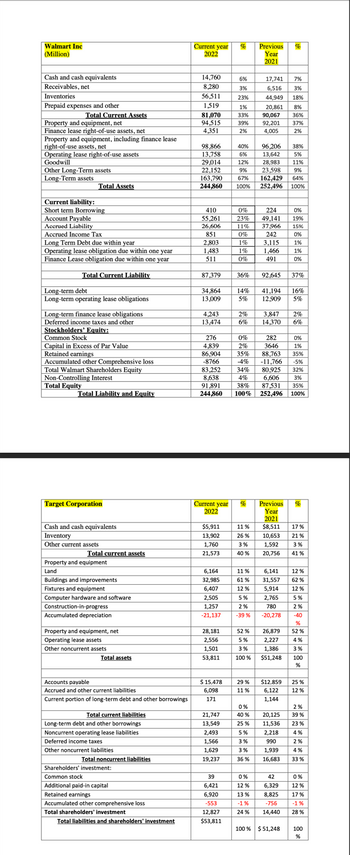

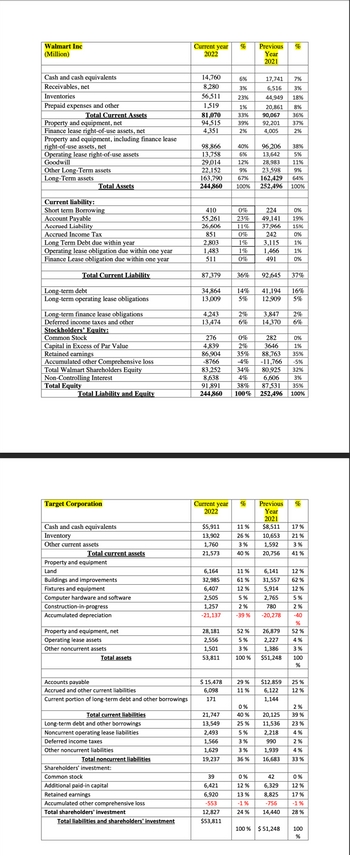

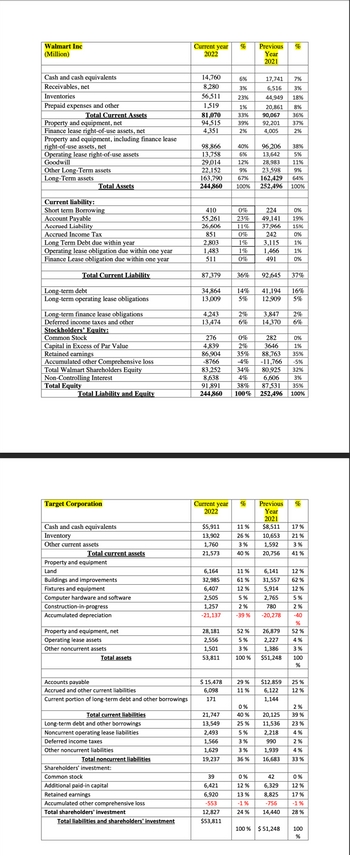

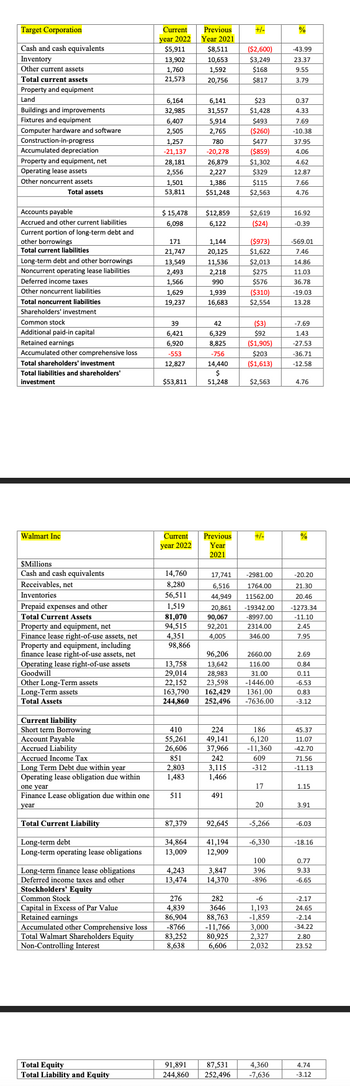

A) Comment on any significant changes in each company in the composition of current assets and current liabilities. Explain.

