Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

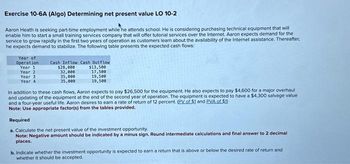

Transcribed Image Text:Exercise 10-6A (Algo) Determining net present value LO 10-2

Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will

enable him to start a small training services company that will offer tutorial services over the Internet. Aaron expects demand for the

service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter,

he expects demand to stabilize. The following table presents the expected cash flows:

Year of

Operation

Year 11

Year 2

Year 3

Year 4

Cash Inflow Cash Outflow

$13,500

17,500

$28,000

32,000

35,000

35,000

19,500

19,500

In addition to these cash flows, Aaron expects to pay $26,500 for the equipment. He also expects to pay $4,600 for a major overhaul

and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $4,300 salvage value

and a four-year useful life. Aaron desires to earn a rate of return of 12 percent. (PV of $1 and PVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Required

a. Calculate the net present value of the investment opportunity.

Note: Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to 2 decimal

places.

b. Indicate whether the investment opportunity is expected to earn a return that is above or below the desired rate of return and

whether it should be accepted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dinabhaiarrow_forwardQuestion 4 of 9 - /0.75 !! View Policies Current Attempt in Progress Ivanhoe's Candles will be producing a new line of dripless candles in the coming years and has the choice of producing the candles in a large factory with a small number of workers or a small factory with a large number of workers. Each candle will be sold for $10. If the large factory is chosen, the cost per unit to produce each candle will be $3.00. The cost per unit will be $7.50 in the small actory. The large factory would have fixed cash costs of $1.8 million and a depreciation expense of $300,000 per year, while those expenses would be $490,000 and $100,000, respectively in the small factory. Calculate the accounting operating profit break-even point for both factory choices for Ivanhoe's Candles. (Round answers to nearest whole units, e.g. 152.) The accounting break-even point for large factory is units and for small factory is eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer APR tvarrow_forward2: Homework Question 5 of 9 - / 1 View Policies Current Attempt in Progress Cullumber's Candles will be producing a new line of dripless candles in the coming years and has the choice of producing the candles in a large factory with a small number of workers or a small factory with a large number of workers. Each candle will be sold for $10. If the large factory is chosen, the cost per unit to produce each candle will be $3.60. The cost per unit will be $7.50 in the small factory. The large factory would have fixed cash costs of $2.30 million and a depreciation expense of $300,000 per year, while those expenses would be $470,000 and $100,000, respectively, in the small factory. Calculate the pretax operating cash flow break-even point for both factory choices for Cullumber's Candles. (Round answers to nearest whole units e.g. 152.) retax operating cash flow breakeven point for the large factory is units and for the small factory is eTextbook and Media Save for Later Attempts: 0 of 3…arrow_forward

- Urmila benarrow_forwardGodoarrow_forwardQuestion 4 of / View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. You are starting a family pizza parlor and need to buy a motorcycle for delivery orders. You have two models in mind. Model A costs $8,500 and is expected to run for 7 years; Model B is more expensive, with a price of $14,900, and has an expected life of 10 years. The annual maintenance costs are $860 for Model A and $640 for Model B. Assume that the opportunity cost of capital is 11 percent. Calculate equivalent annual costs (EAC) of each models. (Do not round the discount factor. Round intermediate calculations and final answers to 2 decimal places, e.g. 15.25.) EAC of Model A is 2$ 2717.11 EAC of Model B is %24 3185.26 Which one should you buy? You should buy Model A eTextbook and Media Attempts: 1 of 3 used Submit Answer Save for Laterarrow_forward

- M1arrow_forwardProblem 6-27 Calculating Project NPV With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a “surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 10,400 in the first year, with growth of 6 percent each year for the next five years. Production of these lamps will require $53,000 in net working capital to start. Total fixed costs are $137,000 per year, variable production costs are $20 per unit, and the units are priced at $62 each. The equipment needed to begin production will cost $595,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 24 percent and the required rate of return is 19 percent. What is the NPV of this project? (Do not round intermediate calculations and round…arrow_forwardProblem 6-27 Calculating Project NPV With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a "surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 10,400 in the first year, with growth of 6 percent each year for the next five years. Production of these lamps will require $53,000 in net working capital to start. Total fixed costs are $137,000 per year, variable production costs are $20 per unit, and the units are priced at $62 each. The equipment needed to begin production will cost $595,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 24 percent and the required rate of return is 19 percent. What is the NPV of this project? (Do not round intermediate calculations and round…arrow_forward

- Problem 6-27 Calculating Project NPV With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a "surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 11,000 in the first year, with growth of 6 percent each year for the next five years. Production of these lamps will require $65,000 in net working capital to start. Total fixed costs are $155,000 per year, variable production costs are $21 per unit, and the units are priced at $64 each. The equipment needed to begin production will cost $625,000. The equipment will be depreciated using the straight-line method over a 5-year life and is not expected to have a salvage value. The tax rate is 25 percent and the required rate of return is 17 percent. What is the NPV of this project? (Do not round intermediate calculations and round…arrow_forwardProblem 6-27 Calculating Project NPV With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a “surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be 10,000 in the first year, with growth of 8 percent each year. Production of these lamps will require $95,000 in net working capital to start. Total fixed costs are $150,000 per year, variable production costs are $34 per unit, and the units are priced at $73 each. The equipment needed to begin production will cost $485,000. The equipment will be depreciated using the straight-line method over a five-year life and is not expected to have a salvage value. The tax rate is 21 percent and the required rate of return is 18 percent. What is the NPV of this project? (Do not round intermediate calculations and round your answer to 2…arrow_forwardBhaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College