FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

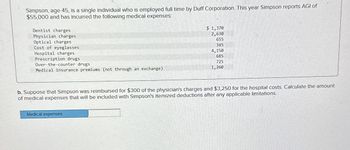

Transcribed Image Text:Simpson, age 45, is a single individual who is employed full time by Duff Corporation. This year Simpson reports AGI of

$55,000 and has incurred the following medical expenses:

Dentist charges

Physician charges

Optical charges

Cost of eyeglasses

Hospital charges

Prescription drugs

Over-the-counter drugs

Medical insurance premiums (not through an exchange).

$ 1,370

2,630

655

345

4,150

685

725

1,260

b. Suppose that Simpson was reimbursed for $300 of the physician's charges and $3,250 for the hospital costs. Calculate the amount

of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations.

Medical expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please help, I’m stuckk, thank youu!!!arrow_forwardHararrow_forwardThe required deduction for Social Security is 6.2% OASDI (Old Age Survivors and Disability Insurance) of wages earned, to a maximum of $97,500 and 1.45% HI (Hospital Insurance, commonly known as "Medicare") for all earnings. Refer to the Social Security and Medicare information. Employers are required to match the employee's deductions and send the total to the IRS. Compute the maximum percent that can be sent to the IRS for any one employee during the period of a year. 13.3% 13.5% 15.3% 15.5%arrow_forward

- O's medical expenses paid during a 12-month period ending in the current year totaled $3,600. The medical expenses for O's 20-year- old son paid during the same 12-month period totaled $1,800. For the current year, O had net income of $120,000 and the son had net income of $6,000. What is the maximum federal medical expense credit? (Enter the amount as a positive number.) Sookarrow_forwardPlease help, I’m stuck on this problem, thank youuuarrow_forwardExercise 12-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $490,200. His additional Medicare tax is $ b. George and Shirley are married and file a joint return. During the year, George earns wages of $298,100, and Shirley earns wages of $447,150. Their additional Medicare tax is $ c. Simon has net investment income of $56,880 and MAGI of $284,400 and files as a single taxpayer. Simon's additional Medicare tax is $arrow_forward

- For calendar year 2023, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2023. How much of these premiums may Giana deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct fill in the blank 1 % of their medical insurance premiums as a deduction for AGI in 2023. Thus, Giana may deduct $fill in the blank 2 as a deduction AGI and she may deduct $fill in the blank 4 as an itemized deduction (subject to the AGI floor).arrow_forwardS7).arrow_forwardAt December 31, 2020, Mallory, Inc. reported in its balance sheet a net loss of $12 million related to its postretirement benefit plan. The actuary for Mallory at the end of 2021 increased her estimate of future health care costs. Mallory's entry to record the effect of this change will include: Multiple Choice A debit to APBO and a credit to Loss-OCI. A debit to Postretirement benefit expense and a credit to APBO. A debit to Loss-OCl and a credit to APBO. A debit to Postretirement benefit expense and a credit to Loss-OCI. 15 of 39 Next > Sy Prev Question no...pages 5...pdf Question no....pages MacBook Air ...arrow_forward

- Sanan. If a servicemember receives reimbursement for moving expenses, how much will the amount be reported to them? Using Form DD 214. On a separate Form W-2 with code P in box 12. The amount is not reported as it is not taxable income. Using Form DD 2058.arrow_forwardSam and Diane are completing their federal income taxes for the year and have identified the amounts listed here. How much can they rightfully deduct? (Assume itemized deductions) AGI: $83,500 Medical and dental expenses: $9,350 State income taxes: $3,850 Mortgage interest: $10,900 Qualified charitable contributions: $1,650arrow_forwardWhich of the following medical expenses are likely deductible assuming the 7.5%-of-AGI threshold is met? Botox injections for wrinkles: $5,000 Treatment for a broken toe: $5,000 ($5,000 reimbursed by insurance) Doctor-prescribed knee brace: $1,500 Child-care while in the hospital for doctor- ordered knee surgery: $350 Deductible- Yes or No?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education