Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

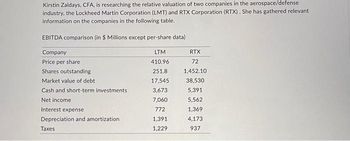

Transcribed Image Text:Kirstin Zaldays, CFA, is researching the relative valuation of two companies in the aerospace/defense

industry, the Lockheed Martin Corporation (LMT) and RTX Corporation (RTX). She has gathered relevant

information on the companies in the following table.

EBITDA comparison (in $ Millions except per-share data)

Company

Price per share

Shares outstanding

Market value of debt

Cash and short-term investments

Net income

Interest expense

Depreciation and amortization

Taxes

LTM

410.96

251.8

17,545

3,673

7,060

772

1,391

1,229

RTX

72

1,452.10

38,530

5,391

5,562

1,369

4,173

937

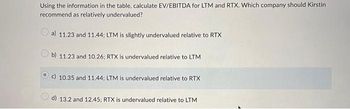

Transcribed Image Text:Using the information in the table, calculate EV/EBITDA for LTM and RTX. Which company should Kirstin

recommend as relatively undervalued?

a) 11.23 and 11.44; LTM is slightly undervalued relative to RTX

b) 11.23 and 10.26; RTX is undervalued relative to LTM

c) 10.35 and 11.44; LTM is undervalued relative to RTX

13.2 and 12.45; RTX is undervalued relative to LTM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute Liquidity and Solvency Ratios for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Cash and equivalents Short-term investments Accounts receivable HAL SLB $2,008 $1,433 1,344 5,182 7,802 Current assets Current liabilities Total liabilities Total equity 11,151 15,731 4,754 13,351 16,438 33,921 9,449 36,220 Earnings before interest and tax (EBIT) 2,442 3,020 Interest expense, gross 554 537 a. Compute the following measures for both companies. Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555). HAL SLB 1. Current ratio 2.32 X 1.17 x 2. Quick ratio 1.5 x 0.68 * 3. Times interest earned 4.45 x 5.67 x 4. Liabilities-to-equity 1.7 x 0.92 x b. Which company appears more liquid? HAL c. Which company appears more solvent? SLB =>arrow_forward1.) Solve the Income Statement of AAA Company using Horizontal Analysis. 2.) As a Financial Analyst how would you interpret the data?arrow_forwardCompute Liquidity and Solvency Ratios for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Cash and equivalents Short-term investments Accounts receivable Current assets Current liabilities Total liabilities Total equity Earnings before interest and tax (EBIT) Interest expense, gross HAL SLB $2,008 $1,433 1,344 5,391 8,117 11,151 15,731 4,946 13.891 16,438 33,921 1. Current ratio 2. Quick ratio 3. Times interest earned 4. Liabilities-to-equity 9,830 37,684 2,541 3,142 554 537 a. Compute the following measures for both companies. Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555). HAL SLB b. Which company appears more liquid? c. Which company appears more solvent? ◆arrow_forward

- A Comparison of Firm Performance 1 2 2013 Financials 3 Net operating revenues 4 Cost of goods sold 5 Gross profit 6 Selling, general, and administrative expense 7 Other costs 8 Operating income 9 Interest expense 10 Other income (loss) - net 11 Income before income taxes 12 Income taxes 13 Net income 14 Assets 15 Cash and cash equivalents 16 Net receivables 17 Inventories 18 Prepaid expenses and other 19 Total current assets 20 Property, plant and equipment 21 Goodwill 22 Other assets 23 Total assets 24 Liabilities and Stockholder Equity 25 Accounts payable 26 Short-term debt 27 Total current liability 28 Long-term debt 29 Other liabilities 30 Total liabilities 31 Stockholder equity 32 B Walmart 469,162 352,488 116,674 88,873 27,801 2,251 187 25,737 7,981 17,756 7,781 6,768 43,803 1,588 59,940 116,681 20,497 5,987 203,105 59,099 12,719 71,818 41,417 113,235 89,870 C Macy's 27,931 16,725 11,206 8,440 88 2,678 388 (134) 2,156 767 1,389 1,836 371 5,308 361 7,876 8,196 3,743 1,176 20,991…arrow_forwardPlease type the answer with good explanationarrow_forwardYou are evaluating the balance sheet for SophieLex’s Corporation. From the balance sheet you find the following balances: cash and marketable securities = $280,000; accounts receivable = $1,380,000; inventory = $2,280,000; accrued wages and taxes = $590,000; accounts payable = $890,000; and notes payable = $780,000. What is the quick ratio (round your answer to 2 decimal placesarrow_forward

- determine the following ratios for both companies, then based on the information analvze and compare the two companies' solvency and profitability. Ratios: Return on total assets Return on stockholders' equity Times interest earned Ratio of total liabilities to stockholders' equity.arrow_forward5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Petroxy Oil Co. and make comments on its second-year performance as compared with its first-year performance. The following shows Petroxy Oil Co.'s income statement for the last two years. The company had assets of $9,400 million in the first year and $15,037 million in the second year. Common equity was equal to $5,000 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Petroxy Oil Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 5,080 4,000 1,855 1,723 254 160 Net Sales Operating costs except depreciation and amortization Depreciation…arrow_forwardYou are evaluating the balance sheet for SophieLex's Corporation. From the balance sheet you find the following balances: cash and marketable securities = $450,000; accounts receivable = $1,100,000; inventory = $2,000,000; accrued wages and taxes = $450,000; accounts payable = $750,000; and notes payable = $500,000. Calculate SophieLex's current ratio.arrow_forward

- Given the financial data in the popup window, , for Disney (DIS) and McDonald's (MCD), compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage component (equity miltiplier), profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The debt ratio for Disney is nothing. (Round to four decimal places.) Help Me Solve ThisView an Example Get More Help Clear All Check Answer Data Table Click on the following Icon in order to past this table's content into a spreadsheet. Disney McDonald's Sales $48,792 $28,023 EBIT $12,116 $8,123 Net Income $7,572 $5,507 Current Assets $15,187 $5,004 Total Assets $84,112 $36,637 Current Liabilities $13,105 $3,064…arrow_forwardAngela Corporation has the following selected assets and liabilities: Given the said data, determine the company’s net working capital. (check the photo) Choose the letter of correct answer a. P35,000.00b. P39,000.00c. P33,000.00d. P72,000.00e. P52,000.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education