Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

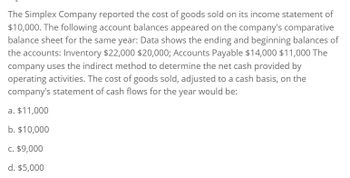

Transcribed Image Text:The Simplex Company reported the cost of goods sold on its income statement of

$10,000. The following account balances appeared on the company's comparative

balance sheet for the same year: Data shows the ending and beginning balances of

the accounts: Inventory $22,000 $20,000; Accounts Payable $14,000 $11,000 The

company uses the indirect method to determine the net cash provided by

operating activities. The cost of goods sold, adjusted to a cash basis, on the

company's statement of cash flows for the year would be:

a. $11,000

b. $10,000

c. $9,000

d. $5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardProvide answer please general accountingarrow_forwardansarrow_forward

- The cost of merchandise sold during the year was $51,768. Merchandise inventories were $13,894 and $8,414 at the beginning and end of the year, respectively. Accounts payable (all owed to merchandise suppliers) were $5,591 and $3,814 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments for merchandise total a.$5,591 b.$51,768 c.$44,511 d.$48,065arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 627,500 Cost of goods sold 294,000 Gross profit 333,500 Operating expenses (excluding depreciation) $ 141,400 Depreciation expense 29,750 171,150 Other gains (losses) Loss on sale of equipment (14,125) Income before taxes 148,225 Income taxes expense 36,850 Net income $ 111,375 FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 63,400 $ 82,500 Accounts receivable 79,360 59,625 Inventory 289,156 260,800 Prepaid expenses 1,300 2,075 Total…arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 627,500 Cost of goods sold 294,000 Gross profit 333,500 Operating expenses (excluding depreciation) $ 141,400 Depreciation expense 29,750 171,150 Other gains (losses) Loss on sale of equipment (14,125) Income before taxes 148,225 Income taxes expense 36,850 Net income $ 111,375 FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 63,400 $ 82,500 Accounts receivable 79,360 59,625 Inventory 289,156 260,800 Prepaid expenses 1,300 2,075 Total…arrow_forward

- Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) $ 137,400 25,750 Depreciation expense Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense Net income Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities FORTEN COMPANY Comparative Balance Sheets December 31 Cash flows from operating activities $ 607,500 290,000 317,500 FORTEN COMPANY…arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 582,500 Cost of goods sold 285,000 Gross profit 297,500 Operating expenses (excluding depreciation) $ 132,400 Depreciation expense 20,750 153,150 Other gains (losses) Loss on sale of equipment (5,125) Income before taxes 139,225 Income taxes expense 24,250 Net income $ 114,975 FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 49,800 $ 73,500 Accounts receivable 65,810 50,625 Inventory 275,656 251,800 Prepaid expenses 1,250 1,875 Total current assets 392,516 377,800 Equipment 157,500 108,000 Accumulated…arrow_forwardThe cost of merchandise sold during the year was $45,245. Merchandise inventories were $13,491 and $8,567 at the beginning and end of the year, respectively. Accounts payable were $5,962 and $3,677 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash paid for merchandise during the year isarrow_forward

- The following selected account balances appeared on the financial statements of the Washington Company. Use these balances to answer the questions that follow. Accounts Receivable, Jan. 1 Accounts Receivable, Dec. 31 Accounts Payable, Jan. 1 Accounts Payable, Dec. 31 Inventory, Jan. 1 Inventory, Dec. 31 15,279 Sales 66,715 Cost of Goods Sold 36,365 The Washington Company uses the direct method to calculate net cash flow from operating activities. Assume that all accounts payable are owed to merchandise suppliers. $13,081 Oa. $73,715 Ob. $70,015 Oc. $66,715 Od. $59,715 6,081 5,652 9,352 7,633arrow_forwardThe following selected account balances appeared on the financial statements of Washington Company: Accounts Receivable, January 1 $16,126 Accounts Receivable, December 31 7,405 Accounts Payable, January 1 5,111 Accounts Payable, December 31 7,854 Merchandise Inventory, January 1 7,084 Merchandise Inventory, December 31 16,812 Sales 66,012 Cost of Merchandise Sold 33,620 Washington Company uses the direct method to calculate net cash flow from operating activities. Cash payments for merchandise were a.$72,997 b.$21,149 c.$46,091 d.$40,605arrow_forwardThe following selected account balances appeared on the financial statements of Washington Company: Accounts Receivable, January 1 $15,102 Accounts Receivable, December 31 7,937 Accounts Payable, January 1 5,381 Accounts Payable, December 31 9,511 Merchandise Inventory, January 1 9,855 Merchandise Inventory, December 31 15,185 Sales 68,703 Cost of Merchandise Sold 32,106 Washington Company uses the direct method to calculate net cash flow from operating activities. Cash collections from customers werearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,