FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hello tutor provide solution

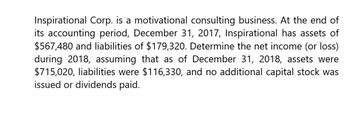

Transcribed Image Text:Inspirational Corp. is a motivational consulting business. At the end of

its accounting period, December 31, 2017, Inspirational has assets of

$567,480 and liabilities of $179,320. Determine the net income (or loss)

during 2018, assuming that as of December 31, 2018, assets were

$715,020, liabilities were $116,330, and no additional capital stock was

issued or dividends paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cullumber Company provides you with the following balance sheet information as of December 31, 2017. Current assets $14,720 Current liabilities $15,360 Long-term assets 32,860 Long-term liabilities 16,860 Total assets $47,580 Stockholders’ equity 15,360 Total liabilities and stockholders’ equity $47,580 In addition, Cullumber reported net income for 2017 of $20,480, income tax expense of $3,904, and interest expense of $1,664. Assume that at the end of 2017, Cullumber used $3,720 cash to pay off $3,720 of accounts payable. How would the current ratio and working capital have changed? (Round current ratio to 2 decimal places, e.g. 2.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Current ratio enter current ratio rounded to 2 decimal places :1 Working capital $enter a dollar amount Compute the debt to assets ratio and…arrow_forwardAnderson Corporation had a credit balance of $43,000 in its Retained Earnings account on December 31, 2018. Net income of $6,000 was reported on its income statement for the year ended December 31, 2019. Dividends in the amount of $5,625 were declared on December 31, 2018; the dividends are payable to the company's stockholders on February 1, 2019. The balance in its Retained Earnings account on December 31, 2019 equalsarrow_forwardWirefree Corporation began 2021 with retained earnings of $290 million. Revenues during the year were $440 million, and expenses totaled $340 million. Wirefree declared dividends of $62 million. What was the company's ending balance of retained earnings? To answer this question, prepare Wirefree's statement of retained earnings for the year ended December 31, 2021, complete with its proper heading. Prepare the statement of retained earnings. (Enter all amounts in millions. Enter a net loss with a minus sign or parentheses. Include a subtotal after the "Add" line of the statement.)arrow_forward

- Are these answers correct?arrow_forwardCerritos Company began operations on January 1, 201. During the first three years of operations, the entity reported following net income and dividends declared: Net income = 2016 - 1,500,000; 2017 - 2,500,000; 2018 - 3,000,000. Dividends declared = 2016 - 0; 2017 - 1,000,000; 2018 - 1,000,000. The entity provided the following information for 2019: Income before income tax = 5,000,000; Prior period error - understatement of 2018 depreciation before tax = 500,000; Cumulative decrease in income from change in inventory method before tax = 1,000,000; Dividend declared = 2,000,000; Income tax rate = 30%. What amount should be reported as retained earnings on December 31, 2019?arrow_forwardWireless Corporation began 2021 with retained earnings of $290 million. Revenues during the year and expenses totaled $360 million. Wireless declared dividends of $60 million. What was the company's ending balance of retained earnings? To answer this question, prepare Wireless's statement of retained earnings for the year ended December 31, 2021, complete with its proper heading. Prepare the statement of retained earnings. (Enter all amounts in millions. Enter a net loss with a minus sign or parentheses. Include a subtotal after the "Add" line of the statement.) Add: Subtotal Less: (millions)arrow_forward

- The 2017 balance sheet of Dream, Inc., showed current assets of $3300 and current liabilities of $1391. The 2018 balance sheet showed current assets of $3200 and current liabilities of $1467. What was the company’s 2018 change in net working capital, or NWC? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.)arrow_forwardNonearrow_forwardApplying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation had total assets of $554,000, total liabilities of $261,800, common stock of $139,300, and retained earnings of $152,900. During 2019, KJ had net income of $225,200, paid dividends of $74,400, and issued additional common stock for $93,900. KJ's total assets at the end of 2019 were $721,800. Required: Calculate the amount of liabilities that KJ must have at the end of 2019 in order for the balance sheet equation to balance.arrow_forward

- Nate Corporation's accounting records include the following items for the year ending December 31, 2024: View the data. The income tax rate for the company is 38%. The company had 10,000 shares of common stock outstanding during 2024 and no preferred stock. Prepare Nate's income statement for the year ending December 31, 2024. Show how Nate reports EPS data on its 2024 income statement. (Use parentheses or a minus sign to enter a loss. Round all earnings per share amounts to the nearest cent, $X.XX.) Gross Profit Nate Corporation Income Statement Year Ended December 31, 2024 Operating Income Other Income and (Expense): Income Before Income Taxes Income from Continuing Operationsarrow_forwardOn February 1, 2019, the balance of the retained earnings account of Blue Power Corporation was $441,000. Revenues for February totaled $86,100, of which $80,500 was collected in cash. Expenses for February totaled $78,600, of which $64,800 was paid in cash. Dividends declared and paid during February were $7,200. Required: Calculate the retained earnings balance at February 28, 2019. (Amounts to be deducted should be indicated with a minus sign.) Retained Earnings Balance, February 1, 2019 Revenues Expenses Dividends Balance, February 28, 2019 $ 0 0arrow_forwardBelow are the May 31, 2015, year-end financial statements for Gillespie Corp., prepared by a sum- mer student. There were no share capital transactions in the year just ended. Gillespie Corp. Income Statement For the Year Ended May 31, 2015 Revenues $382,000 25,000 Service revenue Unearned service revenue Rent revenue 90,000 Expenses Warehouse rent expense Prepaid advertising Salaries and benefits expense Dividends Utilities expense Insurance expense Shop supplies expense Net income 100,000 17,000 110,000 10,000 42,000 15,000 6,000 $197,000 Gillespie Corp. Statement of Changes in Equity At May 31, 2015 Share Retained Total Capital $5,000 Earnings $140,000 197,000 $337,000 Equity $145,000 197,000 $342,000 Opening balance Net income Ending balance $5,000 Gillespie Corp. Balance Sheet For the Year Ended May 31, 2015 Assets Liabilities Cash $ 50,000 Accounts payable $130,000 85,000 45,000 240,000 52,000 Accounts receivable Office equipment Building Shop supplies Total liabilities $130,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education