FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

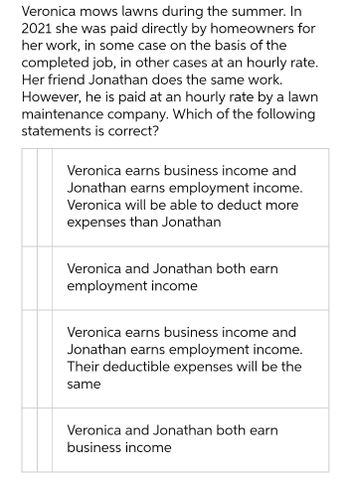

Transcribed Image Text:Veronica mows lawns during the summer. In

2021 she was paid directly by homeowners for

her work, in some case on the basis of the

completed job, in other cases at an hourly rate.

Her friend Jonathan does the same work.

However, he is paid at an hourly rate by a lawn

maintenance company. Which of the following

statements is correct?

Veronica earns business income and

Jonathan earns employment income.

Veronica will be able to deduct more

expenses than Jonathan

Veronica and Jonathan both earn

employment income

Veronica earns business income and

Jonathan earns employment income.

Their deductible expenses will be the

same

Veronica and Jonathan both earn

business income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tim and Martha paid $7,900 in qualified employment-related expenses for their three young children who live with them in their household. Martha received $1,800 of dependent care assistance from her employer, which was properly excluded from gross income. The couple had $56,500 of AGI earned equally. Use Child and Dependent Care Credit AGI schedule. Required: What amount of child and dependent care credit can they claim on their Form 1040? How would your answer differ (if at all) if the couple had AGI of $36,500 that was earned entirely by Martha?arrow_forwardChris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $72,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Chris Filing Single Heather Filing Singlearrow_forwardWhich one of the following costs is most likely NOT fully deductible? Group of answer choices Jose, a local business owner, pays $30,000 in Self-Employment taxes. Sandra owns a mini golf course. She pays her employer portion of payroll taxes because of her employees, which totals to $12,000. Travis owns a CPA firm and pays his son Joe as an associate. Joe is a CPA and is paid the same salary as the other associates. X-Corp writes off a $12,000 business debt owed by Sam because he has not responded to their numerous requests for payment.arrow_forward

- A taxpayer would be required to pay Social Security and Medicare taxes for a domestic employee in all but one of the following situations. In which situation would this not be required? a.A cook who is paid $35,000 a year b.A nanny who earns $22,000 a year c.A baby-sitter who earns $1,300 a year d.A cleaning lady who is paid $8,000 a year e.The taxpayer would not have to pay Social Security and Medicare taxes in any of the above situations.arrow_forwardToby and Nancy are engaged and plan to get married. During 2023, Toby is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed and has wages of $59,400. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Gross income and AGI Toby Filing Single b. Assume that Toby and Nancy get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. Standard deduction (married, filing jointly) Taxable income Income tax Nancy Filing Single Married Filing Jointly c. How much income tax can Toby and Nancy save if…arrow_forwardAdam Fleeman, a skilled carpenter, started a home improvement business with Tom Collins, a master plumber. Adam and Tom are concerned about the payroll taxes they will have to pay. Assume they form an S corporation and each earns a salary of $106,000 from the corporation; in addition, they expect their share of business profits to be $88,500 each. How much Social Security tax and Medicare tax (or self-employment tax) will Adam, Tom, and their corporation have to pay on their salary and profits? (Assume Adam and Tom are paying themselves reasonable salaries.) Adam Tom S corporation FICA Taxarrow_forward

- Chris and Heather are engaged and plan to get married. During 2020, Chris is a full-time student and earns $8,500 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $83,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar.a. Compute the following: ChrisFiling Single HeatherFiling Single Gross income and AGI 8,500 83,600 Standard deduction 12,400 12,400 Taxable income 0 71,200 Income tax 0 11,454 b. Assume that Chris and Heather get married in 2020 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. MarriedFiling Jointly Gross income and AGI 92,100 Standard deduction…arrow_forwardKmarrow_forwardCarrie, a single taxpayer, finished her undergraduate degree using money from a student loan. She earned $56,000 her first year and paid $2,600 in interest in 2021. She can take a deduction for student loan interest in the amount of: a.$0 b.$2,500 c.$2,600 d.$1,500 e.None of these choices are correctarrow_forward

- Suzanna earns $4000 in her summertime job; the rest of the year she attends college fulltime. Suzanna may claim an exemption from FIT withholding if: a.she also has a taxable scholarship (used for housing) = $15,000. b.her unearned income (interest) = $1698. c.her aunt claims her as a dependent and she has no unearned income. d.her unearned income (dividends) = $1800.arrow_forwardTim and Martha paid $19,600 in qualified employment-related expenses for their three young children who live with them in their household. Martha received $1,400 of dependent care assistance from her employer, which was properly excluded from gross income. The couple had $156,850 of AGI earned equally. Use Child and Dependent Care Credit AGI schedule. Required: What amount of child and dependent care credit can they claim on their Form 1040? How would your answer differ (if at all) if the couple had AGI of $139,900 that was earned entirely by Martha?arrow_forwardFred is a 22-year-old full-time college student. During 2022, he earned $2,550 from a part-time job and $1,150 in interest income. Required: If Fred is a dependent of his parents, what is his standard deduction amount? If Fred supports himself and is not a dependent of someone else, what is his standard deduction amount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education