FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

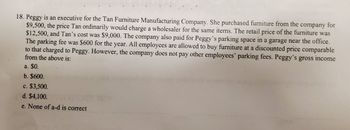

Transcribed Image Text:18. Peggy is an executive for the Tan Furniture Manufacturing Company. She purchased furniture from the company for

$9,500, the price Tan ordinarily would charge a wholesaler for the same items. The retail price of the furniture was

$12,500, and Tan's cost was $9,000. The company also paid for Peggy's parking space in a garage near the office.

The parking fee was $600 for the year. All employees are allowed to buy furniture at a discounted price comparable

to that charged to Peggy. However, the company does not pay other employees' parking fees. Peggy's gross income

from the above is:

a. $0.

b. $600.

c. $3,500.

d. $4,100.

e. None of a-d is correct

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Deloch purchased the stereo systems for $165,000 and sold them for $310,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 4 percent of sales. During the year, she paid $2,350 cash to replace a defective tuner. eBook Required Ask a-1. Prepare an income statement for Deloch's first year of operation. a-2. Prepare a statement of cash flows for Deloch's first year of operation. Print Complete this question by entering your answers in the tabs below. Required A1 Required A2 Prepare an income statement for Deloch's first year of operation. DELOCH STEREOS Income Statement Required A1 Required A2 >arrow_forwardV5. 1.) Beau who just turned 33 works for Textile Industries and makes an annual income of $50,200. Calculate both employee and employer contributions. 2.) Harpreet’s dad had hired her to work part time for his business while she was in grade 9. He had her doing some filing and answering phones over the summer and paid her $17,500. Calculate both employee and employer contributions 3.) Hugo is self-employed and made an income of $226,855 this year. Calculate the total CPP contributionsarrow_forwardKate is an executive for the Cozy Furniture Manufacturing Company. She purchased furniture from the company for $9,500, the price Cozy ordinarily would charge a wholesaler for the same items. The retail price of the furniture was $12,500, and Cozy’s cost was $9,000. The company also paid for Kate’s parking space in a garage near the office. The parking fee was $600 for the year. All employees are allowed to buy furniture at a discounted price comparable to that charged to Kate. However, the company does not pay other employees’ parking fees. Kate’s gross income from the above is: answer choices: $3,500. $4,100. $-0-. $900 $600.arrow_forward

- During the current year, Paul, the vice president of a bank, made gifts in the following amounts. To Sarah (Paul's personal assistant) at Christmas $39 To Darryl (a key client)-$3 was for gift wrapping 42 To Darryl's wife (a homemaker) on her birthday 14 To Veronica (Paul's boss) at Christmas 75 In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $50. Presuming that Paul has adequate substantiation and is not reimbursed, how much can he deduct? Do not round intermediate computations. If required, round your final answer to the nearest cent.arrow_forwardJasmin is a mechanic. She runs her own business specialising in repairing electric cars. During the year, Jasmin incurred the following expenses: a) salary costs to her two regular employees of $150,000 (paid electronically through the business’s payroll system, which automatically applies the relevant tax withholding and pays the amount to the ATO); b) $5,000 on special overalls and eye goggles for Jasmin and her employees to use when they are repairing cars; c) childcare costs of $22,000 so that Jasmin can go to work every day; d) $1,000 on a one-day course on a new accounting software program that Jasmin wants to use in the business to better comply with new tax reporting requirements. Required: Advise Jasmin whether the above expenses would be deductible for income tax purposes.arrow_forwardTo support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Daun purchased the stereo systems for $260,000 and sold them for $370,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 2 percent of sales. During the year, she paid $4,020 cash to replace a defective tuner. Requireda. Prepare an income statement and statement of cash flows for Daun’s first year of operation. b. Based on the information given, what is Daun’s total warranties liability at the end of the accounting period?arrow_forward

- You have decided to start a landscaping business in Rogers Arkansas (you reside in this city). You purchased a used truck for $9,000-and the necessary landscaping tools. During the month of May you charged and collected $6,000 for services rendered (all landscaping jobs were within the city limits of Rogers). Answer the following questions: 1. What amount of sales tax are you required to pay for the used truck you purchased? 2. How much sales tax should you have collected for services rendered?arrow_forwardAnn hires a nanny to watch her two children while she works at a local hospital. She pays the 19-year-old nanny $170 per week for 42 weeks during the current year. Do not round immediate computations and round your final answers to two decimal places. a. What is the employer's portion of Social Security and Medicare tax for the nanny that Ann should pay when she files her Form 1040 for 2018?$ b. What is the nanny's portion of the Social Security and Medicare tax?$arrow_forwardKen is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have worked for Ken full-time for the last four years. The office assistant earns $31,800 per year and each drafter earns $41,800. Ken’s net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $351,800. Ken is considering whether to establish a SEP plan and has a few questions. Assume that all the employees are at least 21 years old. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken’s self-employment tax.arrow_forward

- Carol Wheeler, age 56, is single. Carol earned wages of $48,000 and was enrolled the entire year in a high deductiblehealth plan (HDHP) with self-only coverage. During the year, Carol contributed $3,000 to her Health Savings Account (HSA) and hercousin also contributed $1,000 to Carol’s HSA account. Carol’s Form W-2 shows $600 in Box 12 with code W. She has Form 5498-SA showing$4,600 in Box 2. Carol took a distribution from her HSA to pay her unreimbursed expenses: 2 visits to a physical therapist due to a car accident $300 unreimbursed doctor bills for $700 prescription medicine $400 replacement of a crown $1,500 over the counter sinus medication $80 10 Zumba classes for $125 Carol is a U.S. citizen with a valid Social Security number. 8. The over the counter sinus medication is a qualified medical expense for HSApurposes. True Falsearrow_forwardTony and Lyly are married during the tax year. Tony is a botanist at Red Corporation. Tony earns a salary of $70,000 per year. Lyly owns an accounting practice as a sole proprietor (it qualifies as a full trade or business). Lyly generates $100,000 of revenues during the year. She has the following business payments associated with her firm: Utilities: $2,000 Office Rent: $15,000 Office Supplies: $1,700 Self-employed health insurance premiums: $5,000 Self-Employment Tax (hers): $10,000 Salary for her secretary: $25,000 Fines/Penalties: $2,500 State Income Tax (from business): $6,000 Payroll Taxes (secretary’s): $2,000 Meals: $1,200 (100% for 2021) Payment to officer to let her go from speeding while on her way to a client meeting $100 Lyly also contributed $6,000 into her Traditional IRA. They also have the following personal expenses during the year: Medical Expenses: $17,500 State & Local Taxes (personal): $11,000 Federal Income Tax Payments (personal): $7,000 Cash…arrow_forwardTo support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Deloch purchased the stereo systems for $157,000 and sold them for $294,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 3 percent of sales. During the year, she paid $1,970 cash to replace a defective tuner. Required a-1. Prepare an income statement for Deloch's first year of operation. a-2. Prepare a statement of cash flows for Deloch's first year of operation. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Prepare a statement of cash flows for Deloch's first year of operation. (Cash outflows should be indicated with a minus sign.) DELOCH STEREOS Statement of Cash Flowsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education