Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

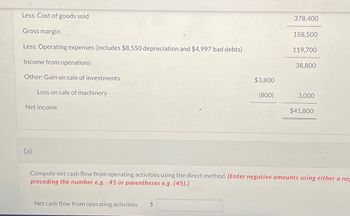

Transcribed Image Text:Less: Cost of goods sold

Gross margin

Less: Operating expenses (includes $8,550 depreciation and $4,997 bad debts)

Income from operations

Other: Gain on sale of investments

Loss on sale of machinery

Net income

(a)

378,400

158,500

119,700

38,800

$3,800

(800)

3,000

$41,800

Compute net cash flow from operating activities using the direct method. (Enter negative amounts using either a ne

preceding the number e.g. -45 or parentheses e.g. (45).)

Net cash flow from operating activities

SA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Obtain free cash flow using the formula FCF = OCF - NFAI - NCAIarrow_forwardYou are given the following information for Smashville, Inc. Cost of goods sold: Investment income: Net sales: Operating expense: Interest expense: Dividends: Tax rate: Current liabilities: Cash: Long-term debt: Other assets: Fixed assets: Other liabilities: Investments: Operating assets: Gross margin Operating margin Return on assets Return on equity $174,000 $ 1,400 $379,000 $ 86,000 $ 7,400 8,000 $ % % % % 40% $ 21,000 $ 21,000 $ 46,000 $ 38,000 $130,000 Calculate the gross margin, the operating margin, return on assets, and return on equity. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) $ 3,000 $ 34,000 $ 64,000arrow_forwardProvide this question solution general accountingarrow_forward

- Please need answerarrow_forwardI need answer of this question solution general accountingarrow_forwardWhat is the Total Asset Turnover Ratio for a company with $120,000 in annual sales, beginning Assets of $250,000 and ending Assets of $200,000? .48 1.34 .26 .53 please give the correct answswer but only one is right.e xplain the correct naswer The efficiency ratio that shows how efficiently a company uses its cash to generate revenue is: Accounts Receivable Turnover Ratio. Total Asset Receivable Turnover Ratio. Cash Turnover Ratio. Inventory Turnover Ratio. please give the correct answswer but only one is right.e xplain the correct naswerarrow_forward

- Prepare Operating income part Selling, general, and administrative expenses Accounts payable Research and development expenses Loss from discontinued operations, net of tax savings of $6,000 Provision for income taxes Net sales Interest expense Net cash provided by operations Cost of goods sold $ 61,200 102,000 44,400 19,200 88,800 694,800 76,800 177,600 326,400arrow_forwardPrepare Cash-Flow Statementarrow_forwardBased on the pro - forma income statement, please estimate OCF and complete the tables. Sales 125,000 Variable costs -29, 000 Fixed costs -30,000 Depreciation -12,800 EBIT 53, 200 Tax -18, 620 NI 34, 580 Enter your final answers as whole numbers without using 1000 separators. Use a " -" sign for cash costs, expenses, cash outflows. (1) Starting from EBIT EBIT + Depreciation - Tax OCF? = OCF What is EBIT? What is Depreciation? What is Tax? What isarrow_forward

- Consider the following income statement: Sales Costs Depreciation Taxes Calculate the EBIT. EBIT $748,168 486,752 110,700 Net income 23% Calculate the net income.arrow_forwardif you have the following information Sales 250,000 Cost of goods sold 260,000 Gross loss (10000) Operating expenses 80,000 Deprecation 20,000 Net loss 110000 The following accounts increase Accounts receivable 22000 bonds 18000 Accounts payable 35000 building 47000 Long term investment 150000 The following accounts decrease : land 24000 Rent payable 28000 Common stock 35000 The cash flows from financing activities is: Select one: O a. 35000 O b. 180000 O c. (35000) O d. (18000) O e. (17000)arrow_forwardPlease do not provide answer in image formate thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning