FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Mr. Jonsson is a salesperson handling a line of computer software throughout Western Canada. During 2021, he is paid a salary of $25,500 and receives sales commissions of $47,300. He does not receive an allowance, nor is he reimbursed by his employer for any of his expenses. During the year, Mr. Jonsson made the following employment-related expenditures.

|

Airline Tickets

|

$2,390

|

|---|---|

|

Office Supplies And Shipping Costs

|

385

|

|

Purchase Of Laptop Computer

|

2,095

|

|

Client Entertainment

|

1,780

|

|

Cost Of New Car

|

24,200

|

|

Operating Costs Of Car

|

6,600

|

Determine Mr. Jonsson's employment income for the 2021

Transcribed Image Text:Additional Information

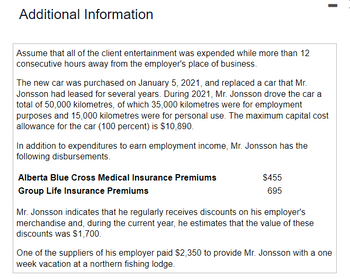

Assume that all of the client entertainment was expended while more than 12

consecutive hours away from the employer's place of business.

The new car was purchased on January 5, 2021, and replaced a car that Mr.

Jonsson had leased for several years. During 2021, Mr. Jonsson drove the car a

total of 50,000 kilometres, of which 35,000 kilometres were for employment

purposes and 15,000 kilometres were for personal use. The maximum capital cost

allowance for the car (100 percent) is $10,890.

In addition to expenditures to earn employment income, Mr. Jonsson has the

following disbursements.

Alberta Blue Cross Medical Insurance Premiums

Group Life Insurance Premiums

$455

695

Mr. Jonsson indicates that he regularly receives discounts on his employer's

merchandise and, during the current year, he estimates that the value of these

discounts was $1,700.

One of the suppliers of his employer paid $2,350 to provide Mr. Jonsson with a one

week vacation at a northern fishing lodge.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not receive an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses. View the expenses. View the additional information. Required Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications. k First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage. Full capital cost allowance Employment-related usage proportion Deductible CCA on automobile Expenses Airline tickets Office supplies and shipping expenses Purchase of laptop computer Client entertainment Cost of new automobile (not zero-emission) Operating expenses of automobile $ 2,380 420 2,095 1,770 47,000 10,700 C X Additional Information Assume that $390 of the…arrow_forwardToren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $7,208. Payroll for the month of May is as follows: • FICA Social Security tax rate at 6.2% FICA Medicare tax rate at 1.45% Federal income tax of $400 • State income tax of $75 Health-care insurance premium of $298 • Union dues of $50 • The employee is responsible for covering 14% of his or her health insurance premium What is the net pay of the one employee for the month of May? Round to the nearest penny, two decimals. # No new data to save. Last checked at 11:47pm Submit Carrow_forward12arrow_forward

- Lisa is a CPA who works for a public accounting firm. How much of the following fringe benefits are EXCLUDED from her gross income if paid for or provided by her employer? Membership in AICPA $ 300 Subscription to a manufacturing association journal (she has several clients in manufacturing) 110 Mobile Phone (entire year of usage) 1,300 Personal photocopying on office machine 15 Coffee and donuts at monthly meeting 80 Membership in state CPA association 150 Reimbursements for child care expenses 2,000 a. $655 b. $1,955 c. $2,655 d. $3,955arrow_forward5. Dennis, the owner of Dennis Company, incurs the following expenses while away from home on a 3-week business trip during 2019: Airfare from Chicago to Boston $800 Hotel charges 1,800 Meal charges 740 Dry cleaning and laundry 100 Local transportation 40 Business entertainment 150 Business gift to Boston customer 45 In addition to the above expenses, Dennis incurred the following expenses for a weekend sightseeing trip to Washington D.C.: Transportation to Washington D.C. $200 Hotel charges 125 Meal charges 95 Calculate the amount Dennis may deduct for 2019 as travel expenses for the trip. Calculate the amount Dennis may deduct for 2019 as entertainment. Calculate the amount Dennis may deduct for 2019 as business gifts.arrow_forwardAccountingarrow_forward

- Justin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forwardDennis Murphy is a salaried, nonexempt administrative assistant for Dionti Investments and is paid semimonthly. He is married filing joint with five dependents under 17. His annual salary is $91,000, and his standard workweek is 37.5 hours. During the pay period, he worked 10 hours overtime. Find the hourly rate, overtime rate, and the number of regular hours and overtime hours.arrow_forwardIn the current year, Chastain takes a trip from Charleston, South Carolina to France primarily for business purposes. He is away from home from March 5 through March 16. He spends four days vacationing and eight days (including two travel days) conducting business. His airfare is $2,900, his meals amount to $180 per day, and lodging and incidental expenses are $420 per day. He is self-employed.In your computations, round any division to two decimal places and use rounded amounts in subsequent calculations.Chastain's deductible expenses are:Plane and taxi expenses: $ Lodging and incidental expenses: $ Meals: $arrow_forward

- Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM87501. Lance works for the convention bureau of the local Chamber of Commerce, andWanda is employed part-time as a paralegal for a law firm.During 2018, the Deans had the following receipts:Salaries ($60,000 for Lance, $41,000 for Wanda) $101,000Interest income—City of Albuquerque general purpose bonds $1,000Ford Motor company bonds 1,100Ally Bank certificate of deposit 400 2,500Child support payments from John Allen 7,200Annual gifts from parents 26,000Settlement from Roadrunner Touring Company 90,000Lottery winnings 600Federal income tax refund (for tax year 2017) 400Wanda was previously married to John Allen. When they divorced several yearsago, Wanda was awarded custody of their two children, Penny and Kyle. (Note:Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John wasobligated to pay alimony and child support—the alimony payments were to terminateif Wanda remarried.In July, while…arrow_forwardHansabenarrow_forwardReed is a waiter at Albicious Foods in South Carolina. Reed is single with one other dependent and receives the standard tipped hourly wage. During the week ending October 20, 2023, 44 hours were worked, and Reed received $250 in tips. Calculate Reed's gross pay, assuming tips are included in the overtime rate determination. Use Table 3-2. Required: 1. Complete the payroll register for Reed. 2a. Does Albicious Foods need to contribute to Reed's wages to meet FLSA requirements? 2b. If so, how much should be contributed? Complete this question by entering your answers in the tabs below. Req 1 Company Complete the payroll register for Reed. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Name Req 2a Reed Totals Albicious Foods Filing Status Req 2b S Dependents 1 Other Hourly Rate or Period Wage Overtime Rate Period Ended: Number of Regular Hours 40.00 10/20/2023 Number of Overtime Hours 4.00 $ Regular Earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education