Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

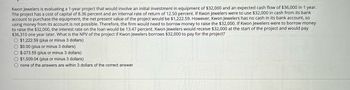

Transcribed Image Text:Kwon Jewelers is evaluating a 1-year project that would involve an initial investment in equipment of $32,000 and an expected cash flow of $36,000 in 1 year.

The project has a cost of capital of 8.36 percent and an internal rate of return of 12.50 percent. If Kwon Jewelers were to use $32,000 in cash from its bank

account to purchase the equipment, the net present value of the project would be $1,222.59. However, Kwon Jewelers has no cash in its bank account, so

using money from its account is not possible. Therefore, the firm would need to borrow money to raise the $32,000. If Kwon Jewelers were to borrow money

to raise the $32,000, the interest rate on the loan would be 13.47 percent. Kwon Jewelers would receive $32,000 at the start of the project and would pay

$36,310 one year later. What is the NPV of the project if Kwon Jewelers borrows $32,000 to pay for the project?

$1,222.59 (plus or minus 3 dollars)

$0.00 (plus or minus 3 dollars)

$-273.55 (plus or minus 3 dollars)

$1,509.04 (plus or minus 3 dollars)

none of the answers are within 3 dollars of the correct answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Galbraith Co. is considering a four-year project that will require an initial investment of $7,000. The base-case cash flows for this project are projected to be $14,000 per year. The best-case cash flows are projected to be $26,000 per year, and the worst-case cash flows are projected to be –$4,500 per year. The company’s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project’s cost of capital is 12%? $30,587 $29,058 $35,175 $36,704 Galbraith now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project…arrow_forwardStrange Manufacturing Company is purchasing a production facility at a cost of $12 million. The company expects the project to generate annual cash flows of $6.4 million over the next 5 years. Its cost of capital is 6.7 per cent. What is the net present value of this project? Round your answer to 2 decimal places. E.g. if the final value is $12345.8342, please type 12345.83 in the answer box (do not type the dollar sign).arrow_forwardA project will produce an operating cash flow of $78,900 a year for five years. The initial cash outlay for equipment will be $110,530. The net after-tax salvage value of $33,147 will be received at the end of the project. The project requires $17,938 of net working capital that will be fully recovered at the end of the project. What is the net present value of the project if the required rate of return is 12 percent?arrow_forward

- Compute the net present value of this investment.arrow_forwardThe management of SoComfy Hotel wishes to capitalize on an investment project that will cost the management to pay $85,000 as an initial cost. This project will take three years to finish with the net cash flows stream of $18,000 for the first year, $21,000 for the second year, and $22,500 for the third year. Should the management accept the project by analyzing the net present value (NPV) of the cash flow stream if they have 12.00% minimum required rate of return on the project?arrow_forwardA project will produce an operating cash flow of $164,000 a year for three years. The initial cash outlay for equipment will be $305,000. The net aftertax salvage value of $12,500 will be received at the end of the project. The project requires $41,000 of net working capital up front that will be fully recovered when the project ends. What is the net present value of the project if the required rate of return is 11 percent?$93,887.95 correct $90,124.63 incorrect$86,361.31 incorrect$82,597.99 incorrect$78,834,67 incorrect $93,887.95 $90,124.63 $86,361.31 $82,597.99 $78,834.67arrow_forward

- Blink of an Eye Company is evaluating a 5-year project that will provide cash flows of $39,300, $80,430, $63,170, $61,250, and $44,470, respectively. The project has an initial cost of $182,560 and the required return is 8.8 percent. What is the project's NPV?arrow_forwardGalbraith Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per year, and the worst-case cash flows are projected to be –$1,500 per year. The company’s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project’s cost of capital is 11%? $24,135 $36,203 $30,169 $25,644arrow_forwardVijayarrow_forward

- The management of Lanzilotta Corporation is considering a project that would require an investment of $208,000 and would last for 6 years. The annual net operating income from the project would be $104,000, which includes depreciation of $15,000. The scrap value of the project's assets at the end of the project would be $24,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Multiple Choice 1.7 years 2.9 years 2.0 years 1.5 yearsarrow_forwardFossa Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $240,000, will last 10 years, and will have a $40,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $60,000 per year in each of the 10 years. Fossa's discount rate is 18%. The net present value of the proposed investment is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $69,640 $37,280 $(48,780) $5,840arrow_forwardHerman Co. is considering a four-year project that will require an initial investment of $5,000. The base-case cash flows for this project are projected to be $12,000 per year. The best-case cash flows are projected to be $20,000 per year, and the worst-case cash flows are projected to be –$1,000 per year. The company’s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project’s cost of capital is 13%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education