Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

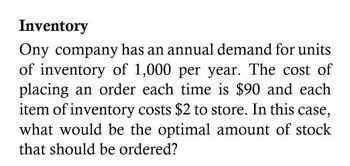

Transcribed Image Text:Inventory

Ony company has an annual demand for units

of inventory of 1,000 per year. The cost of

placing an order each time is $90 and each

item of inventory costs $2 to store. In this case,

what would be the optimal amount of stock

that should be ordered?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that your company sells a product for which the annual demand is 10,000 units. Holding costs are $1.00 per unit per year, and setup costs are $200 per order. What is the minimum total stock administration cost for the product?arrow_forwardArcadia Windings is concerned about its stocks of copper cable. The demand for this is 8,000 meters a week, with a cost of £ 4 a meter. Each order costs £ 350 for administration and £ 550 for delivery, and has a lead time of 8 weeks. Holding costs are about 25 per cent of value held a year, and any shortages would disrupt production and give very high costs. What is the best inventory policy for the cable? How does this compare with the current policy of placing a regular order every week?arrow_forwardAn inventory item has a demand of 10,000 units per month. The cost of each unit is $6, and the interest on tied-up money is 10%. The average ordering cost is $250 per order. a) What is the EOQ? units (round your response to the nearest integer). b) What is the optimal number of orders per year? to the nearest integer) c) What is the optimal number of days between any two orders? your response to the nearest integer) d) What is the annual holding cost? $ nearest integer) orders (round your response e) What is the total annual cost of the inventory system? $ to the nearest integer) days (round per year (round your response to the (round your responsearrow_forward

- Hammond Supplies expects sales of 235,880 units per year with carrying costs of $2.18 per unit and ordering cost of $3.1 per order. Assuming the level of inventory is stable, what is the optimal average number of units in inventory? Round to the nearest whole number.arrow_forwardAssume Palmer Corp. markers uses 1,440,000 gallons of ink each year. Assume Palmer will order the ink at a rate of P2 per gallon plus a fixed cost of P100 per order. At cost, the firm's carrying cost is 20% of the inventory value. What is Palmer's minimum costs of ordering and holding inventory?arrow_forwardXYZ Manufacturing produces a product for which the annual demand is 120,000 units. Production averages 800 units per day, 250 days per year. Holding costs are $3.00 per unit per year, and setup cost is $500.00. If the firm wishes to produce this product in economic batches, what size batch should be used (Q*)? What is the maximum inventory level? How many order cycles are there per year? What are the total annual holding and setup costs?arrow_forward

- Please see imagine for questionarrow_forwardGive me correct answer the accounting questionarrow_forwardNowlin Pipe & Steel has projected sales of 6,400 pipes this year, an ordering cost of $5 per order, and carrying costs of $1.60 per pipe.a. What is the economic ordering quantity? b. How many orders will be placed during the year? c. What will the average inventory be?arrow_forward

- Provide answer the following requirementsarrow_forwardHarrowing Company has the following information: Annual demand =3,500 units Order size = 500 units Ordering cost per order =$400 Carryingcosts per unit for one year =$40 Lead time (maximum 20 days)=10days Maximumd use =25 units Work year =250days Required: a.Determine the economic order quantity for Harrowing b. Determine the reorder point. c. What is the safety stock needed to prevent stockouts?arrow_forwardA trading company expects to sell 15,000 mixers during the coming year. The cost of storing a mixer for is SR 2 per month and the ordering cost is SR 540 per order. a) Find the Economic Order Quantity. b) Calculate the total stock cost. c) How much will EOQ be changed if there is 10% increase in the price of a mixer?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning