FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General accounting

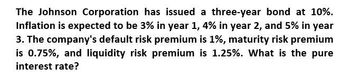

Transcribed Image Text:The Johnson Corporation has issued a three-year bond at 10%.

Inflation is expected to be 3% in year 1, 4% in year 2, and 5% in year

3. The company's default risk premium is 1%, maturity risk premium

is 0.75%, and liquidity risk premium is 1.25%. What is the pure

interest rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If the real rate of interest is 2%, inflation is expected to be 3% during the coming year, and the default risk premium, illiquidity risk premium, and maturity risk premium for the Bonds-R-Us Corporation are all 1% each, what would be the yield (stated rate) on a Bonds-R-Us bond?arrow_forwardThe real risk-free rate is 3 percent. Inflation is expected to average 2 percent a year for the next 3 years, after which the inflation is expected to average 3.5 percent a year. Assume that there is no maturity risk premium. A 7-year corporate bond has a yield of 7.6 percent. Assume that the liquidity premium on the corporate bond is 0.4 percent. What is the default risk premium on the corporate bond?arrow_forwardThe real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 8% per year for each of the next four years and 7% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t – 1)%, where t is the security’s maturity. The liquidity premium (LP) on all Pellegrini Southern Inc.’s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury — AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Pellegrini Southern Inc. issues fifteen-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 11.42% 12.82% 12.27% 5.55% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? Higher inflation expectations…arrow_forward

- The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next two years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t – 1)%, where t is the security’s maturity. The liquidity premium (LP) on all Smith and Carter Inc.’s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury — AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Smith and Carter Inc. issues 10-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 7.35% 7.70% 8.25% 5.05% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on a AAA-rated bond will be higher…arrow_forwardThe real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 3% per year for each of the next two years and 2% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t – 1)%, where t is the security’s maturity. The liquidity premium (LP) on all Moq Computer Corp.’s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury — AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Moq Computer Corp. issues 15-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 7.68% 6.28% 5.55% 7.13% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on a AAA-rated bond will be lower than…arrow_forwardThe real risk-free rate, , is 1.7%. Inflation is expected to average 1.5% a year for the next 4 years, after which time inflation is expected to average 4.8% a year. Assume that there is no maturity risk premium. An 11-year corporate bond has a yield of 8.7%, which includes a liquidity premium of 0.3%. What is its default risk premium?arrow_forward

- The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next two years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t – 1)%, where t is the security’s maturity. The liquidity premium (LP) on all Global Satellite Corp.’s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury — AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Global Satellite Corp. issues 15-year, AA-rated bonds. What is the yield on one of these bonds?arrow_forwardThe real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next four years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t – 1)%, where t is the security’s maturity. The liquidity premium (LP) on all Rink Machine Co.’s bonds is 1.05%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury — AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Rink Machine Co. issues fourteen-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 7.94% 9.24% 8.19% 5.95% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? An AAA-rated bond has less default risk than a…arrow_forwardDrongo Corporation's 3-year bonds currently yield 6.3 percent and have an inflation premium of 3.3%. The real risk-free rate of interest, r*, is 1.5 percent and is assumed to be constant. The maturity risk premium (MRP) is estimated to be 0.1% (t - 1), where t is equal to the time to maturity. The default risk and liquidity premiums for this company's bonds total 1.3 percent and are believed to be the same for all bonds issued by this company. If the average inflation rate is expected to be 3 percent for years 4, 5, and 6, what is the yield on a 6-year bond for Drongo Corporation? ○ 6.05% 6.45% 6.25% 5.85% 5.65%arrow_forward

- General Accountingarrow_forward. CEPS Group has bonds outstanding with a 9.24 percent nominal yield to maturity. The current rate of inflation is 1.75 percent. What is the real rate of return on these bonds?arrow_forwardThe real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next four years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA. 0.80% 1.05% A. ВB 1.45% Gauge Imports Inc. issues 12-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 5.25% 8.58% 8.03% 7.48% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? A AAA-rated bond has less default risk than a BB-rated bond. The yield on a AAA-rated bond will be higher than the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education