FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

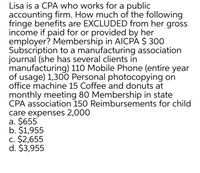

Transcribed Image Text:Lisa is a CPA who works for a public

accounting firm. How much of the following

fringe benefits are EXCLUDED from her gross

income if paid for or provided by her

employer? Membership in AICPA $ 300

Subscription to a manufacturing association

journal (she has several clients in

manufacturing) 110 Mobile Phone (entire year

of usage) 1,300 Personal photocopying on

office machine 15 Coffee and donuts at

monthly meeting 80 Membership in state

CPA association 150 Reimbursements for child

care expenses 2,000

a. $655

b. $1,955

c. $2,655

d. $3,955

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start- up company. What amount of child and dependent care credit can Julie claim in 2021 in each of the following alternative scenarios? Use Exhibit 8-10 b. Julie paid $5,650 to the day care center and her AGI is $52,600 (all salary). Child and dependent care creditarrow_forwardEmily Tumbull, president of Gold Coast Equipment Corporation, is concerned about her employees' well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 5% of their salaries Assume that no employee's cumulative wages exceed the relevant wage bases. Payroll information for the biweekly payroll period ending January 24 is listed below Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Dental Insurance premiums paid by employer Life insurance premiums paid by employer Federal and state income tax withheld FICA tax rate Federal and state unemployment tax rate Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits 3. Record the employer payroll taxes $1,900,000 95,000 38,000 13,300 6,650 488,500 7.65% 6.20% Record the necessary entry for…arrow_forwardJustin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forward

- Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM87501. Lance works for the convention bureau of the local Chamber of Commerce, andWanda is employed part-time as a paralegal for a law firm.During 2018, the Deans had the following receipts:Salaries ($60,000 for Lance, $41,000 for Wanda) $101,000Interest income—City of Albuquerque general purpose bonds $1,000Ford Motor company bonds 1,100Ally Bank certificate of deposit 400 2,500Child support payments from John Allen 7,200Annual gifts from parents 26,000Settlement from Roadrunner Touring Company 90,000Lottery winnings 600Federal income tax refund (for tax year 2017) 400Wanda was previously married to John Allen. When they divorced several yearsago, Wanda was awarded custody of their two children, Penny and Kyle. (Note:Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John wasobligated to pay alimony and child support—the alimony payments were to terminateif Wanda remarried.In July, while…arrow_forwardEmily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees’ well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 5% of their salaries. Assume that no employee’s cumulative wages exceed the relevant wage bases. Payroll information for the biweekly payroll period ending January 24 is listed below. Wages and salaries $2,300,000 Employee contribution to voluntary retirement plan 115,000 Medical insurance premiums paid by employer 46,000 Dental insurance premiums paid by employer 16,100 Life insurance premiums paid by employer 8,050 Federal and state income tax withheld 494,500 FICA tax rate 7.65% Federal and state unemployment tax rate 6.20% Required: 1., 2. & 3. Record the necessary journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)…arrow_forwardBrenda Peterson is single and lives at 567 East Street, Marshfield, MA 02043. Her SSN is 412-34-5670. She worked the entire year for Applebee Consulting in Marshfield. Her Form W-2 contained the following information: Wages (box 1) = $67,155.75 Federal W/H (box 2) = $8,366.12 Social Security Wages (box 3) = $67,155.75 Social Security W/H (box 4) = $4,163.66 Medicare Wages (box 5) = $67,155.75 Mediare W/H (box 6) = $973.76 She also received two Forms 1099-INT. One was from First National Bank of Marshfield and showed interest income of $537.39 in box 1. The other Form 1099-INT was from Baystate Savings and Loan and showed interest income of $329.31 in box 1. Brenda had qualifying health care coverage at all times during the tax year. Prepare a Form 1040 for Brenda.arrow_forward

- Makayla Jennings 34 is filing as a single tax payer during the year she earned 53000 in wages from her job as a high school english teacher makayla has always been a avid reader and in addition to her teaching job she had an opportunity in early 2020 to lead a book club at a nearby community center makayla led the book for early January until March 19 2020 when the center closed due to covid restrictions the community center pay het and in early 2021 she recieve form 1099 nec reporting 510 for nonemployee compensation in box 1 the community center is within walking distance of makayla home so she did not have any vehicle or travel expenses he only businesd related expenses was 50 in supplies makayla has no other income What is the amount of makayla self employment tax?arrow_forwardWhich one of the following would not be included in Doug's gross income? C Doug's employer pays $100 per month directly to his daughter's offsite daycare center C Doug received a $500 bonus from his employer C Doug found $1.000 worth of gold coins while hiking in Yosemite National Park C Doug won $100 playing poker at an illegal gambling clubarrow_forwardV5. 1.) Beau who just turned 33 works for Textile Industries and makes an annual income of $50,200. Calculate both employee and employer contributions. 2.) Harpreet’s dad had hired her to work part time for his business while she was in grade 9. He had her doing some filing and answering phones over the summer and paid her $17,500. Calculate both employee and employer contributions 3.) Hugo is self-employed and made an income of $226,855 this year. Calculate the total CPP contributionsarrow_forward

- Veronica mows lawns during the summer. In 2021 she was paid directly by homeowners for her work, in some case on the basis of the completed job, in other cases at an hourly rate. Her friend Jonathan does the same work. However, he is paid at an hourly rate by a lawn maintenance company. Which of the following statements is correct? Veronica earns business income and Jonathan earns employment income. Veronica will be able to deduct more expenses than Jonathan Veronica and Jonathan both earn employment income Veronica earns business income and Jonathan earns employment income. Their deductible expenses will be the same Veronica and Jonathan both earn business incomearrow_forwardBuford is a manager with the Beauty Supply Company. His fringe benefits for the current year include the following: 20% discount on store items available to all employees (gross profit percentage is 20%) Free parking provided only to management employees Personal letters occasionally typed by secretary Personal use of company condominium for 1 weekend Membership in a local health club Employer-provided van pool for commuting $465 235 50 200 370 100 The above amounts represent the fair market values of the fringe benefits for 1 year. How much is included in Buford's gross income in the current year? А. $670 В. $570 $620 D. $855 Group life insurance premiums paid by the employer covering the lives of employees who designate their own beneficiaries are not deductible. O A. True. В. False.arrow_forward18. Peggy is an executive for the Tan Furniture Manufacturing Company. She purchased furniture from the company for $9,500, the price Tan ordinarily would charge a wholesaler for the same items. The retail price of the furniture was $12,500, and Tan's cost was $9,000. The company also paid for Peggy's parking space in a garage near the office. The parking fee was $600 for the year. All employees are allowed to buy furniture at a discounted price comparable to that charged to Peggy. However, the company does not pay other employees' parking fees. Peggy's gross income from the above is: a. $0. b. $600. c. $3,500. d. $4,100. e. None of a-d is correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education