lindley paid $15.100 of interest on her $301,000 acquisition debt for her home (fair market value of $501,000 $4,100 of interest on her $30100 home equity debt used to buy a new boat and cac $1,100 of credit card interest, and $3,100 of margin interest for the purchase of stock Assume that Margaret Lindley has $10,100 of interest income this year and no investiment expenses. How much of the interest expense may she deduct this year? Multiple Choice O O O $23,400 $22.300 $19,200 $1,200 None of the choices are correctarrow_forwardMs. Drake sold a business that she had operated as a sole proprietorship for 18 years. On date of sale, the business balance sheet showed the following assets: Accounts receivable: 42,250 Inventory: 149,600 Furniture and Equipment: 63,750 Accumulated Depreciation: (51,000) Leashold Improvements: 23,000 Accumulated Amortization: (4,600) The purchaser paid a lump-sum price of $316,500 cash for the business. The sales contract stipulates that the FMV of the business inventory is $154,000, and the FMV of the remaining balance sheet assets equals adjusted tax basis. Assuming that Ms. Drake’s marginal tax rate on ordinary income is 35 percent and her rate on capital gain is 15 percent, compute the net cash flow from the sale of her business.arrow_forward

- Jerry Tasch’s will has the following provisions: $150,000 in cash goes to Thomas Thorne. All shares of Coca-Cola go to Cindy Phillips. Residence goes to Kevin Simmons. All other estate assets are to be liquidated with the resulting cash going to the First Church of Freedom, Missouri. Prepare journal entries for the following transactions: Discovered the following assets (at fair value): Collected interest of $7,000. Paid funeral expenses of $20,000. Discovered debts of $40,000. Located an additional savings account of $12,000. Conveyed title to the residence to Kevin Simmons. Collected life insurance policy. Discovered additional debts of $60,000. Paid debts totaling $100,000. Conveyed cash of $150,000 to appropriate beneficiary. Sold the shares of Polaroid for $112,000. Paid administrative expenses of $10,000.arrow_forwardMargaret Lindley paid $15,160 of interest on her $301,600 acquisition debt for her home (fair market value of $501,600), $4,160 of interest on her $30,160 home- equity debt used to buy a new boat and car, $1,160 of credit card interest, and $3,160 of margin interest for the purchase of stock. Assume that Margaret Lindley has $10,160 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year? Multiple Choice O₁ O $23,640 $22,480 $19,320 $18,320 None of the choices are correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education