FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

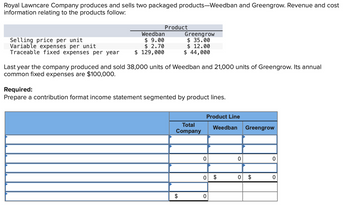

Transcribed Image Text:Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost

information relating to the products follow:

Selling price per unit

Variable expenses per unit

Traceable fixed expenses per year

Product

Weedban

$9.00

$ 2.70

$ 129,000

Greengrow

$35.00

$ 12.00

$ 44,000

Last year the company produced and sold 38,000 units of Weedban and 21,000 units of Greengrow. Its annual

common fixed expenses are $100,000.

Required:

Prepare a contribution format income statement segmented by product lines.

Total

Company

$

Product Line

0

Weedban

0 $

0

0

0

Greengrow

$

0

0

Expert Solution

arrow_forward

Step 1: Contribution format income statement

The contribution format income statement helps to distribute the fixed cost and variable cost. A contribution margin is the excess value of sales revenue over the variable cost. There is also an available amount to recover the fixed cost. Net operating income can be calculated by deducting the fixed cost from the contribution margin. Fixed cost can be traceable fixed cost or common fixed cost.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company Y produces and sells two packaged products Weedban and Greengrow Revenue and cost information related to the products follows: Weedban Greengrow SALES price per unit $9.00 $ 31.00 Variable expense per unit $2.90 $14.00 Traceable fixed expense per year $131,000 $44,000 Last year the company produced and sold 38,500 units of weed ban and 17,000 of Green grow. It's annual common fixed expenses are $106,000. Prepare a contribution format income statement segmented by-product lines ? Thank you,arrow_forwardHardevarrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $2.40 $ 131,000 Greengrow $ 34.00 $14.00 $ 31,000 Last year the company produced and sold 42,000 units of Weedban and 16,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forward

- Royal Lawncare Company produces and sells two packaged products—Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 10.00 $ 31.00 Variable expenses per unit $ 2.40 $ 10.00 Traceable fixed expenses per year $ 130,000 $ 31,000 Last year the company produced and sold 38,000 units of Weedban and 20,500 units of Greengrow. Its annual common fixed expenses are $101,000. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardPathways Careers, Inc. has two products-Resume Reader and Cover Letter Cure. Financial data for both the products follow: Resume Cover Letter Reader Cure 2,600 units 1,300 units Units sold Sales price per unit Variable manufacturing cost per unit Sales commission (% of sales) $600 320 6% $1,000 650 4% Pathways has two sales representatives-Curtis Muller and Willow Brown. Each sales representative sold a total of 1,950 units during the month of March. Curtis had a sales mix of 60% Resume Reader and 40% Cover Letter Cure. Willow had a sales mix of 80% Resume Reader and 20% Cover Letter Cure. Based on the above information, calculate Willow's total contribution to company profits. OA. $380,640 O B. $120,900 OC. $501,540 OD. $573,300arrow_forwardi need the answer quicklyarrow_forward

- Royal Lawncare Company produces and sells two packaged products—Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 9.00 $ 37.00 Variable expenses per unit $ 3.00 $ 13.00 Traceable fixed expenses per year $ 134,000 $ 36,000 Last year the company produced and sold 45,000 units of Weedban and 17,000 units of Greengrow. Its annual common fixed expenses are $107,000. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardSheridan Optics manufactures two products: microscopes and telescopes. Information for each product is as follows. Microscopes Telescopes Sales price $ 34 53 Sales volume 406,565 178,500 Variable cost per unit 15 20 Annual traceable fixed expenses $ 3,003,300 $ 3,505,100 Annual allocated common fixed expenses $ 2,009,500 $ 2,006,700 Prepare a segment margin income statement for Sheridan Optics that provides detail on both the product lines and the company as a whole. (If the amount is negative then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125).) Microscopes Telescopes Total LA $ LA $ LA LAarrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 9.00 $ 2.50 $ 135,000 Greengrow $33.00 $ 13.00 $ 49,000 Last year the company produced and sold 36,500 units of Weedban and 16,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $9.00 $ 2.60 $ 137,000 Product Greengrow $36.00 $ 10.00 $ 38,000 Last year the company produced and sold 36,500 units of Weedban and 17,500 units of Greengrow. Its annual common fixed expenses are $98,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Selling price per unit Variable expenses per unit Traceable fixed expenses per year $ $ $ 133,000 Greengrow $ $ $ 44,000 8.00 34.00 2.40 13.00 Common fixed expenses in the company total $95,000 annually. Last year the company produced and sold 37,000 units of Weedban and 16,000 units of Greengrow. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrowarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education