Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please need answer this general accounting question

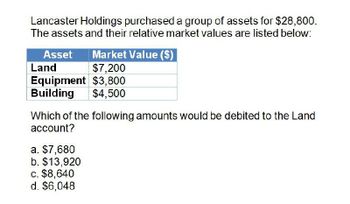

Transcribed Image Text:Lancaster Holdings purchased a group of assets for $28,800.

The assets and their relative market values are listed below:

Asset

Land

Market Value ($)

$7,200

Equipment $3,800

Building

$4,500

Which of the following amounts would be debited to the Land

account?

a. $7,680

b. $13,920

c. $8,640

d. $6,048

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Foley Distribution Service pays $330,000 for a group purchase of land, bulding, and equipment At the time of acquisition, the land has a current market value of $36,000, the building's current market valu $36, 000, and the equipment's current market value is $ 283,000. Prepare a schedule allocating the purchase price of 5330.000 to each of the individual assets purchased based on their relative market val journalize the lump - sum purchase of the three assets. The business signs a note payable for the purchase pricearrow_forwardThe Zylo Corp. made a basket purchase of Land, Building, and Equipment for $6250000. The appraised value of each asset was listed as follows. Land at $1500000, Building at $3900000, and equipment at $1200000. Required: Calculate the cost assigned to each asset.arrow_forwardColumbia recently acquired all of Mercury's net assets in a business acquisition. The cash purchase price was $22,000,000. Mercury's assests and liabilites had the following costs and appraised values: Current assets Land, building and equipment Current liabilites Mortgage payable How much goodwill will rewult from this transaction? Cost Basis $ 6,000,000 $ 14,000,000 Appraised Value $ 6,000,000 $23,000,000 $4,000,000 $4,000,000 $ 10,000,000 $10,000,000arrow_forward

- Please solve this following requirements on these general accounting questionarrow_forwardMohave Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $315,000. The estimated fair values of the assets are land, $60,000; building, $220,000; and equipment, $80,000. Journalize the purchase using the relative sales value method. Date Account Debit Credit MM/DD/YY 6 of 9arrow_forwardUse this information to answer the following 6 questions. Madison Company acquired a depreciable asset at the beginning of Year 1 at a cost of $12 million. At December 31, Year 1, Madison gathered the following information related to this asset: Carrying value of the asset at 12/31/Y1 $10 million Fair value of the asset at 12/31/Y1 $7.5 million Sum of expected future cash flows at 12/31/Y1 $10 million Present value of expected future cash flows at 12/31/Y1 $8 million Remaining useful life at 12/31/Y1 5 years Determine the impact on Year 1 net income from depreciation and possible impairment under IFRS.arrow_forward

- A fixed asset with a cost of $34,571 and accumulated depreciation of $31,113.90 is sold for $5,877.07. What is the amount of the gain or loss on disposal of the fixed asset? Oa. $3,457.10 loss Ob. $3,457.10 gain Oc. $2,419.97 gain Od. $2,419.97 lossarrow_forwardA fixed asset with a cost of $32,167.00 and accumulated depreciation of $28,950.30 is sold for $5,468.39. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. A. $2,251.69 loss B. $2,251.69 gain C. $3,216.70 gain D. $3,216.70 lossarrow_forwardAssume Sambazon.com e sold an acai processing machine for $172,000 cash. If accumulated depreciation on the sale date was $58,311 and a gain of $6,721 was recognized on the sale, what was the original cost of the asset? O $223,590 O $216,869 O $165,279 O $65,032 O $113,689arrow_forward

- A fixed asset with a cost of $31,737 and accumulated depreciation of $28,563.30 is sold for $5,395.29. What is the amount of the gain or loss on disposal of the fixed asset? a.$3,173.70 gain b.$2,221.59 loss c.$3,173.70 loss d.$2,221.59 gainarrow_forwardCozzi Company is being purchased and has the following balance sheet as of the purchase date: Current assets $200,000 Liabilities $ 90,000 Fixed assets 180,000 Equity 290,000 Total $380,000 Total $380,000 The price paid for Cozzi's net assets is $500,000. The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000. The amount of goodwill to be recorded in the purchase is: Select one: a.$150,000 b.$0 c.$190,000 d.$170,000arrow_forwardplease answer do not image.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning