FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A7

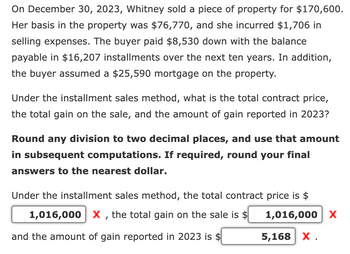

Transcribed Image Text:On December 30, 2023, Whitney sold a piece of property for $170,600.

Her basis in the property was $76,770, and she incurred $1,706 in

selling expenses. The buyer paid $8,530 down with the balance

payable in $16,207 installments over the next ten years. In addition,

the buyer assumed a $25,590 mortgage on the property.

Under the installment sales method, what is the total contract price,

the total gain on the sale, and the amount of gain reported in 2023?

Round any division to two decimal places, and use that amount

in subsequent computations. If required, round your final

answers to the nearest dollar.

Under the installment sales method, the total contract price is $

1,016,000 X, the total gain on the sale is $

and the amount of gain reported in 2023 is $

1,016,000 ×

5,168 X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 14. Determine the numerical value of the factor (F/A, 5%, 10). A 0.1295 0.0795 12.5779 D 7.7217 B.arrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forwardFind v in question c and find c in question darrow_forward

- Bumgardner Incorporated has provided the following data concerning one of the products in its standard cost system. Inputs Direct materials Standard Quantity or Hours per Unit of Output 8.0 liters Standard Price or Rate $ 5.00 per liter The company has reported the following actual results for the product for April: Actual output Raw materials purchased 7,400 units 65,400 liters $ 5.70 per liter 59,210 liters Actual price of raw materials Raw materials used in production The raw materials price variance for the month is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardThe following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $103,000 worth of common stock. B. Six months' rent was paid in advance, $4,100. C. Provided services in the amount of $1,500. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $277 per week. E. Received $520 in payment from the customer in "C". F. Purchased $300 worth of supplies on credit. G. Received the electricity bill. We will pay the $120 in thirty days. H. Paid the worker hired in "D" for one week's work. I. Received $130 from a customer for services we will provide next week. J. Dividends in the amount of $1,800 were distributed. Prepare the necessary journal entries to record these transactions. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. A. B. 111arrow_forwardun.3arrow_forward

- How to solve:S= 1/1.06[1-1/(1.06)^20]/1-1/1.06arrow_forwardCalculate: 1 1 (1+ r)" х 30 where r=0.093, and n=16arrow_forward9. Joba Corporation issued $1,000,000 of 13% (stated rate) bonds payable on January 1, 2020, due on January 1, 2028, with interest payable each January 1. Investors require an effective-interest rate (market rate) of 10%. Calculate the amount of discount or premium that will be recognized when the company issues the bonds (indicate the amount and wither its discount or premium).arrow_forward

- Hansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardNow, assume that the state of the limit order book is as follows just before the call of CBA's opening call auction: Buy Quantity Price $8.08 $8.01 $7.99 $7.96 $7.91 $7.87 $7.84 $7.82 0 0 0 a. $7.96 O b. $8.01 O c. Other O d. $7.99 e. $7.91 1800 800 1100 1900 800 Sell Quantity 1600 1800 1200 0 0 0 0 If no more orders are entered, the call price would be:arrow_forwardRound 1.1235 to the nearest tenth. O 1.12 O 1.2 1.0 1.1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education