b) Which assets in each company have the most significant investment? Why?

c) Are the companies financed primarily with debt or equity? Why?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Are the companies financed primarily with debt or equity? Why?

D) Is the debt primarily short-term or long-term? Why?

E ) Compare the

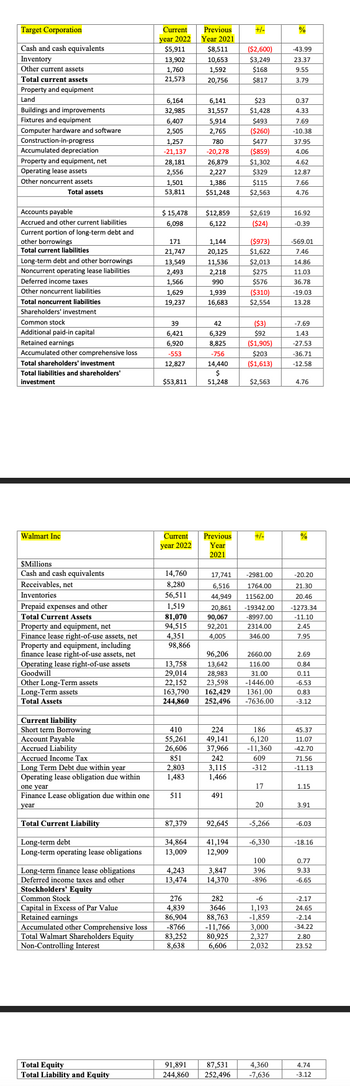

F) Comment on any significant changes in each company in assets and liabilities. Explain

Are the companies financed primarily with debt or equity? Why?

D) Is the debt primarily short-term or long-term? Why?

E ) Compare the

F) Comment on any significant changes in each company in assets and liabilities. Explain

- Liabilities and stockholders' equity are: O increases in assets resulting from profitable operations O economic resources used by a business entity. O sources of financing for economic resources. shown on the income statement in calculating net income.arrow_forwardWhich of the following is classified as a financing activity? Receipt of dividend income Receipt of interest on loan receivable Payment of dividends Investment in another company’s stockarrow_forwardWhich statement is true? All of a company’s identifiable assets and liabilities appear on the balance sheet. The financial statements are linked with each other. The basic financial statements reflect a complete, accurate, portrayal of the financial performance of a company. The difference between a company’s assets and liabilities should be equal to the market value of the shares owned by investors.arrow_forward

- What is Market Value? A. Any cost that has not yet been charged to the expense B. The amount of money a business must currently spend to replace an essential asset C. Maintaining an account tied to a certain asset D. The value of a company according to the stock marketarrow_forwardThe for an organization is the cost of financing its activities through debt or equity.arrow_forwardHow can the retained earnings indicate the number of assets that the company has financed?arrow_forward

- What effect does the recognition of depreciation expense have on total assets? On total stockholders' equity?arrow_forwardThe balance sheet contributes to financial reporting by providing a basis for all of the following except Group of answer choices evaluating the capital structure of the enterprise. assessing the liquidity and financial flexibility of the enterprise. determining the increase in cash due to operations. computing rates of return.arrow_forwardWhich of the following is not true about the information provided in the income statement? OIt helps in evaluating the past performance of the enterprise. O It provides a basis for predicting future performance. It helps assess the risk or uncertainty of generating future cash flows. O It helps in evaluating working capital.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education