Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

None

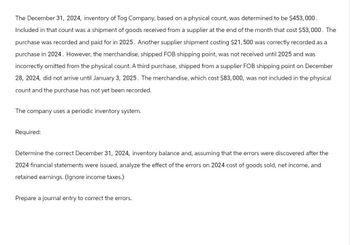

Transcribed Image Text:The December 31, 2024, inventory of Tog Company, based on a physical count, was determined to be $453,000.

Included in that count was a shipment of goods received from a supplier at the end of the month that cost $53,000. The

purchase was recorded and paid for in 2025. Another supplier shipment costing $21,500 was correctly recorded as a

purchase in 2024. However, the merchandise, shipped FOB shipping point, was not received until 2025 and was

incorrectly omitted from the physical count. A third purchase, shipped from a supplier FOB shipping point on December

28, 2024, did not arrive until January 3, 2025. The merchandise, which cost $83,000, was not included in the physical

count and the purchase has not yet been recorded.

The company uses a periodic inventory system.

Required:

Determine the correct December 31, 2024, inventory balance and, assuming that the errors were discovered after the

2024 financial statements were issued, analyze the effect of the errors on 2024 cost of goods sold, net income, and

retained earnings. (Ignore income taxes.)

Prepare a journal entry to correct the errors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000arrow_forwardFava Company began operations in 2018 and used the LIFO inventory method for both financial reporting and income taxes. At the beginning of 2019, the anticipated cost trends in the industry had changed, so that it adopted the FIFO method for both financial reporting and income taxes. Fava reported revenues of 300,000 and 270,000 in 2019 and 2018, respectively. Fava reported expenses (excluding income tax expense) of 125,000 and 120,000 in 2019 and 2018, which included cost of goods sold of 55,000 and 45,000, respectively. An analysis indicates that the FIFO cost of goods sold would have been lower by 8,000 in 2018. The tax rate is 21%. Fava has a simple capital structure with 15,000 shares of common stock outstanding during 2018 and 2019. It paid no dividends in either year. Required: 1. Prepare the journal entry to reflect the change. 2. At the end of 2019, prepare the comparative income statements for 2019 and 2018. Notes to the financial statements are not necessary. 3. At the end of 2019, prepare the comparative retained earnings statements for 2019 and 2018.arrow_forwardThe following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forward

- At December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forwardOn December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forward

- On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardUnder the periodic inventory system, what account is debited when an estimate is made for the cost of merchandise inventory sold this year, but expected to be returned next year? (a) Estimated Returns Inventory (b) Sales Returns and Allowances (c) Merchandise Inventory (d) Customer Refunds Payablearrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- Under the periodic inventory system, what account is debited when an estimate is made for sales made this year, but expected to be returned next year? (a) Sales Returns and Allowances (b) Merchandise Inventory (c) Customer Refunds Payable (d) Salesarrow_forwardAt the end of 2019, Manny Company recorded its ending inventory at 350,000 based on a physical count. During 2020, the company discovered that the correct inventory value at the end of 2019 should have been 400,000 because it made a counting error. Upon discovery of this error in 2020, what correcting journal entry will Manny make? Ignore income taxes.arrow_forwardUnder the periodic inventory system, what account is credited when an estimate is made for sales made this year, but expected to be returned next year? (a) Merchandise Inventory (b) Customer Refunds Payable (c) Sales (d) Sales Returns and Allowancesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning