SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

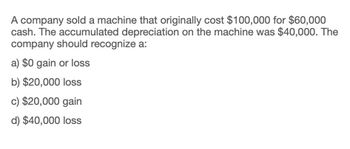

Transcribed Image Text:A company sold a machine that originally cost $100,000 for $60,000

cash. The accumulated depreciation on the machine was $40,000. The

company should recognize a:

a) $0 gain or loss

b) $20,000 loss

c) $20,000 gain

d) $40,000 loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardChapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000arrow_forwardAlbany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forward

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.arrow_forwardBliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.arrow_forwardGarcia Co. owns equipment that costs $150,000, with accumulated depreciation of $65,000. Garcia sells the equipment for cash. Record the journal entry for the sale of the equipment if Garcia were to sell the equipment for the following amounts: A. $90,000 cash B. $85,000 cash C. $80,000 casharrow_forward

- Effect of depreciation on net income Einstein Construction Co. specializes in building replicas of historic houses. Bree Andrus. president of Einstein Construction, is considering the purchase of various items of equipment on July 1. 20Y2. for $300,000. The equipment would have a useful life of five years and no residual value. In the past, all equipment has been leased. For tax purposes, Bee is considenng depreciating the equipment by the straight-line method. She discussed the matter with her CPA and learned that although the straight-line method could be elected, it was to her advantage to use the Modified Accelerated Cost Recovery System (MACRS) for tax purposes. She asked for your advice as to which method to use for tax purposes. What factors would you present for Bree’s consideration in the selection of a depreciation method?arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardSusquehanna Company purchased an asset at the beginning of the current year for 250,000. The estimated residual value is 25,000. Susquehanna estimates that the asset will be used for 10 years and uses straight-line depreciation. Calculate the depreciation expense per year.arrow_forward

- A company sold a machine that originally cost $250,000 for $120,000 when accumulated depreciation on the machine was $100,000. The gain or loss recorded on the sale of this machine is:arrow_forwardSlipper Company sold a productive asset, a machine, for cash. It originally cost Slipper $20,000. The accumulated depreciation at the date of disposal was $15,000. A gain on the disposal of $2,000 was reported. What was the asset's selling price?arrow_forwardTipton Manufacturing has a machine that cost $145,000 when new and has accumulated depreciation of $136,000, which it sold for $1,000. The amount of gain or loss from this sale is: O A. a gain of $8,000 B. a loss of $8,000 O C. a gain of $9,000 D. a loss of $9,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning