Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

2

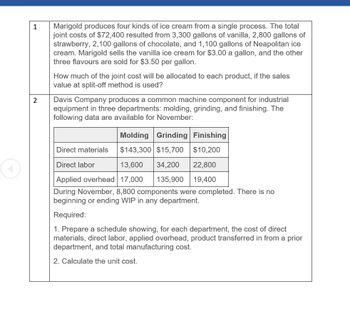

Marigold produces four kinds of ice cream from a single process. The total

joint costs of $72,400 resulted from 3,300 gallons of vanilla, 2,800 gallons of

strawberry, 2,100 gallons of chocolate, and 1,100 gallons of Neapolitan ice

cream. Marigold sells the vanilla ice cream for $3.00 a gallon, and the other

three flavours are sold for $3.50 per gallon.

How much of the joint cost will be allocated to each product, if the sales

value at split-off method is used?

Davis Company produces a common machine component for industrial

equipment in three departments: molding, grinding, and finishing. The

following data are available for November:

Molding Grinding Finishing

Direct materials

$143,300 $15,700 $10,200

Direct labor

13,600 34,200 22,800

19,400

Applied overhead 17,000 135,900

During November, 8,800 components were completed. There is no

beginning or ending WIP in any department.

Required:

1. Prepare a schedule showing, for each department, the cost of direct

materials, direct labor, applied overhead, product transferred in from a prior

department, and total manufacturing cost.

2. Calculate the unit cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- Oriole produces four kinds of ice cream from a single process. The total joint costs of $77,900 resulted in 3,000 gallons of vanilla, 2,700 gallons of strawberry, 2,100 gallons of chocolate, and 1,000 gallons of Neapolitan ice cream. Oriole sells the vanilla ice cream for $3.00/gallon and sells each of the other three flavors for $3.50/gallon. How much of the joint cost will be allocated to each product if the sales value at split-off method is used? (Round proportion to 4 decimal places, e.g. 0.2513 and final answers to O decimal places, e.g. 5,125.) Allocated joint costs $ Vanilla $ Strawberry $ Chocolate Neapolitanarrow_forwardNovak produces four kinds of ice cream from a single process. The total joint costs of $87,800 resulted in 3,000 gallons of vanilla, 3,300 gallons of strawberry, 1,900 gallons of chocolate, and 900 gallons of Neapolitan ice cream. Novak sells the vanilla ice cream for $2.00/gallon and sells each of the other three flavors for $2.50/gallon. How much of the joint cost will be allocated to each product if the sales value at split-off method is used? (Round proportion to 4 decimal places, e.g. 0.2513 and final answers to O decimal places, e.g. 5,125.) Allocated joint costs Vanilla $ Strawberry $ Chocolate ta Neapolitanarrow_forwardam. 276.arrow_forward

- Bronte Confections is known for its rich dark chocolate fudge. Bronte sells its fudge to local retailers. A "unit" of fudge is a 10-pound batch. The standard quantities of ingredients for a batch include 6 cups of sugar, 23 ounces of chocolate chips, 13 ounces of butter, and 25 ounces of evaporated milk. The standard costs for each of the ingredients are as follows: $0.25 per cup of sugar, $0.14 per ounce of chocolate chips, $0.11 per ounce of butter, and $0.08 per ounce of evaporated milk. Calculate the standard direct material cost per batch of fudge. Calculate the standard direct material (DM) cost per batch of fudge. (Enter all dollar amounts to two decimal places.) Standard Quantity X Standard Price Standard Cost Sugar per cup Chocolate chips per ounce Butter per ounce Evaporated milk per ounce Standard DM cost per batch X Xarrow_forwardCrazy Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (5,000 bars) are as follows: Ingredient Quantity Price Cocoa 500 lbs. $1.40 per lb. Sugar 100 lbs. $0.50 per lb. Milk 250 gal. $1.60 per gal. Determine the standard direct materials cost per bar of chocolate.arrow_forwardTruly Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (1,457 bars) are as follows: Ingredient Quantity Price Cocoa 420 lbs. $0.30 per lb. Sugar 120 lbs. $0.60 per lb. Milk 90 gal. $1.20 per gal. Determine the standard direct materials cost per bar of chocolate. Round to two decimal places.fill in the blank 1 of 1$ per bararrow_forward

- Aunt Molly's Old Fashioned Cookies bakes cookies for retail stores. The company's best-selling cookie is the chocolate nut supreme, which is marketed as a gourmet cookie and regularly sells for $8.00 per pound. The standard cost per pound of chocolate nut supreme, based on Aunt Molly's normal monthly production of 400,000 pounds is as follows: Cost Item Quantity Standard Unit Cost Total Cost Direct material: Cookie mix 10 oz. $0.02 per oz. $0.20 Milk Chocolate 5 oz. $0.15 per oz. $0.75 Almonds 1 oz. $0.50 per oz. $0.50 Total $1.45 Direct Labor Mixing 1 min $14.40 per hr. $0.24 Baking 2 min $18.00 per hr. $0.60 Total $0.84 Cost Item Quantity Standard Unit Cost Total Cost Variable overhead 3 min $32.40 per direct-labor hr. $1.62 Total Standard cost per pound $3.91 Aunt Molly's management accountant, Karen Blair, prepares monthly budget reports based on these standard costs. The month of April's…arrow_forwardAnswer please...!arrow_forwardSagararrow_forward

- The Delmar Beverage Company produces a premium root beer that is sold throughout its chain of restaurants in the Midwest. The company is currently producing 1,700 gallons of root beer per day, which represents 80% of its manufacturing capacity. The root beer is available to restaurant customers by the mug, in bottles, or packaged in six-packs to take home. The selling price of a gallon of root beer averages $13, and cost accounting records indicate the following manufacturing costs per gallon of root beer: Raw materials Direct labor Variable overhead Fixed overhead Total absorption cost $ 1.56 1.67 1.11 1.53 $ 5.87 In addition to the manufacturing costs just described, Delmar Beverage incurs an average cost of $1.05 per gallon to distribute the root beer to its restaurants. SaveMore Incorporated, a chain of grocery stores, is interested in selling the premium root beer in gallon jugs throughout its stores in the St. Louis area during holiday periods and has offered to purchase root…arrow_forwardM & Z Creameries, Corp. process milk and sugar to make vanilla ice cream. They sell their ice cream in large one-gallon containers to schools, hospitals, nursing homes, and restaurants. Each batch produces 1,700 gallons of ice cream at a cost of $840 per batch. M & Z Creameries, Corp. sells the one-gallon containers for $23.00 each and spends $0.35 for each plastic container. M & Z Creameries, Corp. has started to determine the feasibility of adding chocolate and strawberries and sell pint-size portions at local supermarkets.Further processing of each batch of ice cream could produce 24,400 pint-sized portions. A recent market study determined a demand existed for this type of product. M & Z Creameries, Corp. could sell each pint-sized portion for $2.70. Additional packaging would cost $0.30 per pint, and the additional materials would cost $0.25 per pint. There would be no change in fixed costs.Should they continue to sell only one-gallon size containers of vanilla ice…arrow_forwardDamato has the practical capacity to produce 15,000 Holiday Panettone (an Italian sweet bread). Based upon practical capacity, the company's average cost = $35.00. Fixed expenses represent 40.0% of the average cost. Currently, Damato sells 13,000 Panettone at a price of $28.00 each. Gustiamo's Italian Bakery requests an order of 5,000 Panettone at a special price = $24.00. The 15.0% sales commission paid on the current sales will be eliminated on the special order. Special packaging will increase direct material costs by $2.00 per Panettone. Gustiamo's is a very large seller of Panettone and Damato would buy a packaging machine for $20,000. The packaging machine would only be required for Gustiamo's special order. Compute the change in Damato's income due to the special order. O Income will INCREASE $1,200 O Income will INCREASE $6,000 O Income will DECREASE $15,000 O Income will DECREASE $24,000 O None of the other answers are correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning